I Have Reached My Limit. I Cannot Stand It. Too Much Sanewashing of the Trump Administration Has Broken My Brain

A huge number of journalists continue to talk about a “Trump administration” with things called “policies” that it “plans”. They know better. They should act better…

As the extraordinary tropism for pretty much everyone to sanewash Trump has taken over, I have been losing it more and more.

In the old days, one could at least count on the news pages of the Wall Street Journal—they were, as one old hand said, information so financiers could make money, while the editorial pages were balm for the right-wing plutocratic soul. But even before Gerry Baker the wall had clearly eroded, and add to it a desire to make sense of Trump (and perhaps a growing eagerness to please sources, and it is now distrust and verify).

Then it was the Financial Times, as Gillian Tett and others began to take an anthropological approach to the Trump administration—look at all these interesting beliefs of this tribe! we should respect their cognitive picture of the universe!

And now we have the very sharp John Authers of Bloomberg:

John Authers: Where’s Mike Tyson With Advice When You Need Him? <https://www.bloomberg.com/opinion/newsletters/2025-04-25/trump-plan-where-s-mike-tyson-with-economic-advice-when-you-need-him>: ‘The great boxer Mike Tyson and once said that everyone has a plan until they’re punched in the face. Similarly, the Trump administration had one for rebuilding the world economy with tariffs. It’s been a rough first round. The plan was Stephen Miran’s A User’s Guide to Restructuring the Global Trading System, which must have been the most-viewed document by the financial world over the last six months. Stunningly ambitious, it helped earn its author a gig as chairman of the president’s Council of Economic Advisers, birthed the concept of the “Mar-a-Lago Accord,” and was widely taken as the road map for Trump 2.0’s bid to reshape the world using tariffs…

That is pretty much all a, well, completely out of contact with anything one might find her on God’s Green Earth:

The Trump administration had no plan.

Trump had grievances.

Miran had a plan.

Navarro had a very different plan.

Trump says stuff.

Bessent, Lutnick, Hassett, and others frantically try to retcon a small selected subset of what Trump says into a plan, and try to get Trump back on some kind of track.

They fail, over and over again. And reporters sanewash the enterprise, over and over again.

Read a little bit further, and you get:

John Authers: Where’s Mike Tyson With Advice When You Need Him? <https://www.bloomberg.com/opinion/newsletters/2025-04-25/trump-plan-where-s-mike-tyson-with-economic-advice-when-you-need-him>: ‘the “User’s Guide” reads differently now. Some of it has come to pass, Trump has deviated sharply from important recommendations, and certain assumptions now look tenuous at best…

No:

It does not read differently now.

It reads like it read last fall: as Miran’s plan, not Trump’s.

Its “certain assumptions” do not “now look tenuous”. They always looked unhinged.

Trump has not deviated sharply from important recommendations. Trump was never on course to follow those recommendations.

IT WAS NEVER TRUMP’S PLAN. TRUMP HAD NO PLAN EXCEPT TO VENT GRIEVANCES AND GET HEADLINES.

GROW UP, SHEEPLE.

And because he starts with sanewashing Trump as his foundational ground zero, very little of what Auther says makes sense. I could feel myself becoming dumber and losing brain cells by the minute as I read it:

(1) “If Europe has already decided that it cannot rely on US protection, as seems likely, then that makes life much easier for the US…”: No—it does not make life easier for the U.S. We used to have real allies, and as primus haud inter pares could count on their economic, diplomatic, moral, and geographic resources as a force multiplier to roughly double our weight in the world. Now, because of Trump, we have no allies. Life is not much easier for the US, it is much harder.

(2) “Miran expected the currency to rise… which he argued would have the effect of putting the burden on to the tariffed country…”: No—he argued that, but it was false. Imposed tariffs plus retaliation plus uncertainty plus the demonstration that everyone needs to derisk from the United States meant the even the threat of the tariffs was always going to put an enormous burden on the United States, with respect to which the effects of changes in terms-of-trade would be minor third-order corrections.

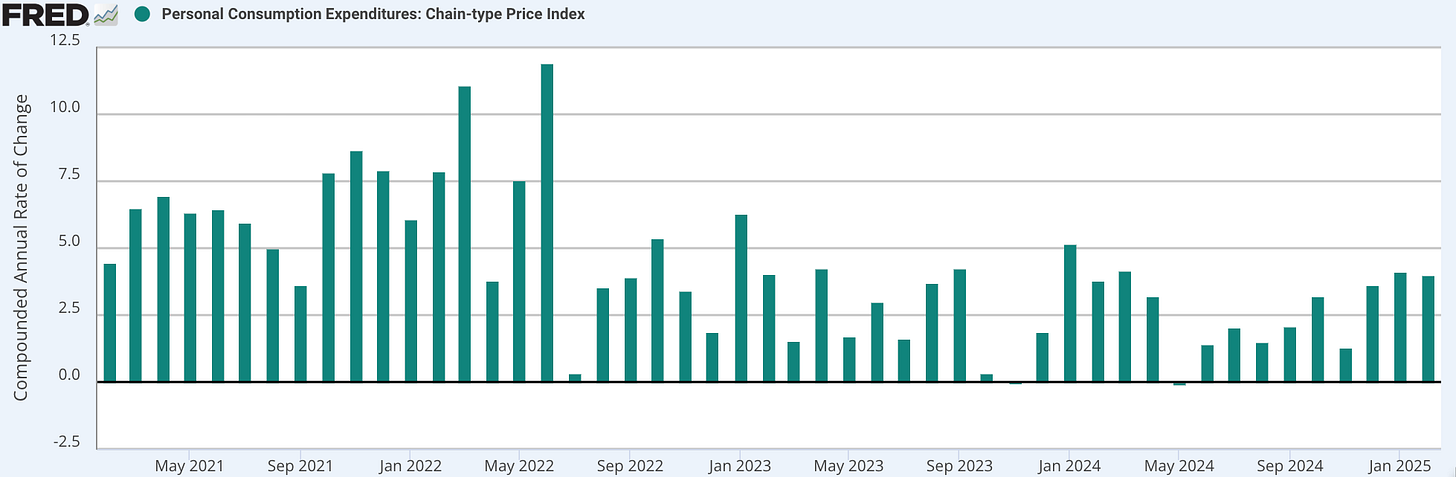

(3) “Miran acknowledged that… if the dollar were to weaken, then continuing inflation worries and the high budget deficit would put pressure on Treasuries…. The good news is that inflation numbers have improved in the last few months…”

What improvement in inflation numbers? The Fed watches the PCE. Given Trump’s desires to impose tariffs and blow up the budget deficit and the expectational consequences of same, all hope for any significant improvement in inflation numbers went out the window last November.

(4) “Advice Ignored: Proceed Gradually…. Miran’s precise suggestion was to raise tariffs by 2% each month until an agreement was reached. That would have worked very much better than the chosen strategy of hiking the tariff on China to 145% in very short order. The exasperating twists and turns of the last three months mean that any forward guidance cannot be credible. That has had a massive effect on uncertainty, even for the administration’s natural constituency of small business owners…. It’s not yet clear how damaging this will be, but the administration has taken a big risk by acting in such an unpredictable way…” No: Not even. There is no even. ESPECIALLY. And it makes no sense to say “the administration has taken a big risk” in the hope of getting some return, because there is no way in which the Trump administration can be, even metaphorically, accurately described as an animal with a mind. Chaos-monkey did chaos. There was no thought about whether the risk was worth running. There is only chaos, and then a few people scrambling around hoping that they can convince John Authers and his ilk that it is all part of a plan, even if they admit it is not a particularly clever or good plan.

(5) “Advice Ignored: Don’t Upset the Markets…. The White House is doing its best to look as unbothered by market selloff as it can…” Does anybody think that the White House as an entity is “unbothered”? Everyone in it is very borrowed. The most you can say with respect to “unbothered” is that Navarro hopes that at some point asset prices will stabilize, and then everyone will forget how much lower they are, and that Trump continues to say random chaotic stuff by day.

(6) “Questionable: Tariffs Aren’t Inflationary…. This looks increasingly like over-learning the lesson from the very different environment of… 2018… [when] tariffs were imposed gradually and with due warning, against a backdrop of placid inflationary pressure…” No: The small tariffs of 2018 delivered about as much inflationary pressure as one would have expected: about 0.3%-points <https://www.aeaweb.org/articles?id=10.1257%2Fjep.33.4.187> <https://www.bostonfed.org/publications/current-policy-perspectives/2025/the-impact-of-tariffs-on-inflation.aspx>. The claim that large tariffs would not be inflationary was always not “questionable” but unhinged. Always.

(7) “Questionable: Demand for Treasuries Is Eternal. [Miran:] ‘Much (but not all) of the reserve demand for [dollars and Treasuries] is inelastic with respect to economic or investment fundamentals. Treasurys bought to collateralize trade between Micronesia and Polynesia are bought irrespective of the US trade balance with either, the latest jobs report, or the relative return of Treasurys vs. German Bunds…’ Demand may not be as inelastic as all that…. Effectively, the suggestion [from Miran] is that the US should charge foreigners a fee for the privilege of lending to Uncle Sam…” For the amount of Treasurys that collateralize trade between Micronesia and Polynesia is microscopic. Reserve and other demand for Treasury’s is HUUUUUGELY dependent on economic, investment, geopolitical, and—as we saw in the misadventures of Liz Truss and Kwasi Kwarteng—moron-premium fundamentals. And the proposal to “effectively… charge foreigners a fee” was never questionable, always unhinged. For it is the most basic principle of public finance is that it is always unwise to alter after the fact the terms of payment on bonds you have already sold.

(8) “Questionable: The US Can Beat China in a Game of Chicken.… It looks at present like this is flat wrong. China retaliated swiftly… amped up the pressure… blocking… rare earths. Trump’s rhetoric is already swerving away from the confrontation…. The Chinese response is that tariffs have to come down first before talks can begin…. This game will be won by the player who can absorb the most pain. That appears to be China, even though it also stands to lose more…” No:

China exports $500 billion a year to the United States—in billions: $125 of electrical and electronic equipment, $100 of machinery, $30 of toys, games, sports requisites, $30 of apparel, $20 of plastics, $20 of vehicles—which are pretty much all finished products: things, and things that are useful, for which there is demand elsewhere in the world.

If China embargoed exports to the United States completely, it would over the next two years have to sell two years’ of stuff at half-off to others, and thus take a $500 billion hit.

The $500 billion a year of Chinese goods exported to the United States feed into the value chains of the predominately service-sector US economy, and are crucial parts of $3 trillion a year of US GDP. Over the next two years, there is not manufacturing capability in the US or elsewhere to replace those. Apple cannot get iPhone hardware at scale other than from China, and without hardware there are no distribution or software or services revenues for Apple or for anybody else relying on their platform. So over the next two years $6 trillion of US GDP simply stops. (Except to the extent that we pay women in Bangladesh to cut “made in China” labels out of and sew “made in Bangladesh” labels into clothes.

Trump has launched a trade war not against China but against the world.

The US is a much bigger loser from a trade war in which the rest of the globalized world continues on its course, and only the US is frozen out.

(9) “What Lies Ahead: So where does this leave us? A hundred days in, Miran’s “User’s Guide” shows that the administration entered the conflict with an inflated view of its own strength, and that it has been handled more abruptly and aggressively than the architects of the policy wanted. The response so far has not been what was bargained for…” No: THERE WAS NO “VIEW OF ITS OWN STRENGTH” THAT COULD BE DESCRIBED AS ‘“INFLATED”. THERE WERE NO “ARCHITECTS”. NOTHING WAS “BARGAINED FOR”.

(10) “We’re not keeping to the course laid out by Miran, but that doesn’t mean that we are irrevocably on the road to de-dollarization…” Again: NO!!! There was never a course. There are now, and will for the foreseeable future be frantic attempts to retcon things into a plan, a strategy, a course. We are not on any road. And we will not be on any road, absent the appointment of a Regent and universal accord that the Truth Social ravings of the president are in no sense to be understood as having anything to do with the policies of the United States of America.