No. There Are No Even Half-Competent Chaos Monkeys in the Trump Administration. Any Questions?

Bessent needs to go. And quickly. Dan Drezner said last week that one good thing that could be said about Scott Bessent was that he was 10% less crazy than the other Trumpist chaos monkeys. Scott Bessent’s response?: “Hold my beer!” Stating that the U.S. will pay the piper but that Javier Milei will call the tune and that U.S. financial support for Argentina is “unconditional” may well be the most unprofessional thing I have ever heard a Treasury Secretary say…

Smart. We may not have an Exchange Stabilization Fund left by this time next year:

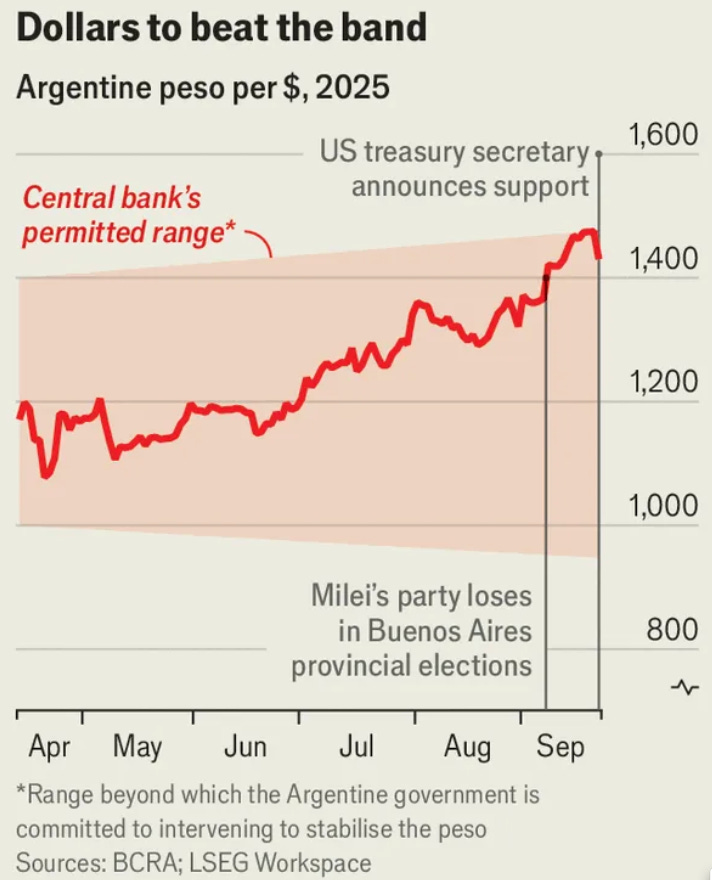

Brad Setser & Stephen Paduano: Other people’s money, and the problem with Mileism <https://www.ft.com/content/5f4bb8d6-e93c-4bf0-b0ae-f459255eb8c7: ‘The US Treasury needs to get Argentina on a better policy path before it blows through the Exchange Stabilization Fund…. Javier Milei has taken a chainsaw to his own government’s spending, but he has shown no objections to tapping the public funds of others…. Milei’s fiscal adjustment hasn’t improved Argentina’s external position. Instead, Milei’s affection for a strong peso — intended to be an inflation anchor — has led to a deterioration in Argentina’s trade accounts and an erosion of Argentina’s reserves. That is how he ended up selling down Argentina’s limited remaining reserves and calling the US over the weekend for a new lifeline.

The US rescue loan is now in the works. But unless it comes with a condition that Argentina allow for exchange rate flexibility, it is likely that Milei will return to the foxhole, praying again for other people’s money…. Secretary Bessent said that US support would be unconditional. That is, for lack of a kinder word, unique. Past Treasury lifelines have come with extensive conditionality, intrusive scrutiny, and pledged resources for repayment….

The functional dollar liquidity of the ESF is tiny: $21.9bn in liquid dollar securities… $3.5bn in yen and $2.2bn in Euros… but that is it…. A $20bn swap facility would consume 95 per cent of the US’s dollar reserves and 72 per cent of the US’s total foreign-currency reserves…. The Treasury… [could] swap… SDRs for dollars with the Federal Reserve… [via] clever financial alchemy, but [that is] not a route an SDR-phobic administration would want to go down in any but the most exceptional circumstances…. [And] the ESF is… not set up to be a long-term lender…. [It] can extend credit for [only] six months in a 12 month window without procedural and political hurdles…

Despite Milei’s tough talk, he has taken Argentina dangerously off track of its IMF programme…. Treasury cannot afford for Argentina to miss its policy targets and blow through this swap line as easily…. Moving forward with the swap line in the absence of clear reserve accumulation targets and a clear repayment source would be a policy error. To do it right will almost certainly require abandoning the peso’s current peg, and a reworked IMF programme built around a much weaker peso…

I do not really have any disagreements with Setser and Paduano. All I can do is to try to put their major points, explicit and implicit, into nice bite-sized talking points. Except for (10). Setser and Paduano do not go there. But it is true, and needs to be said:

The simplest test: does support raise net reserves and secure repayment? If not, it’s subsidy, not stabilization. This commitment doesn’t.

Markets reward credible paths to reserves and current‑account surplus; they punish peg‑defense with thin firepower without fundamentals reform.

Declarations of unconditional ESF support weakens leverage; conditionality is the price discipline that averts moral hazard.

Exchange‑rate flexibility is not optional; a too‑strong peso erodes reserves and worsens the external balance.

Without an FX market that clears, even severe fiscal cuts won’t fix the dollar shortage; macro anchors must align.

Stabilization must start with a devaluation large enough to create a visibly undervalued peso.

That is how Mexico 1995 worked, after depreciation and hard conditions; replicating success means targets, vetoes, and pledged repayment sources.

The political timing magnifies risk: elections raise defense temptations; conditionality must pre‑commit against burn‑rate panics.

IMF–Treasury coordination is existential; policy drift risks sidelining the Fund and damaging preferred‑creditor norms.

A Treasury Secretary who has pledged “unconditional support” for a country in an exchange rate crisis because of its commitment to an unsustainable peg is useless, and needs to resign. If he follows through on his word, he likely transfers all of the Treasury’s Exchange Stabilization Fund to currency traders willing to make the Soros Bet. If he doesn’t follow through on this word, then no statements of his are ever credible—and a Treasury Secretary whose statements are not credible is worse than useless. Bessent needs to go. And quickly.