Yes, Kevin Hassett Would Be a Very Bed Fed Chair

Lying liars who lie and knowingly and deliberately say whatever—whatever—lies they believe are to their immediate advantage are not the kind of people who should chair the Federal Reserve. Any questions?

Time to fire up the WayBack machine and run the videotape. Why economists shake their heads and sigh when Kevin Hassett’s name is brought up, and talk about how great a waste of it all it is.

Back before 2000, Kevin Hassett and James Glassman spent their days telling lies.

Back then, they spent their days telling lies about what bog-standard present-value finance calculations said was then the “fundamental” value of the stock market.

They claimed that:

IF—if, which nobody does—you believed the appropriate equity risk premium vis-à-vis US Treasury bonds was zero,

THEN the fundamental-value price-earning ratio for stocks should be 100,

and the “fundamental” value of the Dow-Jones Index was not its then-current 9000,

but four times as much: 36000.

HENCE you should be happy going all-in on stocks at anything up to four times their then-current price.

And in fact you should go all-in, or mortgage your house and buy even more, in order not to miss the near-term 300% profit from being all-in the DJIA as it imminently converged to what they claimed was its fundamental value over the next three to five years after 1998.

That was the title of their book: Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market <https://www.amazon.com/Dow-36-000-Strategy-Profiting/dp/0609806998>. That was their claim: “our analysis justifies a Dow of about 36,000—not in five or 10 years, but right now.”

(Relative to inflation, a DJIA of 36000 in 1998 corresponds to 72000 today; relative to the size of the economy, A DJIA of 36000 in 1998 corresponds to 108000 today; relative to corporate profits, a DJIA of 36000 corresponds to 180000 today. The DJIA this AM is one quarter of that, just as the DJIA back in 1998 was ¼ of what it was then. The Glassman-Hassett valuation claims were off by a factor of four then. Their methodology is still off by a factor of four now.)

Of course it did not happen.

If you had bought the Dow at 9000, and if you were forced by liquidity to sell at the trough over the next half-decade, you did not quadruple but instead lost 20% of your money.

If you had been unlucky enough to buy at the peak and be forced by liquidity to sell at the trough, you lost 40%.

When challenged by people who said that their math seemed, wrong, Glassman attempted a partial walk-back:

I never made such a claim [of a quadrupling]. I said that dividends are probably a lower bound for cash flow to investors and that official earnings are probably an upper bound…. Accept[ing] your definition of cash flow as dividends… the market is not overvalued…. The market should be roughly 50 percent to 100 percent higher [than he currently is]. Using the outer bound (reported earnings), the market should be 300 percent higher…

Which partial walk-back, of course, involved a big bold-faced lie.

Glassman (and Hassett) had not claimed that the fundamental value of the Dow then at 9000 should be in the range of 13500 to 36000—“roughly 50 percent… higher… [to] 300 percent higher”. Glassman and Hassett had claimed that their fundamental analysis: “justifies a Dow of about 36,000–not in five or 10 years, but right now.”

Hassett, to my knowledge, did not at the time attempt even a partial walk-back when challenged.

The extremely sharp Clive Crook <https://web.archive.org/web/19991231025452/http://www.slate.com/Dialogues/98-04-29/Dialogues.asp?iMsg=1> called Glassman and Hassett on this at the time:

You’re wrong, plain wrong…. I can imagine reasons for thinking the Dow should be at 36,000… [that] would be logically admissible.

This is not the kind of argument you’re making.

Your reasons for believing that the Dow should be at 36,000 are wrong in the same way that it’s wrong to say two plus two equals five.

That, in fact, is almost literally what you are saying. According to you, my mistake is that I’m implicitly predicting zero real growth in earnings and dividends. Indeed, you think the market as a whole is making the same error. The fact that earnings have grown faster than inflation for decades is “little understood,” you say. If only this record of growth were recognized, the Dow would be already be priced at 36,000…. Can you seriously believe that this has been going on decade after decade without the market’s noticing? Doesn’t that strike you as just a little unlikely? Of course it’s been noticed, very much noticed–so adequately noticed, in fact, that the prospect of real growth in both earnings and dividends is already fully priced into the market.

You fail to see this because you haven’t understood your “simple finance formula.” To get your estimate of 36,000… where your formula says “payout,” you have taken this to mean earnings…. [But] if companies pay out every cent of their profits to shareholders… how will they… grow?… Growth requires investment, and that must be paid for by stockholders…. In the real world, of course, this is exactly what they do. Companies pay only some of their earnings out as dividends. As a result, they grow…. The right measure of value is the sum of discounted dividends. This fully captures the effect of capital appreciation because dividends are themselves growing along with the worth of the company…

Crook was and is entirely correct, except in one thing.

That one thing? I know that in Hassett’s case it was not “because [he had] not understood [his] ‘simple finance formula’…” There is no “not understood”. Hassett understood and understands the Gordon fundamental-valuation finance equation very well. (Glassman, I am not so sure.)

The “payouts” Gordon fundamental-valuation equation (a) takes current dividends as payouts and divides them by the difference between the required rate of return and the growth rate of dividends. If you want to use earnings rather than dividends, there is an alternative “resources” equation you can use (b) which takes earnings as resources and divides them by the required rate of return. Resources can either be paid out now, or used to produce growth and so higher profits that can be paid out in the future. Add the value of (a) current payouts to the value of (b) growth produced by investment, which is © the difference between resources and payouts. When you do that addition “payouts” cancel, and you are left with the value of resources. (And you then have to add on a term capturing the company’s ability, if it has one, to make investments with above-market returns.)

Glassman and Hassett took the “resources” from (b) and pretended they were the “payouts} from (a).

They thus double-counted retained and reinvested earnings both as a source of current cash flow and as a driver of profit growth. A given dollar of earnings can be either cash-flow paid out to investors or reinvested to drive profit growth, but not both.

THIS IS NOT SUBJECT TO DEBATE.

THIS IS 2+2=5.

IT IS A LIE TO CLAIM THAT THE TOTAL RESOURCES A COMPANY HAS TO DEPLOY FOR PAYOUTS AND FOR INVESTMENT ARE PAYOUTS, AND SHOULD BE VALUED AS PAYOUTS, PLUS ASSUMING GROWTH WILL CONTINUE.

IT IS A LIE TO CLAIM THAT THIS IS AN ISSUE ABOUT WHICH THERE CAN BE DEBATE.

In Hassett’s case, at least, this is a deliberate, conscious, malevolent lie.

Plus—plus!—to get to their Dow 36000 number then, they had to make the highly counterfactual assumption that the equity risk premium really ought to be not smaller but zero. And, to justify the prediction that the DJIA would go to 36000 over the next three to five years, that whatever factors had been causing the actually-existing risk premium were about to completely stop.

Why did Glassman and Hassett tell these lies back then?

Nobody could ever advance an explanation other than that they wanted to get noticed and sell books.

And Hassett, at least, has not changed his MO in the past three decades.

Here he is, still telling lies, today about the Bureau of Labor Statistics:

Marcus Nunes: The “Smiling Contrarian” <https://marcusnunes.substack.com/p/the-smiling-contrarian?utm_source=post-email-title&publication_id=274427>:” ‘who is a strong contender for Fed Chair!… The president who tried to overthrow an election is now threatening to undercut or destroy—with similar accusations of “rigging”—any institution that could document his failures or malfeasance. The BLS, who dared release bad employment news, is the latest target.

Last Friday, the Bureau of Labor Statistics reported that job growth during Trump’s term was much lower than previously estimated. Trump responded by firing the bureau’s commissioner, Erika McEntarfer. He claimed, baselessly, that the numbers were “rigged,” and he falsely alleged that the bureau had waited until after the 2024 election to issue a similar revision of job numbers under Joe Biden.

Donald Trump: “In my opinion, today’s Jobs Numbers were RIGGED in order to make the Republicans, and ME, look bad — Just like when they had three great days around the 2024 Presidential Election, and then, those numbers were “taken away” on November 15, 2024, right after the Election, when the Jobs Numbers were massively revised DOWNWARD, making a correction of over 818,000 Jobs — A TOTAL SCAM. Jerome “Too Late” Powell is no better! But, the good news is, our Country is doing GREAT!…”

Kevin Hassett, the director of the National Economic Council, a possible (even likely) appointee for Fed Chair made up a story to keep himself in Trump´s good graces.

Hassett knows the bureau isn’t partisan. He also knows it revised Biden’s job numbers two and a half months before the 2024 election—not afterward, as Trump pretended. In fact, BLS delivered the bad news about Biden’s numbers on August 21, 2024, in the middle of the Democratic convention. That was the day before Kamala Harris delivered her acceptance speech. The timing for Democrats couldn’t have been worse!

On Meet the Press, following the release, Kristen Welker asked Hassett whether he had evidence that the BLS numbers were “rigged.” Hassett said yes. The “hard evidence,” he told Welker, was that the revision of Biden’s numbers “came out after he withdrew from the presidential campaign” on July 21, 2024. Hassett said this was part of “a bunch of patterns that could make people wonder” about the bureau’s trustworthiness.

He corrected Trump. The revisions did not come after the election, but more than two months before, in August. But to give it a “Trump spin”, he said that it came after Joe Biden dropped out of the race! (as if that were relevant!).

After the Sunday shows, critics chastised [this is good] Hassett. He could have backed down. But on Monday, when CNBC’s Andrew Ross Sorkin pointed out that the 2024 revision preceded the election, Hassett repeated the same maneuver. The revision “was after Joe Biden had withdrawn,” Hassett told Sorkin. He concluded, “It’s a massive failure of our data agencies to be making willy-nilly changes that are difficult to understand and often have apparently partisan patterns.”

What you notice, in all those interviews, is that Hassett is always smiling, even when h’s speaking!

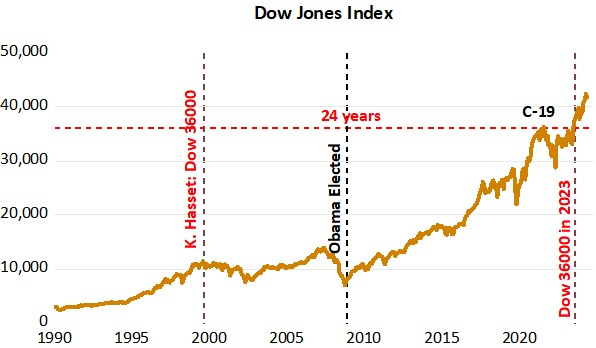

Hassett became a “household name” when he co-wrote (with James Glassman) the book Dow 36,000 at the peak of the dotcom bubble in 1999, saying stocks could “quadruple tomorrow and still not be too high”.

Alas, the Dow soon sank into a 10 year “drought”, bottoming when the “Great Financial Crisis” hit.

Hassett resurfaced as markets bottomed, accusing President Barack Obama of declaring a “war on business” and warning: “No wonder that markets are imploding around us.” Within weeks, an 11-year bull market began, only interrupted by Covid-19, as the Dow was on the cusp of breaking above Hassett’s 36000 mark!

The chart illustrates.

All in all, for Trump, Kevin Hassett seems the “perfect Fed Chair appointee”!…

Back before 2000, I thought that Kevin Hassett had close to destroyed his career by showing that he was a person who was willing to tell bald-faced lies about his analysis, double-down when challenged, and then double-double-down again when challenged more, for no reason other than to sell books.

I might have said some things to people who had been on the faculty of the University of Pennsylvania when Hassett went to graduate school there about unprofessional behavior of some of their Ph.D.’s, and how this might reflect some deficiencies in the “moral education” part of the curriculum. I might have said to Allan Meltzer that it was unprofessional of him to have given the book a blurb, even though Allan claimed that his “every stock owner should read this book” blurb had been intended as snark. (Which, I must say, they might have taken with very good graces.)

But it did not matter for his career as a hewer of wood and a drawer of water for Republican politicans.

Professional Republican politicians seem to have been attracted to an “economist” with a demonstrated reputation for being willing to say absolutely anything for some short-term benefit he perceived. Various Presidents and Boards of the American Enterprise Institute similarly had no problem with Hassett. He had a career. His willingness to say whatever he thought he was incentivized to say was a thing people on the other side of the aisle found very pleasing.

Never mind that his elders and peers in academia would always shake their heads and sigh when his name came up. Never mind that in the circles in which I moved and move, the principal reaction to Hassett is a kind of pity—a waste of talent, and someone who cannot but look back at his life and see a life wasted. The general reaction seemed to be to judge Hassett more-or-less as Platon had his character Sokrates argue in the Politeia <https://www.perseus.tufts.edu/hopper/text?doc=Perseus%3Atext%3A1999.01.0168%3Abook%3D9%3Apage%3D577> that we should judge a tyrant: as a person who was actually in the condition of the most wretched slave. And we should lament the waste of it all. Why? Because for Kevin, as for the tyrant:

His soul [must] be filled with relentless groveling and no choice. The best and most reasonable parts of his mind are slaves to a small part of it. And that small part of his mind, which is the worst and the most frenzied, ruthlessly bosses him around… You [have to] say that that is the lot of a slave…. That is the mind that, least of all, does what it truly wishes. Rather, always yanked around by the relentless itch of neediness, it ends up tangled in chaos and regret…. He is doomed to be perpetually hungry, tormented by cravings he can never satisfy…. more than half-mad by the internal yelling of his own urges…. Such a person is far and away the most wretched one possible…

And if the mental imbalance of such a person is such that he does not recognized how pitiable his situation is? Then that only makes him more pitiable still, and it all even more of a waste. One is driven to give him the advice given by Dean Wurmer in Animal House: “that is no way to go though life, son…”

And it would be really, really unfortunate for the country and the world were any senator to vote to confirm a Kevin Hassett as Fed Chair.