THE MACRO-FINANCE SITCH: The Streams (of Falling Short-Term & Rising Long-Term U.S. Treasury Rates) Cross

In this case, the yield curve uninverts—and yet expectations remain for substantial declines in future short rates. How can this be? Arithmetically, by the “term premium” rising. But what does that term premium rise mean?

In the words of Egon Spengler of the Ghostbusters Team: “Don’t cross the streams!” Yet since September the streams have crossed—falling short-term and rising long-term U.S. Treasury interest rates bringing what looks to me like a premature uninversion of the yield curve. Is it the bond vigilantes cleaning their weapons in anticipation of having a Liz Truss Party for the arriving Chaos-Monkey-in-Chief? Or is it a very interesting but rather technical market microstructure phenomenon? I have a weak belief it is the second…

Yesterday AM we had the very sharp Torsten Slok raising possibilities, and reminding us of how British Prime Minister Liz Truss and her Chancellor Kwasi Kwarteng triggered the appearance of a “Moron Premium” in British government long-bond yields that immediately cost them their jobs:

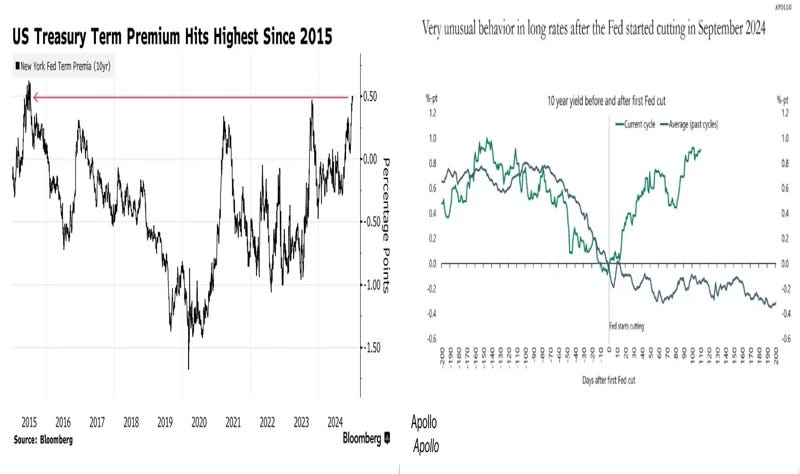

Alice Atkins & Lisa Abramowicz: “Rising [U.S.] Treasury Yields Risk a ‘Truss Moment,’ Apollo’s Slok Says”: ‘Treasury yields have been rising so fast that there’s a risk of bond market turmoil resembling the upheaval that led to the resignation of then British Prime Minister Liz Truss, according to Apollo Global Management’s Torsten Slok….. Concern about how the US will manage its ballooning debt burden, especially at a time that incoming President Donald Trump has promised to deliver tax cuts.… Worries bubbling up that Trump’s policies will fan inflation and unsettle bond investors…. Bond market anxiety… seen in… the term premium… the additional [expected] yield that investors demand to hold long-dated debt instead of [following the strategy of] rolling over shorter-term securities… [which] hit the highest level since 2015…. “80% of the increase in long rates since September has potentially been driven by worries about fiscal policy,” said Slok… <https://www.bloomberg.com/news/articles/2025-01-07/apollo-s-slok-says-rising-treasury-yields-risk-a-truss-moment>

Below (a) the term premium, and (b) a nice plot by Slok of how this easing cycle really is different as far as the reaction of the ten-year Treasury rate is concerned:

The key point: this upward jump in the second half of 2024 is not a belief that short-term interest rates will be higher in the future. It is, rather, a belief that short-term interest rates in the future are very uncertain, and thus that you need to be paid more in order to buy a long-term bond right now and so lose your ability to react when short-term rates change. So what is causing this belief?

This AM Paul Krugman chimes in, with what he says “may be wishful thinking”, making the case that this substantial—0.8%-point—upward move in ten-year interest rates since September is history rhyming—occurring the first time, as farce, and appearing the second time, as farce as well: a Moron Premium as “the bond market [is] starting to suspect that Trump really is [the unleashed chaos monkey] who he seems to be”:

Paul Krugman: “Is There an Insanity Premium on Interest Rates?”: ‘Look at the dynamic…. Jeff Stein… reported… people around Trump were planning a fairly limited, strategic set of tariffs…. Trump quickly responded with a Truth Social post calling the report “Fake News” and declaring that he does too intend to impose high tariffs on everyone and everything. In short, Sources: “Trump isn’t as crazy as he looks.” Trump: “Yes I am!” Then, as if to dispel any lingering suspicions that he might be saner than he appears, Trump held a press conference in which he appeared to call for annexing Canada, possibly invading Greenland, seizing the Panama Canal and renaming the Gulf of Mexico the Gulf of America. This morning CNN reported that Trump is considering declaring a national economic emergency — in a nation with low unemployment and inflation! — to justify a huge rise in tariffs…. But, you may ask, if bond investors are starting to worry about the madness of Trump 2.0, why are stocks up?… [Perhaps] stock… investors are… lizard-brained. Everyone knows about meme stocks…. I haven’t heard of any meme bonds…. [Perhaps]… the recent rise in stocks is… AI…. I don’t want to push this too far…. I don’t want to give in to motivated reasoning…. But rising interest rates even as the Fed cuts may be an early sign of things to come… <https://paulkrugman.substack.com/p/is-there-an-insanity-premium-on-interest>

So what do I think of this?

I think that Paul and Torsten are, more likely than not, engaging in at least a little wishful thinking here.

This feels to me much more like a “market microstructure” phenomenon than a “bond vigilantes cleaning their weapons at the prospect of the reïnstallation of the Chaos-Monkey-in-Chief” phenomenon.

Briefly, it does not look to me like bond traders are thinking that inflationary Trumpist policies will make short-term interest rates higher in the future than we thought they would be back in November. Rather, it looks to me like bond traders have shifted from “we locked in what looked like a very attractive yield” to “we preserved our freedom and avoided exposure to duration risk” as the message they are rehearsing in case they have to explain to their bosses what went wrong. Why they have done this is a fascinating question, but one that would require a deeper dive than I am capable of providing, and one that could not be easily explained by the spread of the “Trump will try to goose inflation” meme.

Much more in the weeds below the fold:

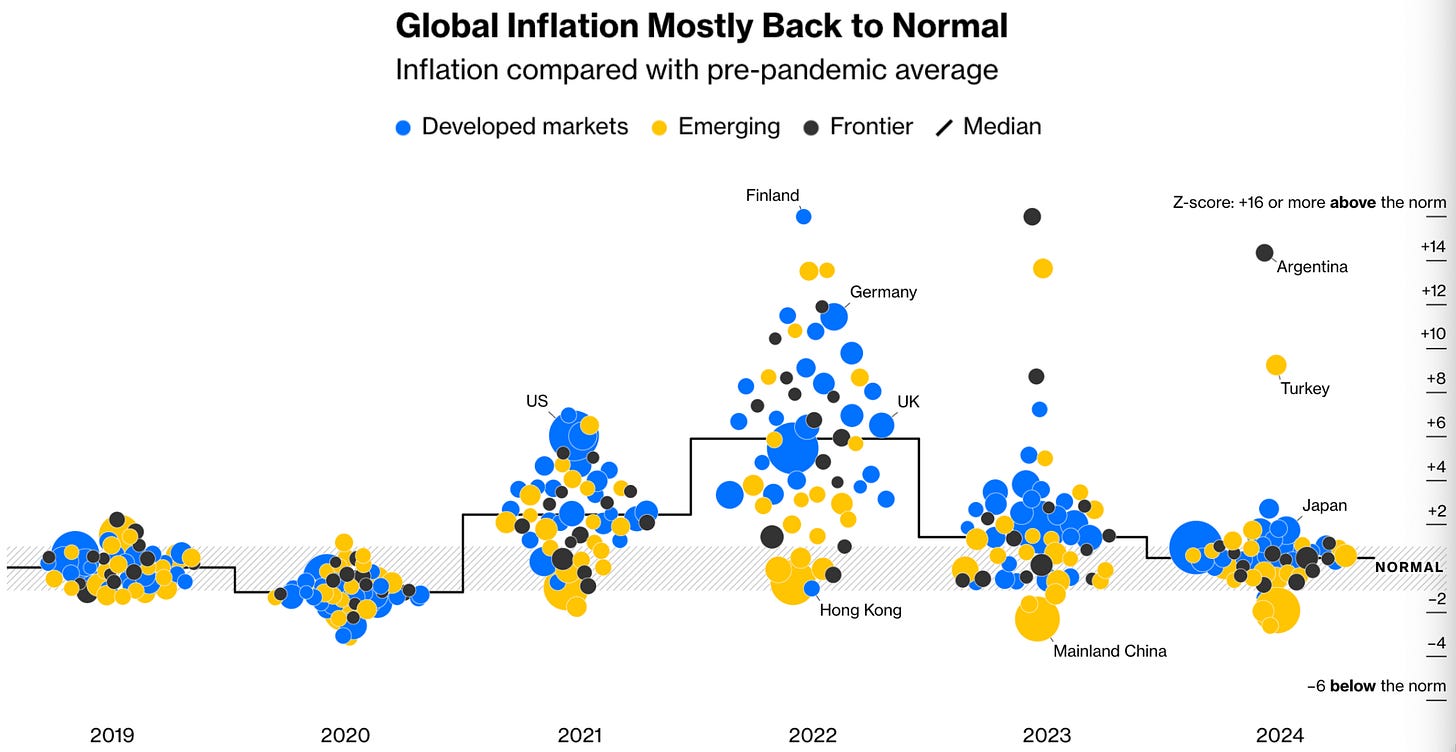

Start with the fact that the principal source of macroeconomic uncertainty over the past three years—whether the outburst of inflation we saw emerging in 2021 would be transitory (and so return to earth without any required substantial economic downturn) or permanent (and require a painful high-unemployment recession to return inflation to target)—has been settled: it was transitory, even when the supply shock of Putin’s attack on Ukraine was added to the mix. A very nice graphic from Bloomberg <https://www.bloomberg.com/opinion/features/2024-12-19/fed-cuts-2025-central-banks-began-a-descent-they-can-t-finish>:

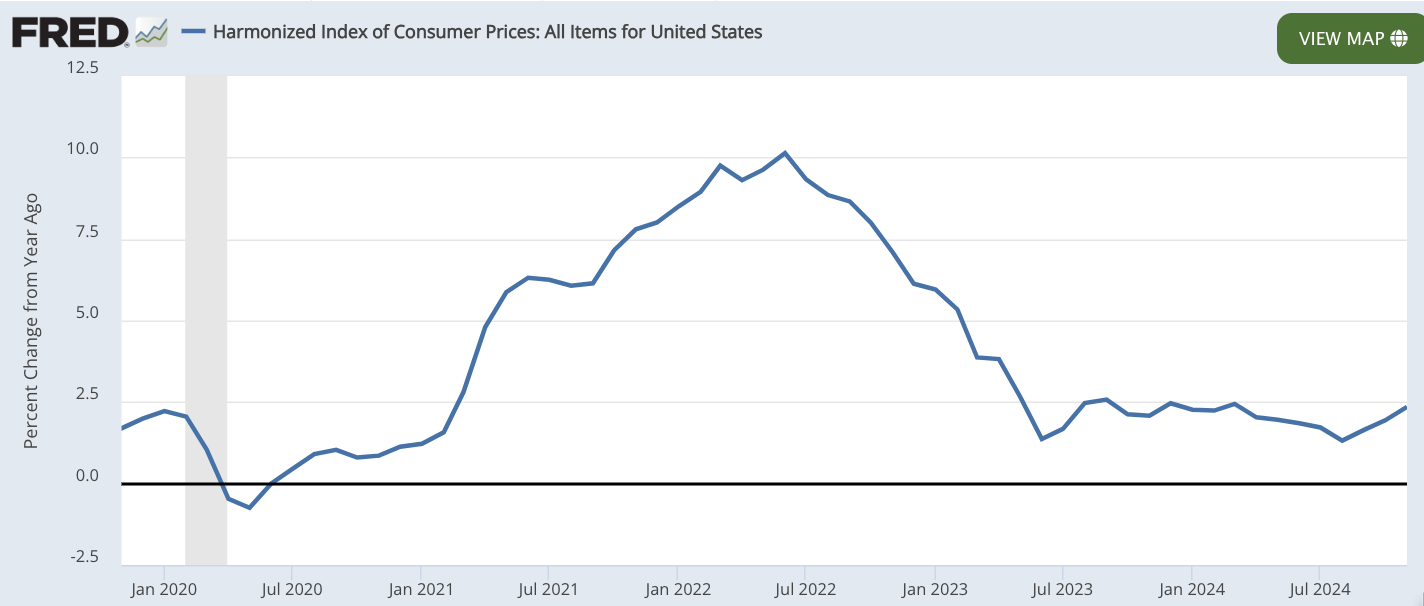

In fact, the U.S. completed its inflation soft landing by June of 2023. So the Harmonized Index of Consumer Prices, which leaves out the guesses about owner-occupied homes tells us. Here is the previous year’s outcome:

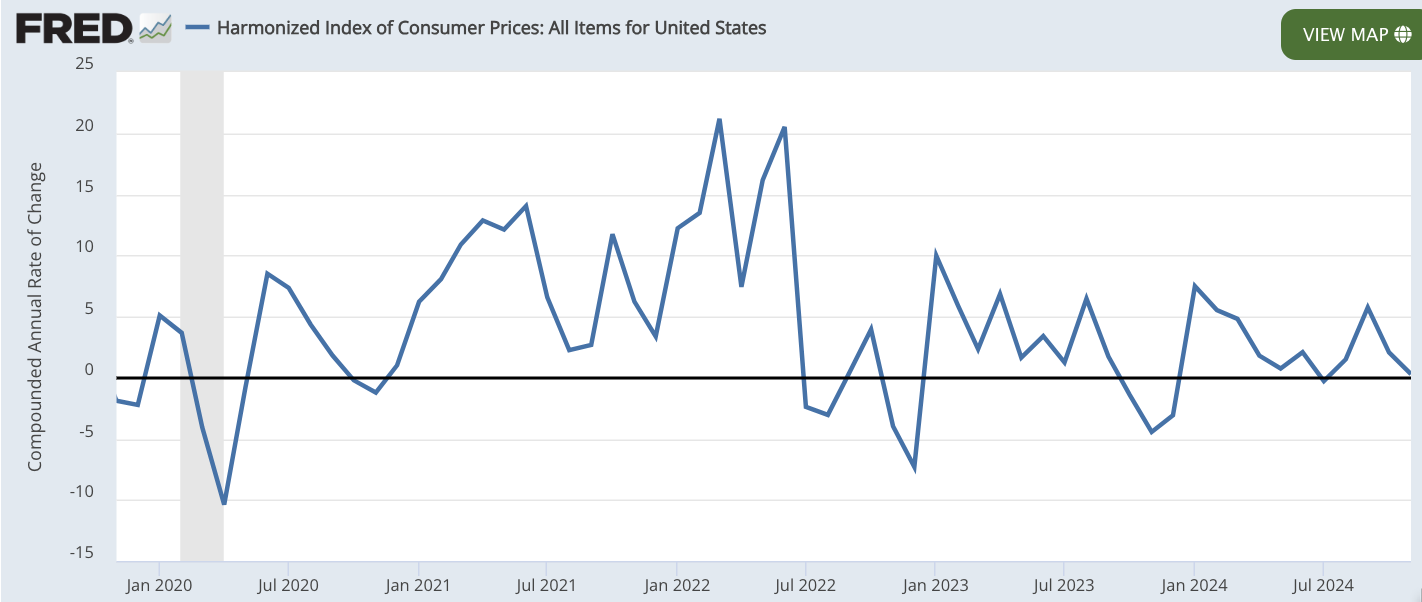

And here is the month-to-month:

Since then, for more than a year and a half now, as far as inflation and employment are concerned the economy has just been slowing down, taxiing off the runway, and approaching the terminal. Nothing much has been happening other than that things have gone surprisingly well: Given how low and durable the return to near-normal inflation has been, U.S. production, demand, and employment have been very surprisingly strong. Given how surprisingly strong production, demand, and employment have been, inflation has been surprisingly low. What’s not to like?

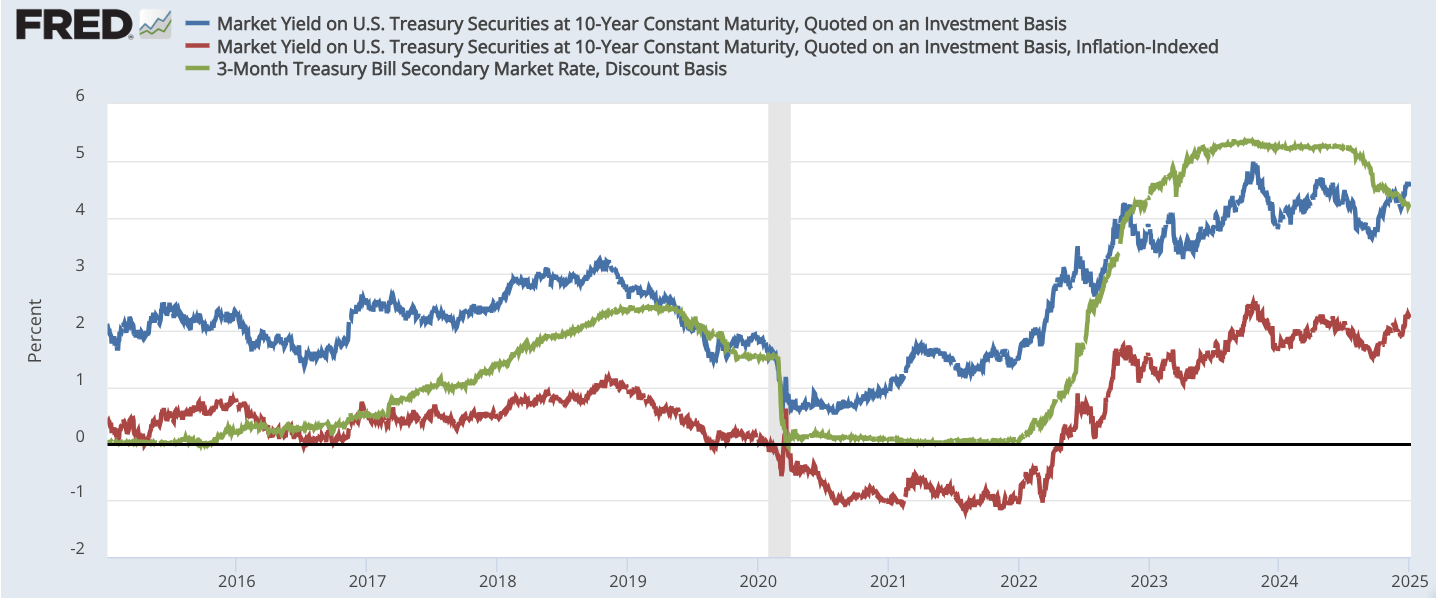

Let us recall where the Treasury bond market actually is right now—the 10-Year nominal Treasury yield, the 10-year inflation-indexed TIPS Treasury yield, and the Treasury Bill rate:

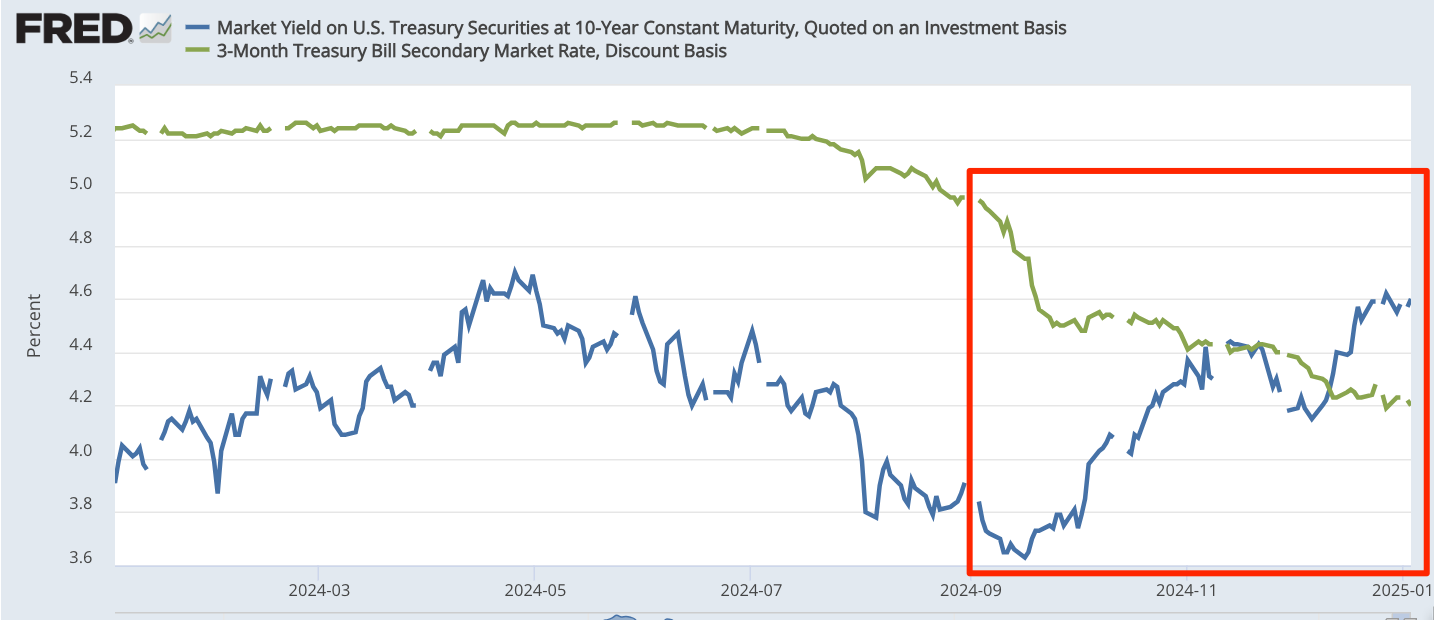

And we can focus in on 2024, especially since September, when things have changed:

Throughout the past five months—indeed, throughout the past nineteen—the market has understood that as the inflation and its memory ebbs the Federal Reserve will be and is moving short-term interest rates to what regards as “neutral”. In that, the only unusual thing has been the slow start of the easing cycle and then the rapid catchup of easing in September.

But what has been very unusual is that since September this has been accompanied by such a swift markup in what the long-run rates corresponding to short-run “neutral” are: from 1.6% to 2.6% in the long-run ten-year real Treasury rate, rather than following the standard pattern of an easing cycle that sees previous expectations of what long-term “neutral” would be validated.

Indeed, the entire year and a half since the U.S. economy attained its inflation soft landing have seen wild swings in the ten-year nominal Treasury bond rate. As that soft landing has receded into the distance with all going great for macro stabilization, the ten-year nominal Treasury yield has yo-yoed up from 3.8% to 5.0%, down to 3.9%, up again to 4.6%, down to 3.6%, and now up again to 4.6%. And you are not hallucinating if you see these swings as much more than you would have thought normal, at least by “normal” defined as “typical since the 2008-9 Global Financial Crisis:

Back in the 2010s full percentage-point movements in the ten-year yield either happened quickly in response to real news about the macroeconomic configuration, and then stuck; or they took years to eventuate as recognition that the world was different percolated through the minds of traders and (if there are any) investors. You did not have five such-sized largely offsetting moves in a single year and a half.

And, as Slok notes, this last upward swing in particular, and these swings in general have been, predominantly, not changes in the expected future path of short rates (at least not changes we can see any reason for in the data), but rather changes in this term premium. Back in the late spring of 2023, the estimated term premium—the extra amount you needed to be paid to buy a long-term bond right now and so lose your ability to react when short-term rates changed—was -0.9%-points: buyers of the long Treasury Bond were willing to give up 0.9% per year in return to lock-in yield and avoid the fluctuations from the rollover strategy. Today the estimated term premium is +0.5%-points: buyers of the long Treasury Bond require an extra 0.5% per year in return to give up their freedom to react to changes in short-term interest rates.

This smells to me much more like a “market microstructure” story than a “bond vigilantes cleaning their weapons at the advent of Trump 2.0” story. Back in the late spring of 2023 the marginal player and holder of long-term Treasuries was rehearsing the message “we locked in what looked like a very attractive yield”, while today the same guys are rehearsing the message “we preserved our freedom and avoided exposure to duration risk”. It is (or shoud be) very interesting to every student of bond finance that there is such extraordinary and frantic paddling and splashing below the surface while everything sails serenely on above.

But I think it is wishful thinking to see this as the bond vigilantes cleaning their weapons at the prospect of the reïnstallation of the Chaos-Monkey-in-Chief.

If reading this gets you Value Above Replacement, then become a free subscriber to this newsletter. And forward it! And if your VAR from this newsletter is in the three digits or more each year, please become a paid subscriber! I am trying to make you readers—and myself—smarter. Please tell me if I succeed, or how I fail…