Fed Watching in Mid-September 2024: Genuinely Uncertain Whether Interest Rates Are Going to Fall 0.25%-Points or 0.50%-Points Later This Week

A disturbing position for me to find myself in. Usually I have views of likely actions on the part of the FOMC. My views may be wrong ex post, but they are views and well-reasoned views. This week I find that I do not…

Federal Reserve future policy action tea-leaf reading seems unusually difficult.

And not just this week.

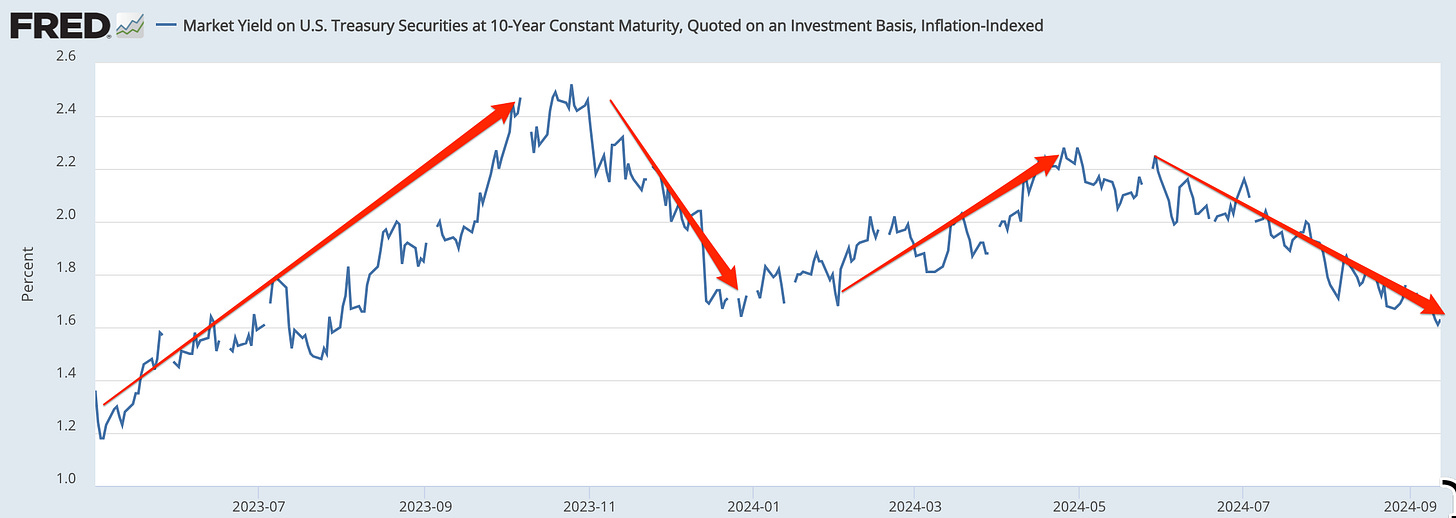

Market expectations about where the economy and the Fed are going have swung remarkably widely recently. We have now had seventeen months since the economy touched down on what appears to be a remarkably smooth and soft economic landing. The Federal Reserve has left the interest rates it controls untouched throughout this period. And yet there have been these very wide swings in the interest rates that matter most for the economy, even though they have been accompanied by no FOMC policy actions whatsoever:

But Federal Reserve future policy action tea-leaf reading is especially difficult this week.

The very sharp Tim Duy of SGH Macro Advisors <https://www.sghmacro.com> thinks, however, that the Fed is more likely to cut interest rates not by 0.25%-points but by 0.5%-points this week, basing his view on the appearance of two news articles from last Thursday:

Nick Timiraos: The Fed’s Rate-Cut Dilemma: Start Big or Small?: ‘Starting with a 50-basis-point cut could communicate greater alarm about the economy or lead markets to anticipate a faster pace of rate cuts, which in turn might ignite market rallies that make it harder to finish the inflation fight…. If the risks are truly balanced between higher inflation and weaker labor market conditions, as Fed officials have said they believe is the case, then the Fed should want rates much closer to a neutral level, said William Dudley, who served as New York Fed president from 2009 to 2018. Given that all Fed officials believe that rate is below 4%, it doesn’t make sense to move in 25-basis-point increments. “Logic says they should be going faster,” he said. For those reasons, [Esther] George said she would find it hard to oppose a larger cut right now. “You can make a very good case for 50, to say, ‘Just as we went quickly’” to raise rates above a neutral setting, “we’re now well above it, and so we can take a couple of bites at this apple”… <https://www.wsj.com/economy/central-banking/fed-interest-rate-cut-size-861c9600>

and:

Colby Smith: Federal Reserve wrestles with how aggressively to cut interest rates: ‘A half-point rate cut in September would let the Fed return borrowing costs to normal levels more quickly, removing restraint on the economy and protecting the labour market from further weakness. Krishna Guha, vice-chair of Evercore ISI, said a half-point move next week “would take less risk with the soft landing”… <https://www.ft.com/content/bcff6242-2442-4369-8c15-8524c6bea60f>

The thinking? That Governor Chris Waller’s September 6 employment-release day “The Time Has Come” speech at Notre Dame <https://www.federalreserve.gov/newsevents/speech/waller20240906a.htm> closed the door to an 0.5%-point September cut nearly all the way. And then the Fed was supposed to go into pre-meeting communications blackout. But then someone told both Nick Timiraos and Colby Smith to take another look and pointed them at different parts of the previous messaging. The line is “once is happenstance, twice is coïncidence, three times is action”. And here we have only twice. But it does feel like more than coïncidence.

Usually Tim is right. But in the past I have always had a view (a) about whether his analysis is better than mine and (b) about whether he is right.

Right now I do not have a view on either of these things.

I confess that not only do I genuinely not know whether the Fed is more likely to cut interest rates by 0.25%-points or by 0.50%-points at its meeting later this week, but that also I do not see anybody who I trust to be likely to have a more informed view than I do about what their choice will be—except, of course, for the FOMC meeting participants and their senior staffs.

My principal takeäway from all this is that it shows that there is a rather urgent Federal Reserve communications task here. Federal Reserve communications policies need to change to get the Fed out of the box it has trapped itself in. In a good world, expectations of future Federal Reserve policy would be anchored by clear messaging about:

What the Fed thinks the level of r* is—that is, if nothing big hits the economy over the next several years and the economy attains true “equipoise”, to what level the Fed thinks it will try to guide the level of interest rates.

How long the Fed thinks it will take to get close to r.

How large the range of uncertainty is about r.

Thus I am on Team John Williams here:

John Williams: R: A Global Perspective: ‘R is either explicitly or implicitly at the core of any macroeconomic model or framework one can imagine. Pretending it doesn’t exist or wishing it away does not change that… <https://www.newyorkfed.org/newsevents/speeches/2024/wil240703>

And I think this needs to be faced squarely. Otherwise we get into situations like this, in which an absence of a medium-run anchor for policy guidance leads market psychology to focus squarely and improperly on the very short run, when it ought to take a longer view of things.

References:

SGH Macro Advisors. <https://www.sghmacro.com>.

Smith, Colby. 2024. “Federal Reserve Wrestles with How Aggressively to Cut Interest Rates.” Financial Times, September 12. <https://www.ft.com/content/bcff6242-2442-4369-8c15-8524c6bea60f>.

Timiraos, Nick. 2024. “The Fed’s Rate-Cut Dilemma: Start Big or Small?” Wall Street Journal, September 12. <https://www.wsj.com/economy/central-banking/fed-interest-rate-cut-size-861c9600>.

Waller, Chris. 2024. “The Time Has Come.” Speech at Notre Dame, Federal Reserve, September 6. <https://www.federalreserve.gov/newsevents/speech/waller20240906a.htm>.

Williams, John. 2024. “R*: A Global Perspective.” Lisbon Speech, Federal Reserve Bank of New York, July 3. <https://www.newyorkfed.org/newsevents/speeches/2024/wil240703>.