The Economic Foundations of Peace: On International Economic Organizations :: Thursday Hoisted From the Archives:

From 1997-11-05: Largely forgotten lessons of 1931: how economic missteps fueled global conflict, & how danerous a historical pattern economic chaos and political extremism can rapidly become…

What do international organizations have to do with maintaining the peace?

Let me start with a quote from a book published in 1928. A book written by two inhabitants of Britain--Quigley and Clark--to introduce and summarize for their fellow English-speakers what had been going on in Germany since the end of World War I. In the introduction to their book, Republican Germany: An Economic and Political Survey, the authors wrote that they had been very lucky in that their subject had a single powerful important theme: In the introduction the authors wrote that they were fortunate because they had a single, central, powerful theme: the coming-to-maturity of the post-World War I German republic. They wrote that:

The consolidation of the German [Weimar] Republic is in itself a theme of the most absorbing interest; it lends itself to dramatic presentation with the leading characters active at moments with a real dramatic force.... The fifth and probably last act [of the play of consolidation] is now being played, and promises something... heartening... There may be scenes of conflict, world-shaking events, accompanied by the possibility and dangers of war, but the real consumation will probably be reached-- namely, the recognition of the German Republic as a permanent feature in German history and its economic and political relations, and, with it, the opening of a new era of international prosperity…

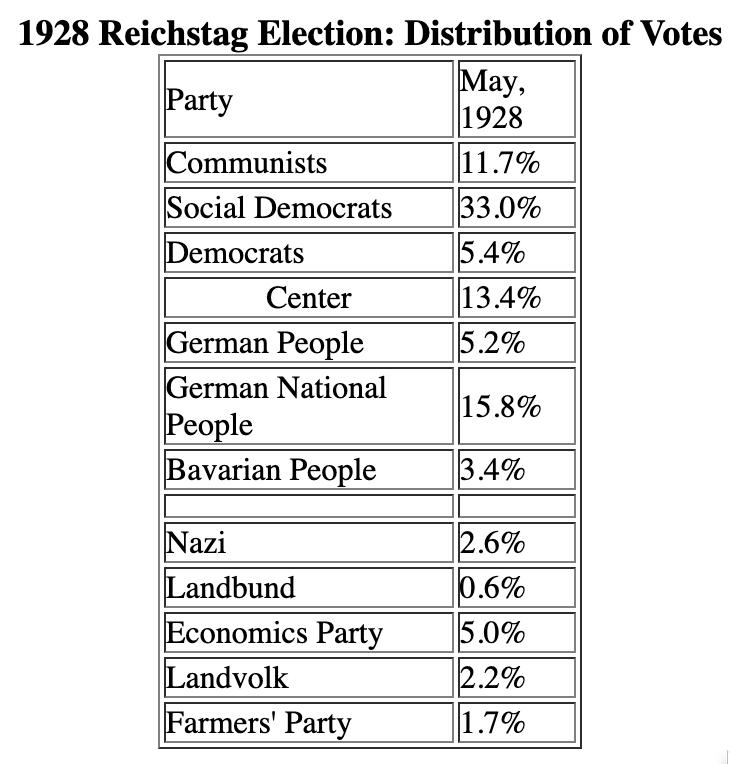

To support their theme of successful Republican consolidation, Quigley and Clark discuss at length the failure of extremists to overthrow the government or even to mount a substantial electoral challenge in the legislature. They acknowledge that the extremes of German politics contain "...secret societies in morality and mentality far more akin to the worst traditions of medievalism than to those of the twentieth century...", but the extremes were small. One of the parties that Quigley and Clark discuss--the National Socialist German Workers' Party--got a mere 2.6% of the vote in the Reichstag elections of 1928. Only 23 percent of the electorate voted either on the left on the right for the fringe parties with more-or-less impractical and nutty platforms. Some 77 percent of the electorate voted for the main band of the left-right spectrum extending from the social-democratic SPD on the left to the hawkish and nationalist DNVP on the right.

Now Quigley and Clark were not idiots. In 1928 the Nazis were an unimportant part of the political fringe--equivalent to Lyndon LaRouche or to Harry Brown in America today. There was every reason to expect that the continued economic growth and recovery of Weimar Germany would further marginalize the Stalinist left of Thaelmann and the extreme right of Hitler.

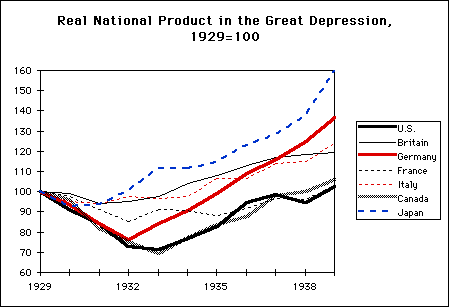

Project the economic growth of Germany from 1920 or 1924 to 1928 out through the 1930s, and it would have been a different world. Perhaps the mayor of Köln would have become the leader of the Catholic Center party, and maintained the grand coalition of the center. In all probability the British Prime Ministers Stanley Baldwin and Neville Chamberlain would have responded very favorably to requests from a democratic German government for the revision of the terms of the Treaty of Versailles--which had left Germany alone of the nations of Europe with a very substantial part of the speakers of its language in territories assigned to other nations. Perhaps Konrad Adenauer in the late 1930s would have won diplomatic triumph after diplomatic triumph over the issues of Germany's frontiers, showing that Germany could win friendship and diplomatic victories through trade and aid rather than through conquest.

Perhaps political science graduate students would now be writing dissertations on the origins of Neville Chamberlain's far-sighted policies of appeasement in the late 1930s, which had done so much to lay the foundations for the European Community and the great European economic boom of the 1940s and 1950s.

But that was not to be.

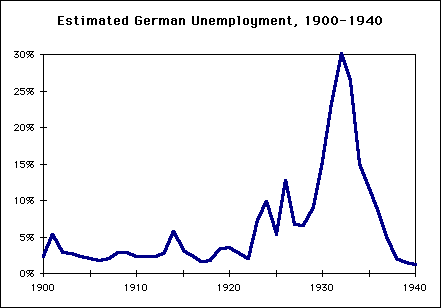

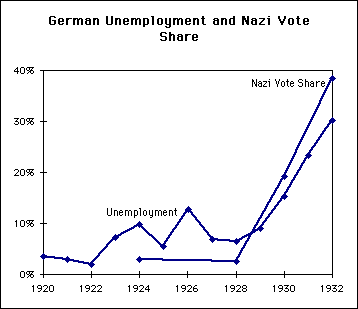

After 1928, German unemployment began to rise.

And as unemployment rose, the Nazi Party vote rose as well. The party that had won 2.9 percent of the national vote in 1924 and 2.6 percent in 1928 won 19.2 percent in the election of 1930, and 38.4 percent in the election of 1932.

No Great Depression, no sharp rise in German unemployment. No sharp rise in German unemployment, no rapid and substantial rise in Nazi Party vote share. No rapid and substantial rise in Nazi Party vote share, no fatal mistake by German conservatives in January 1933 of inviting Hitler to share the government.

The major international economic organizations--the International Monetary Fund, the International Bank for Reconstruction and Development, and the other development banks--were born out of this history. The lessons drawn from this history by those present at the creation of these post-World War II international economic institutions was roughly as follows:

Great Depressions--substantial interruptions in the pace of economic growth coupled with mass unemployment--are extremely dangerous to industrializing (and possibly industrial) democracies and semi-democracies. Extreme parties on the left, the right, or those claiming to be both at once (as did the National Socialist German Workers Party) flourish in times of economic discontent.

Once such a party achieves power the peace and security of its neighbors is endangered. Perhaps (for example, Mussolini in Italy, Galtieri in Argentina, or Milosevich in Serbia) they will go to war as a way of distracting public attention from domestic discontent, labelling internal political dissenters as traitors, and winning victories to make the people feel good about the government. The most frank exposition of this view was the statement by one of Czar Nicholas II's ministers, Count Witte, that what the Czarist government in 1904 really needed was "a short, victorious war."

Or perhaps the extreme party that takes control will believe that the world is populated by its enemies: the Jews, the assembled multinational bourgeoisie, perhaps those of different religion--there are lots of possible enemies. It is well-known that a country surrounded by enemies has to strike first in self-defense. For example, the rulers of Germany in the 1930s believed that the only way to defend Germany against International Jewry was (a) to conquer Poland, Belorussia, Ukraine, and Russia itself to provide enough land and living space for the German people to become self-sufficient in food and to grow in population, (b) to enserf or exterminate the current inhabitants of eastern Europe, and (c) to annihilate as many Jews as they could reach.

An anti-democratic regime that rules by force is more likely to think that force is a good way to resolve international disputes than is a democratic regime. To promote prosperity and thus preserve democracy--to hasten developing economies through the danger zone of industrialization where they are most vulnerable to totalitarianism, and to keep the world economy an a sufficiently even keel to reduce the threats to democracy in the already- industrialized core of the world economy--these are the reasons that the IMF and the IBRD exist. These are the reasons that plans for these institutions (and there just-born younger sibling, then called the ITO but today called the WTO) were well-advanced on the postwar-planning drawing boards well before the end of World War II, and well before the partition of Korea and the subsequent invasion of South Korea, or the pushing of Czechoslovakia's Foreign Minister out the window, the Soviet blockade of Berlin, or any other of the precipitating incidents of the Cold War were even gleams in Stalin's eyes.

To my knowledge, at least, there is no evidence against the rough rule-of-thumb political science that underlay the decision by Franklin Roosevelt and others--Winston Churchill, John Maynard Keynes, Dean Acheson, Harry Dexter White, Henry Morgenthau, Henry Stimson, George C. Marshall, and many others--to establish the major international economic organizations of our day. It may not be right--the chain of events from the failure to maintain economic growth and full employment to a militaristic regime bent on aggressive war is a long one, and could be interrupted at many points; some democracies have at times gone to war with as much zeal and glee as any class-antagonism or social-darwinism believing totalitarian.

But even if it isn't right, the fact that there is no evidence against this rough rule-of-thumb political science means that we at least have no choice other than to assume that there is a chance that it could be true. Thus we are under grave moral obligations to speed the progress of countries through the possible vulnerable period of industrialization not just for the sake of the countries' populations but for the sake of their neighbors' survival--and in these days all countries are one another's neighbors. This is what the World Bank is supposed to be for. And we are under grave moral obligations to keep the growth of the world economy as smooth and steady as possible--and to make sure that the less-than-fully-rational lurchings of internatinal investment and finance do not drive countries or regions into analogues of the Great Depression. This is what the IMF is supposed to be for.

How well do they do their jobs?

Better than one might fear, but not nearly as well as one would hope.

Let me return for a moment to the 1930s. If there is one moment in the 1930s that haunts economic historians, it is the spring and summer of 1931--for that is when the severe depression in Europe and North America that had started in the summer of 1929 (in the United States) and in the fall of 1928 (in Germany) turned into the Great Depression. The successive series of national financial crises inducing forced devaluations and causing suspensions of currency convertibility played a large role in inducing wealth-holders to pull their money out of the banking systems of their respective nations and to hold it in the form of gold or cash. These internal drains on the banking-system reserves of the various nations played a major role in further reducing the money stocks, levels of aggregate demand, price levels, and production around the world.

And there is the suspicion that if only the first of these crises--the Austrian crisis--could have been handled successfully, that international speculators would have drawn the lesson that the financial governors of the world economy were strong enough to resist forced devaluation and convertibility suspension. In that case the waves of speculation that occurred from 1931 through 1936 would have been waves of stabilizing speculation, reinforcing confidence in the ultimate soundness of the international economy--and with hot private-sector money betting on the success rather than the failure of central banks, the economic history of the 1930s might have been much, much better.

Austria's major bank, the Credit Anstalt, was revealed to be bankrupt in May 1931. Its deposits were so large that freezing them while bankruptcy was carried through would have destroyed the Austrian economy. The government stepped in to guarantee deposits, but the resulting expansion of the currency made people fear that there would be a devaluation. Capital fled Austria. The Bank for International Settlements began to host negotiations to coordinate international financial cooperation to boost Austria's reserves and allow it to survive the panic without either devaluation or a suspension of convertibility.

Charles Kindleberger and others have always suspected that rapid and successful conclusion of these negotiations might have stopped the spread of depression. Austria was a small country. There was not that much capital to flee. A sizable international loan to Austria's central bank would have allowed it to prop up its internal banking system and maintain convertibility. A month later those whose capital had fled would realize that the crisis was over, and that they had lost a percent of two of their wealth in fees and exchange costs in the capital flight.

Other speculators would observe that the world's governments were serious in their commitment to the gold standard, that the potential foreign exchange reserves of any one country were the world's, and thus that the likelihood of a speculative attack succeeding in inducing a devaluation was small. Perhaps investors would then have begun returning gold to central banks in exchange for interest-bearing assets, would have begun to shrink down their demand for liquidity, and would have begun to boost worldwide investment. The Economist's Berlin correspondent thought so:

It was clear from the beginning [he wrote]... that such an institution [as the Credit-Anstalt] could not collapse without the most serious consequences, but the fire might have been localized if the fire brigade had arrived quickly enough on the scene. It was hte delay of several weeks in rendering effective international assistance to the Credit Anstalt which allowed the fire to spread so widely…

We don't know whether the Great Depression could have been stopped because the attempt to stop it was not tried. Speculators continued to bet on devaluation, investors continued to hoard gold, the preference for liqidity continued to rise, and investment continued to fall.

The substantial loan to Austria was not made because French internal politics entered the picture. At the beginning of his political carreer French Premier Pierre Laval had styled himself a politician of the left: the Clarence Darrow of France. But by the early 1930s he had become a strong nationalist. He blocked the proposed international support package for Austria, insisting that if France was to contribute France had to get something out of it. The price that Laval demanded was made up of a series of diplomatic concessions, most important of which was the renunciation of a prospective customs union with Germany. To Laval, playing the nationalist card in French politics, nothing that benefited Germany could be allowed by France.

The BIS, the international economic agency that would have run the loan program, was not about to make a single move without the approval of all of Europe's economic superpowers.

So Austria lost: the support package collapsed, and the Austrian economy abandoned the gold standard and went into recession. In the long run France lost too: Nine years after the Credit-Anstalt crisis, the French government surrendered to the Nazis. Pierre Laval was not greatly inconvenienced at first by the Nazi conquest. He discovered that he was not a leftist at all but a Fascist. He became the second most powerful figure, and the true focus of decision making, in France's wartime collaborationist Vichy government.

Laval was executed for treason after the end of World War II.

Back in 1931, speculators observed that the international financial community did not support currencies that came under pressure. They wondered which country would be next to devalue--and thus which country to pull their money out of fast if they did not want to lose the thirty percent or so of gold value lost in a devaluation. The Great Depression came to Europe in full force:

John Maynard Keynes saw the Great Depression coming. He wrote at its very start, in 1930, the world was

as capable as before of affording for every one a high standard of life.... But today we have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand…

Keynes feared that "the slump" that he saw in 1930 “may pass over into a depression, accompanied by a sagging price level, which might last for years with untold damage to the material wealth and to the social stability of every country alike." He called for resolute, coordinated monetary expansion by the major industrial economies to "restore confidence in the international long-term bond market... restore [raise] prices and profits, so that in due course the wheels of the world's commerce would go round again."

Could better international economic agencies have avoided the trap into which the BIS fell? Problably not. Charles Kindleberger has pointed out that such action never emerges from committees, or from international meetings. And governments who choose the directors of international financial institutions tend to dislike leaders who are capable of strong decisive action in a crisis, especially when the major economic powers are split. The failure of the BIS to move in advance of and against the wishes of one of its major shareholders, France, is not unusual but is rather to be expected.

Then as now, the story is the same.

The IMF, the World Bank, and whatever other international economic institutions we construct are not going to do a good job of creating the preconditions for peace by acting swiftly and boldly to stem international financial panics. When there is consensus for action among the major economic powers, the international institutions are not needed (although they do function as useful instrumentalities). When there is no consensus for action among the major economic powers, the IMF and the World Bank will not dare move. Michel Camdessus and Stanley Fischer pushed the IMF a little bit out in front of the G-7 consensus when they committed some IMF resources to support the Mexican peso in the spring of 1995: Britain and Germany made their displeasure at even this small step known.

So I am sorry that I cannot offer more favorable news. But the international institutions that we have constructed are simply not up to the job of preserving prosperity that their builders hoped they would obtain.

A fuller quote from Quigley and Clark:

We have in Germany what is lacking in other countries during the post-war period--namely, a theme. The consolidation of the German Republic is in itself a theme of the most absorbing interest; it lends itself to dramatic presentation with the leading characters active at moments with a real dramatic force. The first act had all the vivacity and strength and suggestive force of a great play--the collapse of the German armies and the outbreak of the revolution, with Ebert emerging as the character dominating the stage. The second act, if we may continue the simile, was less interesting than the first, and represented a period of preparation, when new characters were introduced and new dramatic motifs were being evolved--the Treaty of Versailles and the early reparations discussions.... The third act had all the elements of tragedy in it.... Against a background of destitution and despair... strong contrasts and strong colours with a suggestion of future greatness of a fine, inspiring quality.... The fourth act... [showed] the emergence of new motives closely related to those which had gone to the proclamation of the Republic.... Capital and labour were working together and the State was deriving fresh strength from their union. The reparations problem had... reached a temporary solution.... The first period of consolidation of the German Republic after a time of disturbance. The fifth and probably the last act is now being played, and promises something more heartening than a catastrophic ending. There may be scenes of conflict, world-shaking events, accompanied by the possibility and dangers of war, but the real consummation will probably be reached namely, the recognition of the German Republic as a permament feature in German history and in economic and political relations, and, with it, the opening of a new era of international prosperity.

The dramatic theme is present, therefore, and only requires illumination and, to some extent, interpretation.... We may have a tendency to regard such things as the development of a democratic constitution as outside the range of literary and artistic effect, but even the struggles of a State forcing its way into a new conception of social, economic and cultural values may have in it all the greatness and all the tragic pettiness of the human spirit. There is certainly in this subject of Republican Germany the possibilities of a fine drama or of a world-embracing novel similar to Tolstoy's War and Peace. It is in this spirit that the study of contemporary Germany should be undertaken....

The main problem confronting the German Republic from the day of its birth was, in essence, that which confronts every modern democracy. Only, instead of a democratic constitution and a democratic view of life being developed over many decades and even many centuries, the act of conversion had to take place within a very short period.... The German revolution [of 1918-1919]... forced democracy to undertake its own salvation and its own direction. From the beginning, therefore, it was on trial, without traditions, without previous experience, and possibly without any real vision of future expansion. In any other country, as Italy and Russia have shown, democracy would not have survived.... It was largely a shaking-down process, with the discarding of many elements in the old regime which might at one time have been deemed important, and the discarding of such elements was not unattended by political and social disturbances. The Kapp revolt and the Hitler disturbance were political phenomena actuated by reactionary and conservative elements, even as much as the Spartacist and Kurt-Eisner revolutions were phenomena of extremism from the Left, which, in turn, had to be broken up and discarded.

We should not forget also the roles played by the first two German Presidents--namely, Ebert and Hindenburg. They contributed immensely to the success of the new regime ; their sincerity, their keen sense of duty and their consistency of character were, in themselves, an inspiration to the rest of Germany... [with] Hindenburg an even more admirable defender of the new democracy than Ebert...