Losing Friends, Hobbling Manufacturing Businesses & Workers, & Sabotaging Growth with One Inept Chaos-Monkey Tariff Trick

A masterclass in self-destruction as Bessent, Lutnick, Greer, Hassett, Vought, Miran, Navarro, Miller, and all the other grifters try to retcon the chaos-monkey social-media posts of Trump into a policy, pushing up inflation, fueling corrupt cronyism, & causing America’s decline in both prosperity and in ability to shape the world for our safety…

Today we have Paul Krugman saying that as a result of Trump’s tariffs U.S. autoworkers’ products now are disfavored relative to Japanese autoworkers’ products:

Paul Krugman: The Art of the Really Stupid Deal <https://paulkrugman.substack.com/p/the-art-of-the-really-stupid-deal>: ‘What the heck were the Trumpists thinking?… Trump announced… a big trade deal with Japan… [got] a 0% score… reaction from the manufacturing sector, both management and labor….

This deal… leaves many U.S. manufacturers worse off than they were before Trump began his trade war…. How did this happen?… Trump’s negotiators probably had no idea what they were doing, and didn’t realize that in their frantic rush to conclude a deal they were agreeing to tariffs that would be highly unfavorable to U.S. manufacturing. Why were they frantic?… He and his people were surely anxious to make some major announcements before his self-imposed deadline of Aug. 1…. And of course they may also have hoped that a splashy trade deal would move the news cycle off Jeffrey Epstein…

We also have Anne Krueger noting that deals are not deals, and tariff rates have no systemic rationale whatsover:

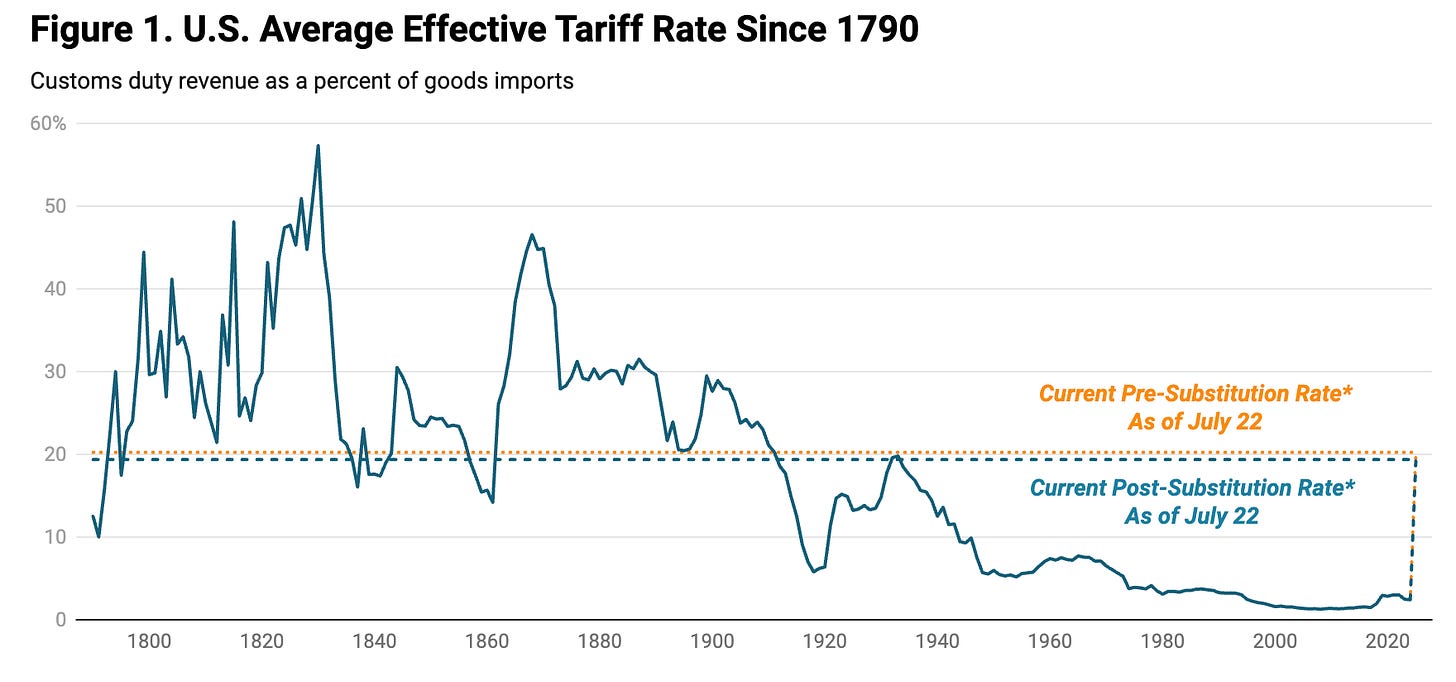

Anne Krueger: Trump’s Self-Defeating Trade Agenda <https://www.project-syndicate.org/commentary/trump-tariff-war-makes-no-economic-sense-by-anne-o-krueger-2025-07>: ‘The unpredictability of Trump’s trade policies poses a grave threat…. Trump announced a trade deal with Vietnam that imposes a 20% tariff on Vietnamese imports… [that] contain no Chinese components; otherwise, the rate jumps to 40%…. [That is] far higher than the 11% that Vietnamese policymakers – caught off guard by his announcement – reportedly believed they had negotiated…. Adding to the uncertainty are Trump’s tariff hikes and new restrictions on commodity imports. Since January, the US has raised steel, aluminum, and copper tariffs to 50% and imposed a 25% tariff on auto parts. Although he claims that his deal with China will ensure US access to rare-earth minerals, their status remains in limbo…. The entire process has been marked by confusion and inconsistency…. The increasingly visible rise of crony capitalism, as a steady stream of foreign officials and American business executives descends on Washington to lobby for tariff exemptions and protections…

We have Alan Wolfe on the bewildering unpredictability of the chaos monkey, and the response to deepen globalization everywhere but with the United States:

Alan Wolfe: Is US tariff policy reshaping the world trading system? <https://www.piie.com/blogs/realtime-economics/2025/us-tariff-policy-reshaping-world-trading-system>: ‘What the US tariffs will be and on which products, either in blanket fashion (President Donald Trump campaigned on having 10 or 20 percent tariffs on all but China, whose products would be tariffed at 60 percent) or by country of origin or product sector is unknown….. The blanket tariff at 10 percent or above is part of the US negotiating position, with tighter restrictions on named product sectors as varied as semiconductors, lumber, pharmaceuticals, polysilicon, and copper. Adding to the unpredictability, Trump has threatened, and in a few cases has already obtained agreement to the imposition of, much higher across-the-board tariffs for individual countries…. One can only conjecture how soon and to what extent these costs in terms of inflation or availability of products will become apparent….

Major participants in world trade, including Canada and the European Union, speak in favor of diversifying their trade…. Sweden and some forward-looking trade experts have suggested… a closer economic relationship and policy coordination between the European Union and the countries of the Comprehensive and Progressive Trans-Pacific Partnership (CPTPP)…. 39 countries… build[ing] on WTO rules while achieving even freer trade…. The United States will increasingly face trade discrimination in foreign markets…. [Even with a] one-way zero tariff deal, as it reportedly has achieved with Vietnam and Indonesia… countries can resort to a myriad of nontariff barriers to impede imports…. For the best part of a century, the world relied on leadership from the United States to shape the rules of the world trading system. That task, at present, now falls to others…

And we have questions but no answers as to whether there even was a Japan-U.S. trade deal at all:

Balazs Penz: The $550 Billion Enigma at the Heart of Japan’s Trade Deal <https://www.bloomberg.com/news/newsletters/2025-07-25/the-550-billion-enigma-at-the-heart-of-japan-s-trade-deal>: ‘The trade deal that US President Donald Trump celebrated as the largest in history becomes the more puzzling the more layers are peeled back. The centerpiece is Tokyo’s pledge to set up a $550 billion US investment fund…. The White House said over $550 billion will be invested under the direction of the US, and Trump said… 90% of the profits will be given to America…. Shigeru Ishiba, on the other hand, said Japan would offer a mixture of investment, loans and loan guarantees up to a maximum of $550 billion…

It is very clear, reading between the lines, that there are now bureaucrats in Japan who will be tasked with coming up with ways to relabel the current flow of investment from Japan to the United States and add government blessing to them over whatever period is needed to make the total add up to $550 billion—or is it $400 billion?

And, no, foreigners are not paying the tariffs. Exporters to the United States are not cutting their margins significantly. Krugman again:

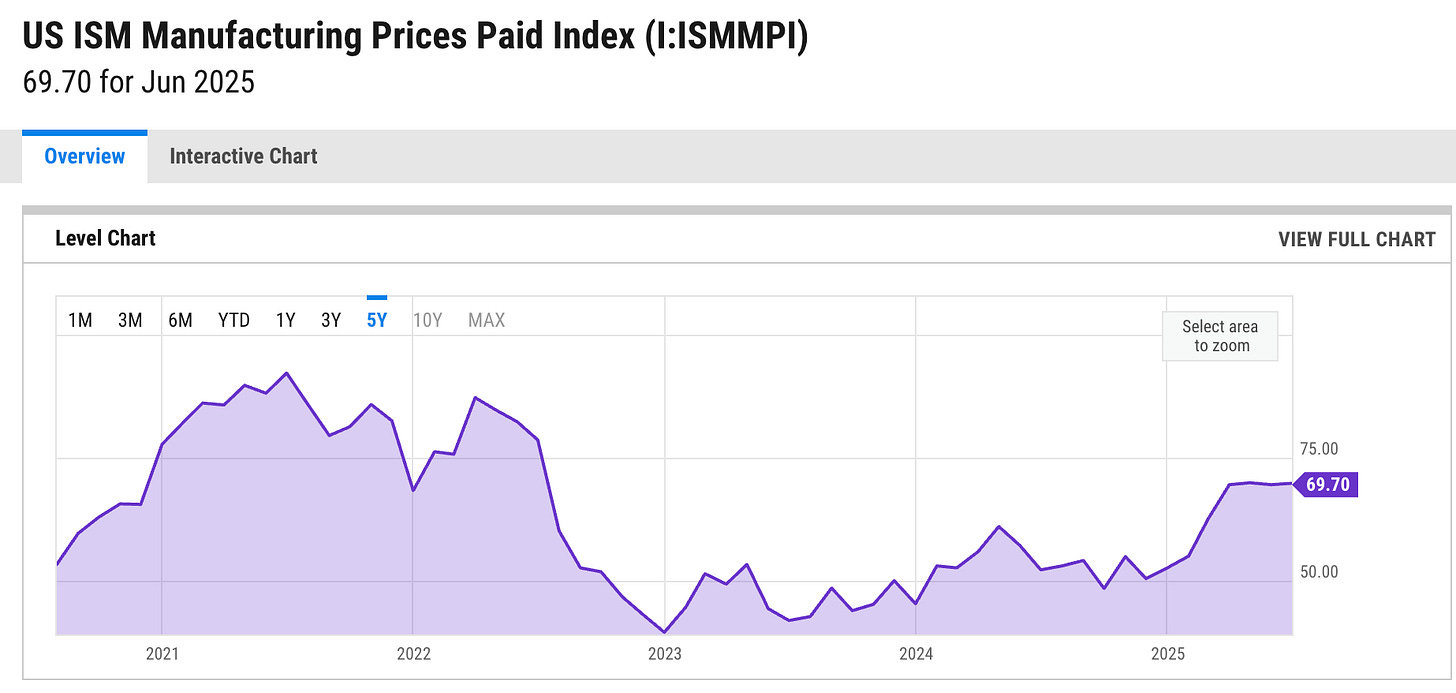

Paul Krugman: The Art of the Really Stupid Deal <[paulkrugman.substack.com/p/the-art...](https://paulkrugman.substack.com/p/the-art-of-the-really-stupid-deal>): ‘You want to look at are import prices — the prices foreign producers are charging America, prices tracked by the Bureau of Labor Statistics. If Trump were right, we’d be seeing a large fall in import prices, offsetting the tariff hikes…. What we actually see is… foreigners don’t seem to be paying any significant share…. So far, the burden seems to be falling mainly on U.S. businesses…. The Institute for Supply Management’s report on manufacturing… [shows that] we’re currently experiencing cost inflation at levels not seen since the summer of 2022:

So far, these costs haven’t been fully passed on… but once businesses see how high tariffs on Japan and Europe are after they’ve made deals, their willingness to absorb the tariffs rather than passing them on to consumers will evaporate.

This is in no way a shrewd exercise in mercantilism.

This is not even a risky but somewhat coherent experiment in economic nationalism.

This is chaos-monkey chaos unleashed on the patterned global division of labor that is a substantial part of the bedrock underpinning our prosperity. The spectacle has been, by turns, comic and tragic—a Monty Python sketch reimagined as a trillion-dollar policy disaster, with the global economy as its unwitting straight man. It is not a break with the past but a leap into the void.

The administration has cited every conceivable rationale—national security, job creation, deficit reduction, even the prosecution of foreign leaders—without ever deigning to submit its actions to the discipline of economic logic. The result is a system in which more than 10,000 tariff classifications can be and are adjusted at a moment’s notice, producing a combinatorial explosion of uncertainty for every firm, worker, and consumer engaged in cross-border commerce.

Higher tariffs have not reduced the trade deficit, except to the extent that they reduce investment in America while also leading American consumers to spend less and save more. The trade deficit arises when there is a financing gap between desired investment by businesses and savings provided by Americans interested in holding something other than government bonds. That gap is an opportunity for foreigners to invest in America. But in order to get the dollars they need to finance that investment, they need to sell us more goods and services than they buy from us. Voilà: trade deficit. To the extent that Trump’s tariff policies succeed in raising household savings, they risk recession by weakening consumption spending. To the extent that Trump’s tariff policies succeed in reducing investment in America, they make economic growth slower and us poorer. For Trump’s tariff policies—unbacked as they are by any complementary macroeconomic policy adjustments—to be part of a policy mix that actually reduced the trade deficit would be an even greater disaster than the ongoing breaking of the production-network links that support prosperity. Fortunately for us, they are unlikely to do so.

But recent macroeconomic modeling from the Penn Wharton Budget Model does project that the latest Trump tariffs would reduce long-run U.S. GDP by about 6% and average wages by 5%, inflicting lifetime losses on middle-income households that far exceed those from an equivalent corporate tax hike. And this is without fully incorporating the consideration that U.S. tariffs have triggered a cascade of retaliatory measures from major trading partners. This threatens to lead to an escalating cycle of trade barriers and counter-barriers that would fragment global supply chains that touch the United States. Those that route around the United States are, if anything, growing stronger and more valuable.

And, of course, a court system that took Congress as the first branch seriously—that required that the findings-of-fact set forth by Trump necessary to trigger the powers given him under the trade laws were in fact made in good faith—would have already stopped this: stayed tariff imposition on the grounds that ultimate success in justifying the findings-of-fact in a court was extremely unlikely. But four Supreme Court justices believe that Trump has much more powers than a British king had in the 1700s. (Not, mind you, that Biden had such powers, or that a future Democratic president would have such powers.) And two Supreme Court justices are terrified that if they get Trump mad he will move against them and start a fight that they would lose.

References:

Krueger, Anne O. 2025. “Trump’s Self-Defeating Trade Agenda.” Project Syndicate, July 24, 2025. https://www.project-syndicate.org/commentary/trump-tariff-war-makes-no-economic-sense-by-anne-o-krueger-2025-07.

Krugman, Paul. 2025. “The Art of the Really Stupid Deal.” Paul Krugman Substack, July 25, 2025. https://paulkrugman.substack.com/p/the-art-of-the-really-stupid-deal ↗.

Penn Wharton Budget Model. 2025. “The Economic Effects of President Trump’s Tariffs.” April 10, 2025.

https://budgetmodel.wharton.upenn.edu/issues/2025/4/10/economic-effects-of-president-trumps-tariffs ↗ Penz, Balazs. 2025. “The $550 Billion Enigma at the Heart of Japan’s Trade Deal.” Bloomberg Evening Briefing, July 25, 2025. https://www.bloomberg.com/news/newsletters/2025-07-25/the-550-billion-enigma-at-the-heart-of-japan-s-trade-deal ↗.

Wolfe, Alan. 2025. “Is US Tariff Policy Reshaping the World Trading System?” Peterson Institute for International Economics (PIIE) Realtime Economics Blog, July 23, 2025. https://www.piie.com/blogs/realtime-economics/2025/us-tariff-policy-reshaping-world-trading-system ↗.