Understanding the State of the Corrupt Supreme Court Today

Legal Realism in CrazyTown facing the chaos-monkey president: Reading the Roberts Court as a Trump‑era power machine as Alito, Thomas, Gorsuch, Kavanaugh, Roberts, and Barrett turn Trumpist chaos-monkey impulses into what they call “law”. The robes donned are “textualism” and “originalism”. The reality is emergency stays, shattered agencies, and a presidency unchained as hollow promises are made of rule of law and simply calling balls and strikes. The Roberts Court is not really a 3-3-3 court with a moderate center at all, but one with a neofascist two and four neofascist fellow travelers. That is what you see when you look at the Roberts Court as a political‑economic actor in a Trump‑run regime…

There are many people worth respecting and following writing about the current state of the Supreme Court and its right-wing neofascist turn.

I recommend:

Steve Vladeck <https://www.stevevladeck.com/>

Adam Feldman <https://empiricalscotus.com/>

Amy Howe <https://www.scotusblog.com/author/amy-howe/>

Erwin Chemerinsky <https://www.scotusblog.com/author/erwin-chemerinsky/

Ian Millhiser <https://www.vox.com/authors/ian-millhiser>

Leah Litman <https://michigan.law.umich.edu/faculty/leah-litman>

Kate Shaw <https://crooked.com/podcast-series/strict-scrutiny/>

But they—all of them, overwhelmingly—clothe what is going on in the drapery of legal doctrine and argument. They thus pretend that justices are law-abiding and law-respecting. And that is—except for Sotomayor, Jackson, and Kagan—a mistake.

We need more Legal Realism Freak Flag Flying here. So let me—stepping far indeed away from my wheelhouse—try to provide some:

There are two on the Supreme Court—Alito and Thomas—who are fascists in the strict sense: believe that the United States is under dire threat from Wokeism, the U.S. Constitution is thus suspended: Trump, in the words of the late-Roman Republic’s senatus consultum, ultimum, is free to act as he wishes: videat præses ne quid res publica detrimenti capiat, let the president see that the republic suffers no harm.

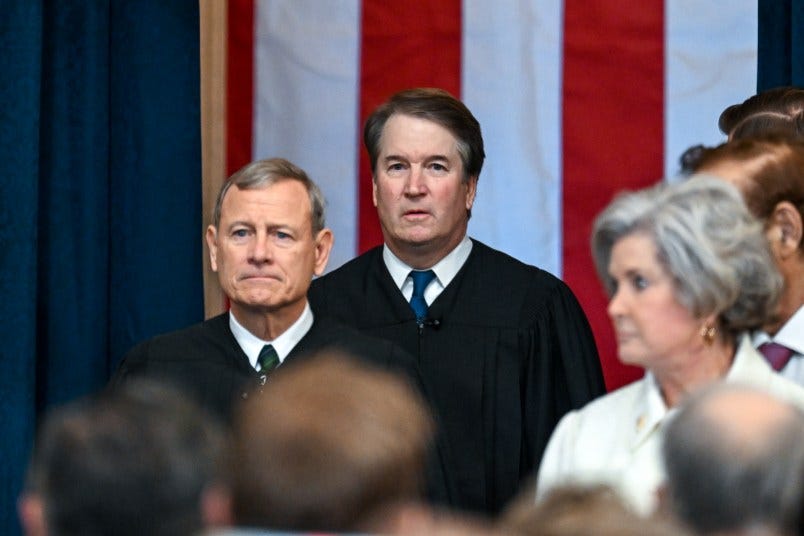

There are two on the Supreme Court—Gorsuch and Kavanaugh—who will almost always vote with Alito and Thomas that Trump gets to do what he wants.

These two will, however, occasionallywant to put a time limit on it—allow Trump to move fast, break things, and establish facts-on-the-ground that then shape the future, but only for a limited time—perhaps a year or so. (Although do note that Kavanaugh dissented and joined the true fascists on Learning Resources v. Trump.)

Then there is Justice Barrett—her vote will almost always drag Roberts’s along. (The only significant exception I can recall is the two EPA cases Ohio v. EPA (shadow docket) and San Francisco v. EPA (merits docket)).

Roberts will follow Barrett, except where the EPA is concerned

And there are three Supreme Court justices—Justice Jackson, Justice Sotomayor, and Justice Kagan—who have their heads screwed on tight, and are law-abiding, -respecting, and -fearing.

With the current alignment, therefore, “Supreme Court Majority” = “Justice Barrett”, overwhelmingly.

Properly reporting and analyzing what the Supreme Court has done, is doing, and will do therefore requires a deep understanding of what Justice Barrett thinks she is doing and why, and of the somewhat different what Justice Barrett is doing, and why.

As I see it—and, I repeat, I am well out of my wheelhouse here, but I believe someone should say this—Barrett sees herself as attempting to apply but also rescue Scalia’s vision of the constitutional order from the danger generated by the Trumpists’ weaponization of it in the interests of kleptocratic fascism.

The surface story she may tell herself is that judges apply law as written; judges are not policymakers; originalism and textualism are the neutral algorithms that prevent courts from becoming mini‑legislatures. Her Federalist Society talks are about interpretive method, not about how to entrench a one‑party regime.

But somehow, on the architecture of power and the shadow docket, the recurring reality is that when Trump’s White House needs an emergency stay to keep some sweeping policy in place—deportations under the Alien Enemies Act, mass firings of civil servants, wholesale grant cancellations, aid freezes—Barrett is there for him. The four‑step kabuki is by now familiar: district court issues a skeptical injunction; appeals court mostly affirms; DOJ sprints up the marble steps; right-wing majority says “yes, you may proceed,” usually in a paragraph. Facts on the ground are created.

This is driven by the bomb‑throwing Thomas, Alito, and Gorsuch. The modern administrative state is constitutionally suspect. “Independent” agencies are a New Deal mistak. Deference to expertise is judicial cowardice. Emergencies justify maximal deference to a friendly executive. They write as if they have been waiting since 1937 for precisely this kind of president to blow things up. Barrett goes along—but not as a true believer: rather, as an anxious technocrat of the right, worrying about how to keep some category of “independent” agencies while trimming doctrine around the edges.

But when the Trump administration says: “Freeze $2 billion in USAID reimbursements; we want to dismantle the program first, then litigate later,” that is fine with Barrett. When the NIH wants to terminate hundreds of millions in health grants because they smell of DEI and “gender ideology,” again the emergency stay majority includes Barrett. When the administration wants to delay or prevent reinstatement of independent‑agency heads or block nationwide injunctions against its more extreme domestic policies, the stay is granted, the lower‑court brakes are lifted, and the merits get “fast‑tracked.” Barrett is either in the majority or, at most, registering a carefully hedged partial dissent that doesn’t actually stop Trump from getting what he wants on the ground.

Perhaps Barrett, by being the “reasonable” one in this coalition, makes the architecture function. Her presence allows Roberts to tell himself that this is a 3‑3‑3 Court with an institutionalist middle, not a 6‑3 wrecking crew. But from the point of view of the people on the losing end of these orders, that nuance is metaphysical. The grants vanish all the same.

What, then, does she think she is doing? My guess is that she is profoundly invested in the story that textualism and originalism are the right way to do law, and not merely partisan cloaks. The nightmare scenario for her is that Trump’s abuses discredit those methods for a generation. Thus she uses the big merits cases to show constraint: siding with the liberals on San Francisco v. EPA in part; hinting that Humphrey’s Executor might survive; occasionally joining a liberal majority in some apolitical statutory case. These are, in her mind, exhibits for the proposition: “I am not Trump’s judge; I am the law’s judge.”

On structural questions, however, her view is that a Trump White House that can purge independent commissioners, reverse long‑settled agency policies overnight, and avoid universal injunctions is not a partisan horrorshow but a rebalancing of the separation of powers in the right direction: away from bureaucracy, toward elected control.

Trump is obnoxious, but he is an elected executive; the grant‑writers at NIH are not. If a choice must be made between empowering the sloppy democracy of elections and the technocracy of bureaucracies and lower courts, she picks the former and enables Trump. In her worldview, at least as I infer it, these expansions of presidential power are not supposed to be Trump‑only. A future, more palatable president could in theory use the same doctrines to do “good” things: rapidly expand regulation, protect rights, shovel money into public health. She writes as if doctrine is symmetric.

But we legal realists know that in practice, enforcement, standing, and “major questions” mysteriously become more rigorous when the president is a Democrat.

Inside her own head, however, she may very well believe she is strengthening the office, not merely this occupant.

The Roberts‑Barrett conceit: that you can keep Trump’s agenda mostly intact while occasionally drawing a bright line—Learning Resources on IEEPA tariffs; Trump v. Illinois on National Guard federalization; perhaps Slaughter on FTC removal—and that these isolated acts of resistance will suffice to preserve “the rule of law.” Barrett’s votes, especially in the shadow‑docket cases, are the lubricant in that machine. She is the one who makes it possible to say: “This isn’t lawlessness; this is just textualism, faithfully applied.”

That is the most charitable legal‑realist reconstruction of her self‑conception I can come up with.

Moving further into CrazyTown, what do Kavanaugh and Gorsuch think they are doing?

My guess: In Kavanaugh’s head, he is the Court’s responsible Republican: the one who will give you 90% of the movement’s wish‑list but insists on doing so in full sentences, with citations, and with at least a hand‑wave toward precedent, administrability, and the long‑run legitimacy of the institution. He is not Alito, gleefully bayoneting Roe and affirmative action and Section 2 of the VRA while taunting the losers. He is na Reagan‑Bush lawyer who believes in a strong presidency, weak agencies, deregulatory instincts, and a certain residual concern that the Court not look too obviously like the RNC’s legal department.

But on the emergency docket architecture, Kavanaugh is almost always in the same place as Thomas and Alito. When Trump wants to: purge the Education Department and NSAIDs‑funded civil servants; freeze USAID or NIH grants that offend the anti‑DEI crusade; end Temporary Protected Status or parole programs; cut off foreign aid as bargaining chips against Congress; Kavanaugh almost never provides the fourth vote to deny Trump interim relief. He writes separate opinions now and then—“we should be careful,” “this is only about forum,” “this doesn’t prejudge the merits”—but, on the ground, the policy goes forward. The people deported, fired, or de‑funded do not experience his caveats as meaningful.

Why? Because:

The president gets a very long structural leash: Kavanaugh has always been a maximalist on Article II power. He does not experience this as “enabling Trump,” but as vindicating his long‑held view that the modern presidency was over‑judicialized after Watergate.

Being the technocratic hammer, not the ideological bomb: His merits opinions are couched as “we must clean up doctrine,” “we must align practice with statute,” and “we must stop lower courts from going rogue.”

The institutionalist in the mirror: Kavanaugh is signaling to elite legal audiences—Harvard, the D.C. bar, the New York Times editorial board—that while he is a conservative, he is not a crazy conservative. But these breaks are carefully rationed. When it comes to the cases that structure Trump’s ability to break the administrative state and purge the civil service he is with the wrecking crew.

The “not as bad as Gorsuch” self‑comfort: Perhaps there is a final psychological layer here. In the internal conservative ecology of the Court, Gorsuch has become the avatar of the full‑bore anti‑administrative crusade—no deference, no patience for agency expertise, no tolerance for broad delegations. Kavanaugh is, comparatively, a moderate within that camp: That allows Kavanaugh to tell himself that he is the one preventing things from going completely off the rails. even as he signs onto outcomes that cripple agencies.

Kavanaugh sees himself as the tribune for:

Hyper‑empowered presidency;

Shrunk and disciplined administrative state;

Expanded corporate and property rights;

Narrowed civil‑rights and regulatory enforcement;

Occasional high‑profile nods to voting rights or institutional legitimacy when the Court is staring into the abyss.

Trump is simply the first president in decades willing to drive that project at full throttle. Kavanaugh thinks he is there to keep the car nominally on the road: preserving what he sees as a principled, technocratic conservative constitutionalism from being discredited by Trump’s ugliness—while signing onto almost every structural decision that makes Trump harder to constrain.

And Gorsuch? My guess: He sees the administrative state as original sin, a mistake—legally, morally, and economically. He believes the Court has both the duty and the opportunity to dismantle it: cf. Chevron deference, non‑delegation, “major questions,” and standing. Broad delegations are not practical necessities but constitutional evasions. The dense web of environmental, labor, and financial regulation is not an evolved response to market failure but a slow coup against the separation of powers.

He likes people he imagines as standing alone before the state: an individual believer facing a bureaucracy; a defendant facing a prosecutor; a tribe facing the federal government. They are not the diffuse beneficiaries of environmental rules, workplace protections, or civil‑rights regulations. Those he tends to treat as abstractions marshaled by “lawyers and activists” who want to get in the way of the elegant, simple constitutional order. Protect concrete, individualized rights; strip away the elaborate procedural machinery that lets groups and institutions gum up government action. In practice, it means he is far more sympathetic to a sole proprietor challenging OSHA than to the millions of workers OSHA protects.

I do not think Gorsuch experiences himself as Trump’s enabler. He experiences Trump as an inconvenient plaintiff—a deeply flawed avatar through whom these structural questions are arising. He is a structural revolutionary first; Trump is simply the chaos‑monkey president providing him with opportunities.

From the outside, however, the effect is hard to distinguish from straightforward class and partisan politics:

Business and the wealthy get a Court ready to gut regulation on textualist and historical grounds.

Presidents of his faction get a Court ready to bless unilateral action, especially when framed as “emergency” or “foreign affairs.”

Workers, consumers, and marginalized groups get eloquent dissents from the liberals and occasional libertarian crumbs, but structurally less protection.

Thus Gorsuch is not the Court’s eccentric libertarian uncle; he is its most coherent revolutionary. The others improvise. He has a plan.

So hold on to this:

the neofascist two—Alito and Thomas

the structural Lochner counterrevolutionary: Gorsuch

the “responsible Republican” poseur: Kavanaugh

the decisive vote: Barrett, with her worries that Trumpian overreach will cripple her Scalia-student legal transformation project.

Roberts as partisan Republican soldier along for the ride—unwilling to vote with Democrats when there are no Republicans to provide cover (except when the bright line was crossed that is wholly pretextual Trumpist impoundments).

Three actual justices with judicial temperament, rather than partisan-ideological projects: Justice Sotomayor, Justice Kagan, and Justice Jackson.