More Lies About Trade Tariffs From the Chaos Monkeys

How can it be that imposing tariffs did not cause inflation or reduce affordability, but that removing tariffs will reduce inflation and increase affordability? It makes no sense. But it is not supposed to. The point is not to make a coherent argument, but to provide talking points that corrupt media can flash on screens to convince the uninformed to follow someone they portray as a leader doing something…

The Trumpists want interest-rate cuts right now. The majority on the Federal Reserve’s FOMC is signalling that it will not deliver because it is worried about inflation above target, creeping up, and fueled by past tariffs with effects still working through the pipeline and unknown random chaotic future tariffs. The Trumpists’ response is incoherence: insisting tariffs don’t raise prices while arguing that removing them will lower prices, and so demanding immediate rate cuts starting in mid-December. Meanwhile, spin‑authoritarian tactics—media capture, exemptions, and rolling threats—block normal adjustment. Models that assume steady policy understate harm: the real‑world regime of chaos tariffs delivers lower GDP, fewer jobs, and higher prices by a multiple of what economists’ certainty-equivalent general-equilibrium models estimate. Plus there are the further corrosive effects a politics of dominance via enforced doublethink rather than argument based on, you know, actual facts.

And so Jared Bernstein watches Trumpists tell yet more lies:

Jared Bernstein: White House: Tariffs don’t raise prices, but taking them away will lower prices <https://econjared.substack.com/p/white-house-tariffs-dont-raise-prices>: ‘And that’s actually just one part of their incoherence… [for] if tariffs aren’t pushing up inflation, then what is??… In fact, reducing tariffs is the admin’s best, quickest play to help with prices, in sharp contrast to other ideas they’ve surfaced, like 50-year mortgages or health savings accounts…. The admin desperately wants the Fed to cut interest rates, but their argument that tariffs are not responsible for the inflationary pressures that are worrying the Fed board pushes the wrong way…. If admin officials are right and tariffs are not the thing that’s been keeping inflation high and sticky, then the central bank would be remiss to dismiss inflation stuck above their target as something that’s now in the rearview mirror. (The fact that Trump never stops negotiating new tariffs also makes it harder for them to “look through” them.) This is why “tariffs are not the cause of higher inflation” and “the Fed should cut rates” is an incoherent combination of statements…

I hate to break it to Jared, but making statements that add up to a consistent logical argument or picture of the world is not a goal of the Trumpists, or of Trump. The goal is not to persuade onlookers and interlocutors by logical argument. The goal is to flummox interlocutors, and thus to get onlookers to go along by demonstrating dominance. See “Gish Gallop”:

Wikipedia: Gish gallop <https://en.wikipedia.org/wiki/Gish_gallop>: ‘Named…after the creationist Duane Gish… the galloper confronts an opponent with a rapid series of specious arguments, half-truths, misrepresentations, and outright lies, making it impossible for the opponent to refute all of them within the format of the debate. Each point raised by the Gish galloper takes considerably longer to refute than to assert. The technique wastes an opponent’s time and may cast doubt on the opponent’s debating ability for an audience unfamiliar with the technique, especially if no independent fact-checking is involved, or if the audience has limited knowledge of the topics. The difference in effort between making claims and refuting them is known…informally “the bullshit asymmetry principle”…

The right-wing Tax Foundation is trying to keep score:

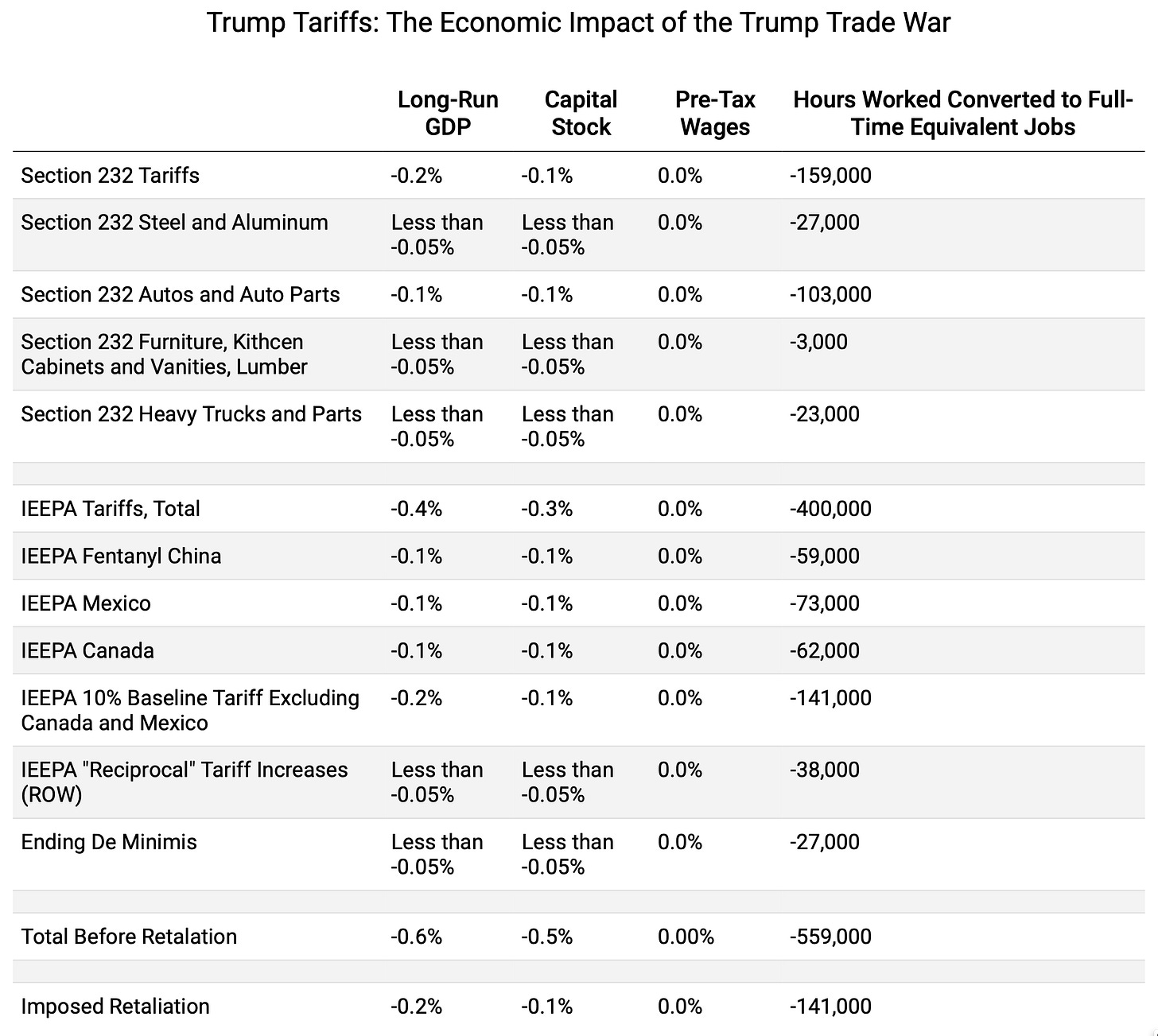

Erica York & Alex Durante: Trump Tariffs: Tracking the Economic Impact of the Trump Trade War <https://taxfoundation.org/research/all/federal/trump-tariffs-trade-war/>: ‘The Trump tariffs amount to an average tax increase per US household of $1,200 in 2025 and $1,600 in 2026…. The average effective tariff rate, reflecting behavioral responses, rises to 12.5 percent—the highest average rate since 1941…. Historical evidence and recent studies show that tariffs are taxes that raise prices and reduce available quantities of goods and services for US businesses and consumers, resulting in lower income, reduced employment, and lower economic output

…

The Tax Foundation GE Model estimates that the fully phased-in effect of the tariffs is to reduce employment in the U.S. by 0.5%—700,000 lost full-time jobs. And, no, this is not a loss that other macroeconomic policy moves can neutralize. It does not estimate the effect on inflation or the price level.

I have one very large complaint about the Tax Foundation’s modeling strategy. It is grossly inadequate to the problem. They estimate planned, constant tariffs. We have unplanned, chaotic, constantly moving tariffs. Thus all of the normal adjustments that could be made to reduce and cushion the adverse impact cannot be made. And there are a host of other production- and employment-reducing steps that are now being taken in order for firms to buy insurance against future random chaos-monkey tariff moves on the part of Trump.

My personal guess is that the actual likely damage is perhaps five times larger, plus added additional risk-aversion general-equilibrium effects arising because foreign powers will not simply retaliate to imposed tariffs, but understand that every point of integration of their economies with the United States—whether viewing the U.S. as customer, supplier, or value-chain participant—is an extra point of potential attempts by Trump and his band of grifters to try to exert leverage.

But step back: The deeper point and argument is one that we have known since before Orwell: the point of doublethink is not to channel thought and analysis, but rather to demonstrate power.