Factory Asia & Trustability Bankruptcy: A Table Suggesting the Race to Be "The Furnace Where the Future is Forged" for the World in the 2000s Is Nearly Over

Agglomeration locks in advantage; weaponized tariffs unlock dysfunction. Macro self‑sufficiency hides micro choke points—and China sits at the hub. The U.S. lost trust; China gained leverage; decoupling shrank to slogans…

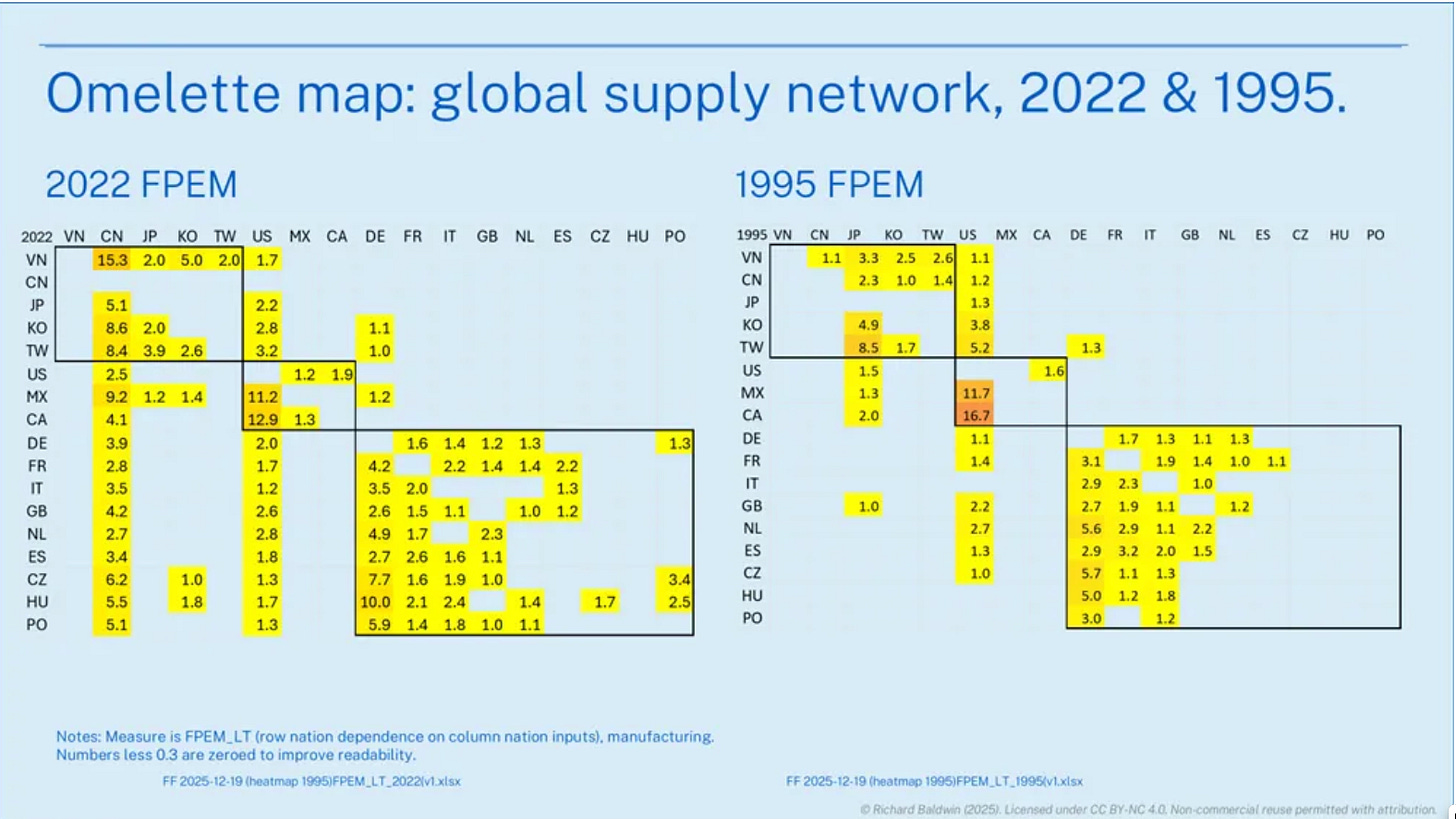

Big economies look nearly self‑sufficient—until a single input fails. China’s hub advantage, the U.S.’s trust deficit, and Brexit’s self‑inflicted friction show why weaponized trade weakens coalitions more than China. Global supply chains are an omelette—entangled, efficient, and hard to reverse. The macro story (large domestic shares) masks micro fragility: specialized intermediates, scaled clusters, and dense spillovers that make agglomeration self‑perpetuating. China’s role as dominant supplier of intermediates creates asymmetric leverage; the U.S., Japan, and Germany are more exposed to China than vice versa. Tariffs, deployed unpredictably, erode allied coordination and deepen reliance on precautionary stockpiles rather than capacity. Brexit exemplifies how added friction shreds regional resilience. If the race to be the furnace that forges the global future isn’t already decided, agglomeration economics—not punitive trade optics—will decide it soon.

A very nice piece from Richard Baldwin:

Richard Baldwin: Does Geopolitics have an Omelette Problem? <https://rbaldwin.substack.com/p/does-geopolitics-have-an-omelette>: ‘Coordinating complex manufacturing processes at great distances was impossible in the days of landlines, faxes, and express mail…. With ICT, G7 firms found they could lower costs by taking their technology and managerial know-how and combining it with low-wage labour abroad. This offshoring, and the industrialisation it triggered in emerging economies, reorganised and entangled manufacturing on a global scale…. By the 2000s… a global supply chain “omelette.”… Cooking the omelette propelled efficiency and progress… had miraculous results… pulled hundreds of millions out of poverty…. [But] today, shocks are no longer rare, localised, and passing…. Extreme weather events and purposeful or accidental digital disruptions…

Look at… the row countries’ imports of industrial inputs from the column countries… normalized by the gross manufacturing output of the importing nation…. All the entries below 1% are zeroed out for clarity….

China is the dominant supplier of intermediates… [but] has very low exposure…. The US is the second most significant source of industrial inputs… but the numbers are smaller than China’s…. The exceptions are… “Factory North America”…. Germany is number three…. Its column is lit for most nations, and its role is especially important in “Factory Europe”…. All the big European nations are significant suppliers to each other….

One general observation…. The numbers are all pretty small. At the macro level, the big nations are largely self-sufficient…. However, these average over all inputs and all manufacturing sectors. The vulnerabilities that are a major concern today take place in very special inputs and very specific importing sectors…

And I have a few thoughts: