Trump vs. Powell vs. Trump vs. Warsh

On the Edge Again: The Fed, Trump, and the Risk of a 1980s-Style Spiral: An ongoing cautionary tale of monetary policy, inflationary pressures, and the destabilizing influence of political interference…

From now on the Federal Reserve faces a harder balancing act, as Donald Trump reenters the political fray with threats against Fed Chair Jerome Powell. On one side, economic momentum is weakening: business investment is retracting in the face of political chaos as the “animal spirits” that drive growth are deflating. On the other side, inflationary pressures are building from Trump tariffs. Now layered atop this economic instability is the political wildcard of Donald Trump’s chaos-monkey act, in the context of his very clear and very present desire to fire his own former choice for Fed Chair, Jerome Powell. Inflation bares its teeth, recession looms, and Trump wants the Fed Chair’s head on a pike. These are waves that might wash the sandcastle order of economic stability and prosperity away.

To switch metaphors, the Federal Reserve right now is pinned like a butterfly stuck in a museum case. We have collapsing business animal spirits as people who enthusiastically voted for Trump last November recognize that the damage from chaos-monkey policies outweighs the benefits of tax cuts, and that they are better cut back investment. Raising interest rates thus runs big risks of a recession, and risks a big recession. But Trump tariffs are bringing rising inflation as surely as day follows night for all who are not Joshua, son of Nunn. Failing to raise interest rates thus runs risks of boosting inflation. It required four shocks from bad policy and bad luck to get the U.S. into the inflationary spiral it was in 1980: the failure to contract fiscal and monetary policy during the Vietnam War, Nixon’s turning up the heat to boost his reëlection chances while welding the top onto the pot via wage-and-price controls, the 1993 OAPEC Yom Kippur Arab-Israeli war oil embargo, and the Iranian Revolution. We have now had three shocks: post-COVID reopening, Putin’s attack on Ukraine, and Trump tariffs.

Will there be a fourth?

And might it bring a return to a 1980-like expectational spiral?

I think it will not. I think we are still far from the cliff. But we are much closer than we were back in 2020.

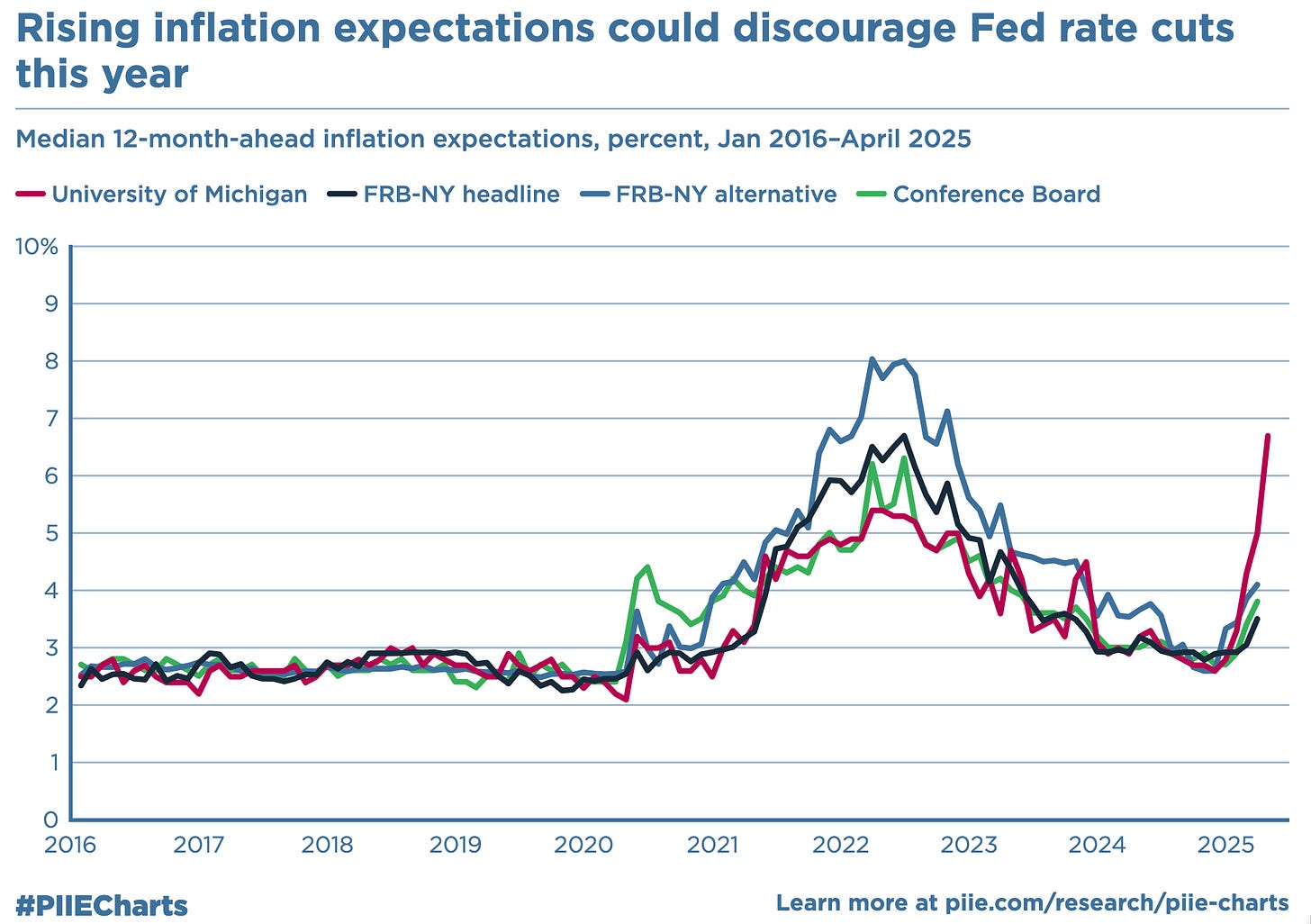

And there already is shock #4: Trump’s desire to try to fire Fed Chair Jerome Powell, even though all his advisors are pulling back on what reins they have on him as hard as they can. Inflation expectations are already on the move—to a small degree among the professionals, and a large degree in the surveys:

And we have today, April 23:

Dan Ennis: Trump backs off his push to fire Fed’s Powell <https://www.bankingdive.com/news/trump-no-intention-fire-jerome-powell-fed/746148/>: ‘President Donald Trump said Tuesday he has “no intention” of firing Federal Reserve Chair Jerome Powell. “Never did,” Trump told reporters in the Oval Office. “The press runs away with things”…

We had, on April 18:

Aimee Picchi: Trump is studying how to remove Fed Chair Jerome Powell, economic adviser says <https://www.cbsnews.com/news/trump-powell-studying-removal-fire-kevin-warsh/>: ‘President Trump and his team are studying whether firing Federal Reserve Chair Jerome Powell is an option, according to National Economic Council Director Kevin Hassett…. "The President and his team will continue to study that matter"…

Kevin Hassett still has his job. So Trump is very happy having someone directly working for him who he claims is a big liar. And Hassett has so little self-respect that he is happy to keep working for someone who claims he is a big liar. Two scorpions in a bottle, each thinking he is using the other, and both probably wrong. Not to mention the fact that Powell was, originally, the one person out of 330 million Americans whom Donald Trump picked as best qualified to be Fed Chair.

And on April 17 we had:

Brian Schwartz & Nick Timiraos: Trump Has for Months Privately Discussed Firing Fed Chair Powell <https://www.wsj.com/economy/central-banking/trump-has-for-months-privately-discussed-firing-fed-chair-powell-628d3d79>: ‘The president hasn’t made a decision on whether to try to oust Powell, and some of his advisers have warned against the move: President Trump said he can fire Federal Reserve Chair Jerome Powell at any time because he believes the chair has been slow to cut interest rates…. President Trump has for months privately discussed firing Federal Reserve Chair Jerome Powell, according to people familiar with the matter, but he hasn’t made a final decision about whether to try to oust him…

Who would Trump want to choose to replace Powell? Kevin Warsh. We also have:

Brian Schwartz & Nick Timiraos: Trump Has for Months Privately Discussed Firing Fed Chair Powell <https://www.wsj.com/economy/central-banking/trump-has-for-months-privately-discussed-firing-fed-chair-powell-628d3d79>: ‘In meetings at the president’s private Florida club, Mar-a-Lago, Trump has spoken with Kevin Warsh, a former Fed governor, about potentially firing Powell before his term ends and possibly selecting Warsh to be his replacement, the people said. Warsh has advised against firing Powell and has argued that he should let the Fed chair complete his term without interference, according to the people. The conversations with Warsh carried into February, while others close to the president have spoken to Trump about firing Powell as recently as early March, the people said…. Trump’s advisers don’t agree themselves over how far the president should go, and it remains unclear if the president will move to fire Powell

Several people who have spoken to Warsh in the past year said Warsh gave the impression that the Fed job had all but been offered to him once Powell’s term expires…. Trump… mak[es] the case to allies in private meetings that the Fed chair should lose his job and that the Fed’s governing law, which says policymakers can only be removed “for cause,” isn’t strong enough to hold up in court if he sought to remove Powell…

And to complete the chaos-monkey circus, we have puzzlement from Dan Ennis later down in his story:

Dan Ennis: Trump backs off his push to fire Fed’s Powell <https://www.bankingdive.com/news/trump-no-intention-fire-jerome-powell-fed/746148/>: ‘Fed governor Kevin Warsh, 55, is a former Morgan Stanley executive who was nominated to the Fed's board of governors by President George W. Bush. Mr. Trump is considering selecting Warsh as Powell's replacement, the Wall Street Journal reported on Thursday. However, Warsh has advised Mr. Trump to allow Powell to remain through the end of his term, the publication added. Widely respected, Warsh is considered to be even more hawkish — or willing to allow interest rates to remain high to control inflation — than Powell, according to a January blog post by Harvard economist Kenneth Rogoff…

Indeed, Ken Rogoff did write on January 2 that Warsh has been more hawkish than Powell with respect to interest rates in his comments and had been more hawkish than Powell with respect to interest rates in his votes when he was on the Fed. But that was before Warsh signed up with Donald Trump. And many, many people lose their moral principles and their intellectual commitments when Trump offers them a chance that they think will get him on his careening career of grift. Will Warsh be different? Perhaps. So is Rogoff right? Perhaps, perhaps not. I am made very uneasy by Rogoff’s:

Kenneth Rogoff: Will Trump Fire the Fed? <https://www.project-syndicate.org/commentary/trump-bid-to-control-fed-puts-us-economy-at-risk-by-kenneth-rogoff-2025-01>: ‘Trump’s antagonism toward Powell is baffling, given that Powell has been doing an excellent job…. To Trump’s credit, the leading candidate to replace Powell, Kevin Warsh, is a highly regarded former Fed governor who has consistently been even more hawkish than Powell…

But that would be to Trump’s credit only if you think that Powell has been insufficiently hawkish. And I have certainly not seen that argument made. Plus Rogoff is one of the few people alive who claims to be “baffled” by Trump’s strong eminent antagonism toward and desire to fire Powell. Everyone else seems to have no problem understanding it.

So in what rhetorical mode are we supposed to take this?