The Fed’s Year-Ago Achieved Soft Landing:—& Why Our Transitory Inflation Was a Feature, Not a Bug.

Time to Update My Inflation-Talk Talking Points. & so, as of October 8, 2024, the sitch. For my fall round of what-is-the-economic situation talks…

The U.S. economy’s rapid post-pandemic recovery defied expectations, with inflation surprising many. Was it a failure of monetary policy or a triumph of strategic patience? Here’s why I think the Fed’s approach was the right one, relying on Friedrich von Hayek’s economic principles to explain why our transitory burst of inflation was a desirable catalyst for successful recovery & growth.

As of mid-2023, inflation had cooled, and the economy achieved a rare soft landing. This success wasn’t just luck; it was the outcome of the Federal Reserve’s calculated patience in navigating unprecedented supply shocks. Had the Fed acted sooner to tighten monetary policy, it would have unduly constrained the market’s ability to dynamically reallocate resources. Conversely, loosening policy earlier might have risked a return of no-longer-desirable inflation. The careful, strategic patience of Jay Powell’s Fed has proved nearly optimal—a matter of skill, plus lots of luck.

The general belief that the short-run Phillips Curve was flat meant that the sheer magnitude of the reopening inflation came as a substantial surprise to many:

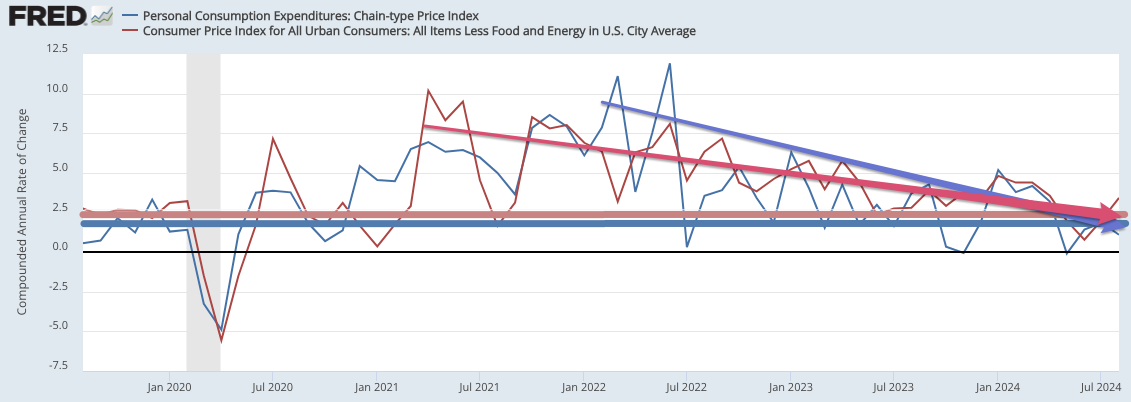

And yet the inflation proved transitory—so transitory that, as far as inflation is concerned, the economy touched down on its soft landing by June 2023, with inflation afterwards bouncing up and down above and below target, but with no statistically significant deviations in either direction to ring any kind of alarm.

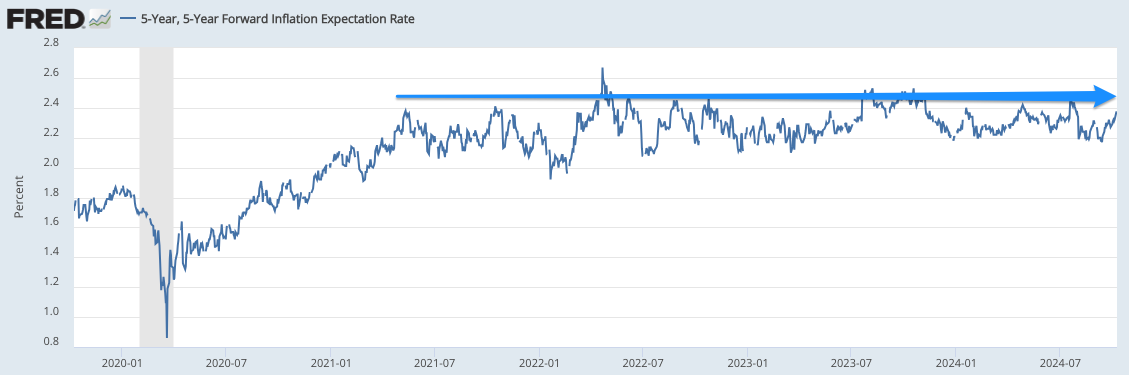

Moreover, throughout the inflation, medium-term expectations of future inflation in the bond market remained nailed to where they need to be for the Fed to costlessly attain its 2%/year PCE and 2.5%/year CPI target for the annual inflation rate by simply waiting for supply shocks to die away—in fact, expectations have consistently been a hair low:

And so: