Bidenomics: Truly Transitory Inflation, Remarkably Successful on Employment & Growth—But Unable to Break Through the Media Misinformation Machine

My attempt to set forth a balance sheet: Bidenomics was an extraordinary success. The economy healed fast; the story never did. A brief moderate transitory inflation. A long and strong jobs and structural reorientation boom. But the dominance of the misinformation machine: where Biden-Powell reattained full employment, voters heard “affordability crisis.” Policy competence overwhelmed on the political-electoral level by narrative failure, as growth, jobs, and reindustrialization couldn’t win. Facts lost to vibes…

My view: On the economic prosperity ledger, Joe Biden fiscal policy and Jay Powell monetary policy in the aftermath of the COVID plague depression were close to perfect—extremely sensible given the balance of risks ex ante and still accomplishing a very good outcome ex post.

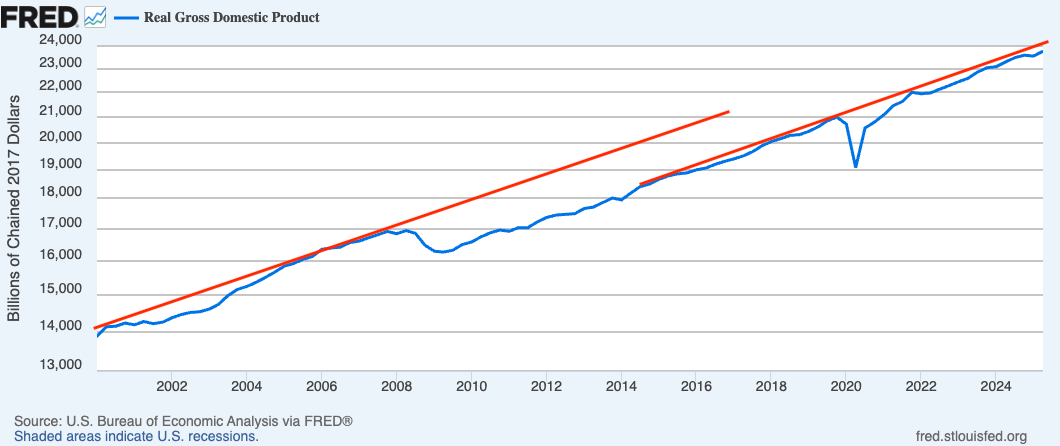

The rapid Biden-Powell-era reattainment of full employment—a striking contrast to what happened under Obama-Bernanke—was a tremendous policy victory for good. It was generated by an unusually forceful policy mix—vaccination scale-up, income support, and a deliberately generous fiscal stance—interacting with roughly $3 trillion in household excess savings to jump-start demand as health risks ebbed. The inflationary friction that followed was characteristic of a fast merge back onto the growth “highway,” the leaving rubber-on-the-road when you want to get up to speed quickly. Unfortunate, yes. But necessary if you are not to get rear-ended. And it was in no-wise 1970s-style stagflation. Priorities were near-lexicographic: get unemployment down quickly first, then address side effects second. But that was the right thing to do. And it happened:

The failure over 2009-2016 of recovery to fill-in the gap in real GDP created by the lost half-decade of growth following the GFC created an “affordability crisis” for America as a whole, as prosperity fell far short of where Americans had before the GFC expected the economy to be. The COVID plague recession cast no such affordability-crisis shadow onto our present, precisely because of the growth-and-recovery success.

Plus there is more: it is not just a floor wax but also a dessert topping! Rapid recovery and expansionary fiscal pressure caused a successful wheel in the economy’s employment-productive structure toward a more prosperous future. The labor market quickly became stressed in a good way: churn, quits, and elevated vacancies were features of a healthy reallocation process as workers upgraded matches, low‑wage sectors repriced labor, and firms adapted to new demand and technology patterns. Anomalous Beveridge-curve behavior—vacancies falling without an unemployment spike—signalled improved matching efficiency and normalization rather than demand collapse, consistent with rapid return to full employment powered by strong household balance sheets and timely policy support. The payoff was huge: a tighter, more inclusive, better-allocated labor-productive structure, in contrast to the failure to move workers toward more productive occupations during the recovery from the GFC. In addition to pushing unemployment far down, it was a successful structural wheel of the economy toward a more efficient allocation of labor that fit with the societal learning that took place during the COVID plague depression.

Biden-Powell policies also were prudent insurance against a risk that loomed large ex ante, even though from an ex post standpoint it had rapidly evaporated: the risk of a return to full-fledged secular stagnation. After the GFC, the Obama-Bernanke macro policy reaction function misread the level of the neutral interest rate as r-star collapsed, and tolerated an output gap that ossified into hysteresis. Second, fiscal timidity in the form of a premature pivot-to-austerity and underpowered public investment left monetary policy overworked and trapped at the interest-rate zero lower ground. Meanwhile, financial regulation leaned against bubbles but not enough toward demand, with the Obama administration’s failure to use the mortgage-finance GSE’s to counteract the enormous and destructive prolonged structural depression in housing construction as a major failure.

I think the right way to read 2009–2016 is as a case study in how an advanced economy can stumble into a chronic saving‑investment imbalance: safe-asset demand surges, investment demand lags, and the equilibrium real rate goes subterranean. Summers’s secular stagnation framing—borrowed in spirit from Hansen, updated for global capital markets—was a useful diagnostic; Bernanke’s “global saving glut” lens highlighted the international transmission. Put them together and you get the policy imperative: in a world of very low real rates, governments must do the obvious Keynesian‑but‑also‑neoclassical thing—expand public investment, crowd in private activity via appropriate public risk-bearing (cough, housing GSE’s, cough), and rebuild the economy’s productive base. Call it the simple rule of thumb: when the price of public capital is roughly zero, failing to buy productive future output is not prudence; it is vandalism of the growth path. The lost half‑decade was not inevitable. It was a policy choice. Obama staffers protest that it was not their policy choice. But it was Obama who called for a federal spending freeze in his 2021 State of the Union, when the unemployment rate was still 9.7%.

Biden also began reindustrialization policy, in an act of congress-management wizardry that still leaves me awestruck and blinking my eyes. But, still, it was not at the appropriate scale—less fiscal-expansion money to household balance-sheets and more to reindustrialization subsidies would have been much better. The CHIPS and Science Act, the Inflation Reduction Act, and the Infrastructure Investment and Jobs Act are impressive achievements in the partisan-gridlock America today. But the scale remains mismatched to the challenge of decades-long deindustrialization and a geopolitics reshaping supply chains. I have views: more of the government as first-and-best customer, and less on simple subsidies.

But these cavils should not keep you from seeing that, as far as production, employment, and the fundamentals of growth are concerned, Bidenomics was really successful.

However, there was a cost: inflation:

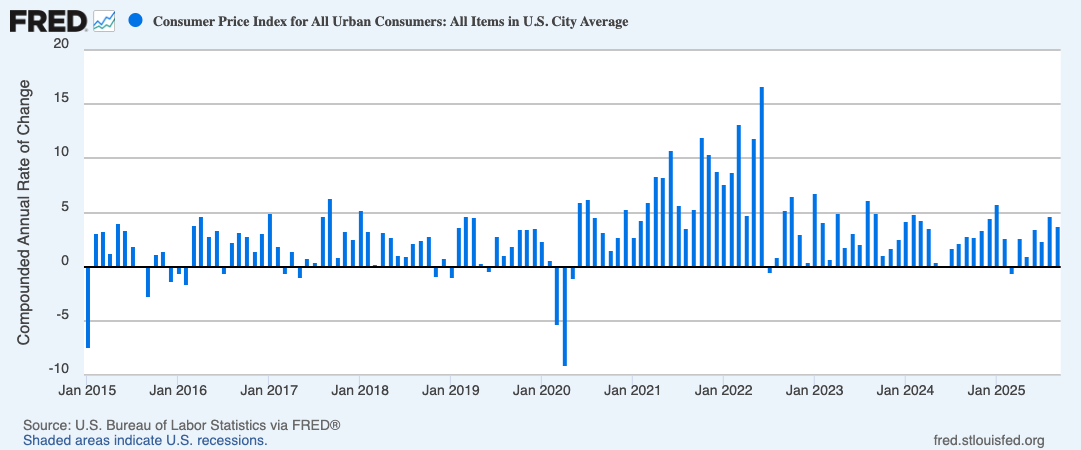

The cost of all this success was a short, transitory burst of moderate inflation, springing from the combination of rapid reopening, of expanding sectors having to offer wage premiums to attract workers in the context of sticky not-falling wages in contracting sectorss, nd of repeated supply-chain disruptions as plague intensity hopped around the world. The result was 7.6% CPI inflation from January 2021 to January 2022. However, it looked as though inflation was ebbing—was truly transitory and very short—when 2022 began. But then came the additional inflationary supply shock imposed on the world by the attack on Ukraine by Vladimir Putin, the dictator of Muscovy ‘Rus. The result was a further 4.4% increase in the price level in six months: an inflation rate of 8.8% in the January-July first half of 2022.

And then the burst of moderate inflation stopped cold. It was over after the middle of 2022.

Since June of 2022 CPI inflation has averaged 2.8% per year—only very slightly elevated over the Federal Reserve’s target, which on a CPI basis is about 2.5% per year, given the roughly 0.5%-point per year wedge between the CPI and the PCE. Yes, the first year and a half of Biden’ term did see two transitory bursts of moderate inflation: one produced by plague, reopening, and strong demand; and one produced by Putin’s invasion. But then it stopped, and during the last 2.5 years of Biden’s term, what Alan Greenspan called “effective price stability” was nearly achieved.

Do I see flaws in Biden administration policies relating to the economy? Yes I do. By far the major flaw was Biden’s failure to vaccinate not just the US but to pay to vaccinate the world in the first half of 2021—which gave the virus much more time to remain, well, virulent. The U.S could have done it: it had the financing capacity, the power to waive bottlenecks, the ability to coordinate procurement, and the logistics would have been an interesting but possible test of our military and other worldwide lift capacity. That failure to vaccinate the world was, I think, extremely short-sighted and extremely costly. It extended the pandemic’s economic and human toll and incubated variants that forced renewed restrictions, disrupted supply chains, and complicated recovery. In a world where interest rates were low and the social return extraordinarily high, the optimal policy was maximal global vaccination; we chose less, and paid for it. The benefits to the U.S. from less blowback from virulent variants incubated elsewhere would have far exceeded the costs of making and administering the mRNA products.

And I also see a lesser flaw: failing to do enough explaining and vaccine-giving to Americans throughout 2021. There was insufficient domestic persuasion and vaccine delivery to make early summer 2021 feel safe for the young, middle‑aged, and healthy elderly. With highly effective shots blanketing the country, the right stance could have been: risks become small and manageable, so July 4 could have marked a civic reopening, a declaration of independence from plague year constraints. Instead, muddled communications—starting with shifting mask guidance, continuing with inadequate celebration of vaccination’s protective power—let uncertainty dominate, slowing normalization even where the data supported it. July 4, 2021 could have been a day to declare independence from the virus, and return life to near-normal. It was not. And the American people suffered from that.

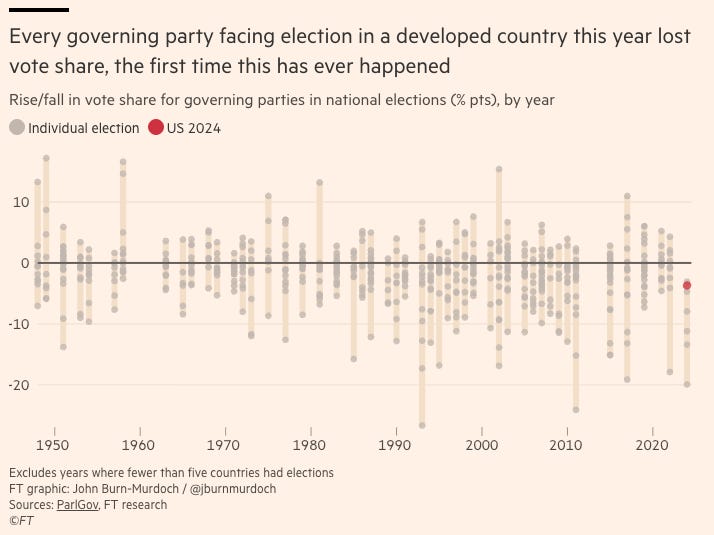

Whenever I give this argument that I have just presented, I get substantial pushback: Brad, say people, Donald Trump is now president. The voters judged Bidenomics, and judged it as substantially unsuccessful. Indeed, voters worldwide judged the handling of the plague and the reopening as sufficiently unsuccessful to harshly punish every single rich0-country ruling party in the 2024 elections, the first time this has ever happened:

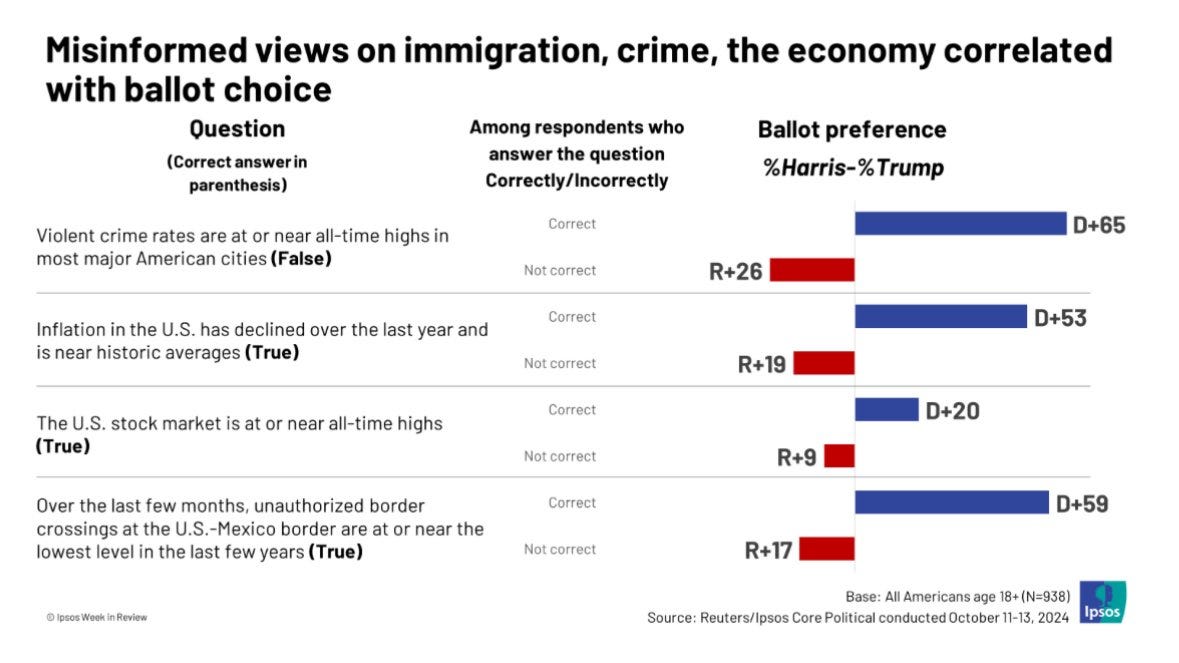

Indeed they did. But I trace must of this punishment to a misinformation gap. As I said just after the 2024 election <https://braddelong.substack.com/p/a-very-peculiar-kind-of-triumph-of>, I was very impressed by Dean Baker’s surfacing of the Reuters/Ipsos misinformation poll:

Dean Baker: I hate to put a lot of highly paid pundits out of business, but look at this f**king graph:

If the point here is not obvious, if we can’t get people to know the most basic facts about the economy and the other issues they consider most important, how do we think we will get them to hear our great messages? Obviously, the causation goes both ways, Trumpers don’t want to hear that unemployment is near a half-century low and crime is down, but that doesn’t change the problem. If we don’t have a way to get them to hear basic facts about the issues that concern them most, how would do we expect them to hear our plans for dealing with them?

<[twitter.com/DeanBaker...](https://twitter.com/DeanBaker13/status/1854752514090189261/)

Fact: those with justified true beliefs about the state of issues like crime, inflation, immigration, and the state of the stock market overwhelmingly supported Harris. So did Trump voters believe lies because Trump told them to, or were they Trump voters because they believed lies? And how do Americans who want a better politics and a better future dismantle the misinformatin system and, as Viscount Sherbrooke after the 1867 extension of the voting franchise in Britain: “we—or, rather, you—must educate our masters” on how to go about understanding the world, and how to go about deciding who to believe?

Let me outline the difference between potential voters who knew or guessed true things and false things:

Those who had not been misinformed by the Fox-Facebook system and who knew violent crime was not at or near all-time highs were more pro-Harris by a 91%-point margin.

Those who knew that southern border-crossings were more pro-Harris by a 76%-point margin.

Those who knew that inflation was down were more pro-Harris by 72%-points.

Those who correctly knew that the stock market was at an an all-time high were more pro-Harris by a 29%-point margin.

So I reject the characterization that achieving prosperity at the cost of a transitory episode of moderate inflation was a decisive mistake by Biden along the prudent political governance dimension. I characterize 2024 as reflecting a worldwide failure to break the misinformation system—the global misinformation system that rose to prominence and power in 2016 with its “accomplishments” if that is the word, of BREXIT and Trump I; that has maintained its structure and influence since; that those of us in the Sisyphus Brigade have failed to dismantle; and that has turned public -eason and self-governance into a sinister and destructive clown show.