Macroeconomy Soft Landing Watch: Still in the Groove

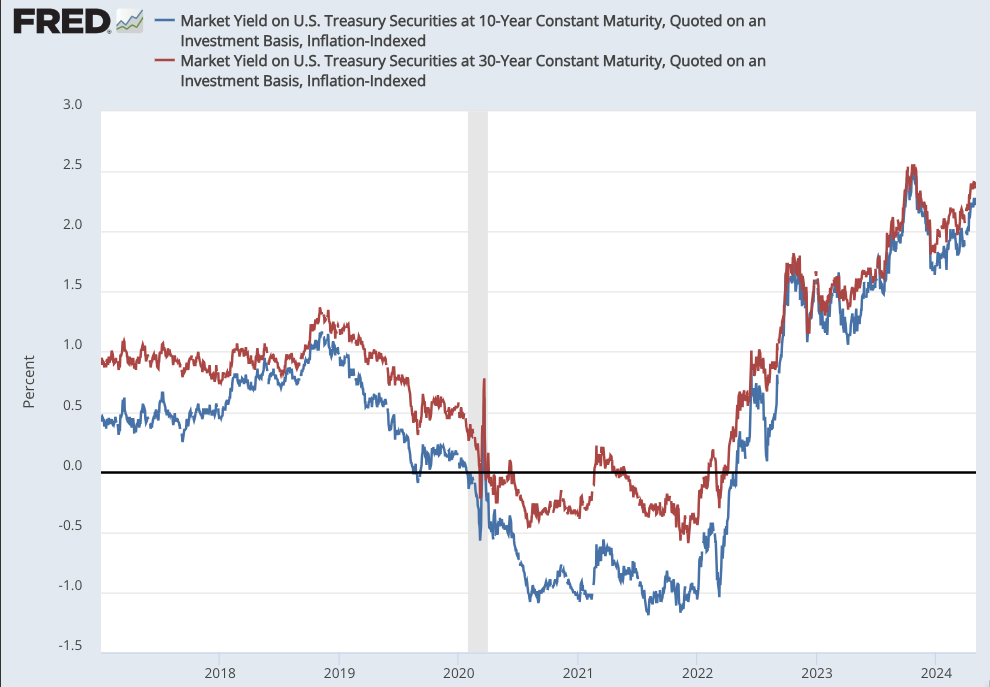

I have to confess, I do not see where the upward swing in long Treasury yields is coming from. But then I did not see where it was coming from early last fall either. I get that a lot of rich people wish to keep their Trump tax cut—a most notable thing that was, for who other than Donald Trump could devise a cut on taxes on capital that provided 0% net incentive to invest and 100% net incentive to do stock buybacks?—& that a lot of people work for such rich people. I get that what bleeds, leads. But still…

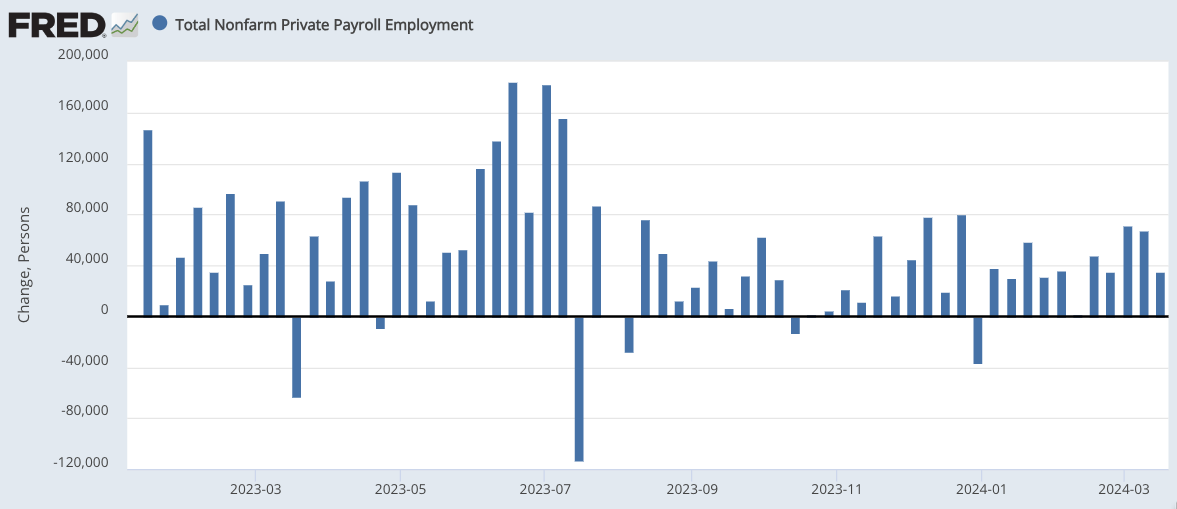

A seasonally adjusted estimated –22,000 revision to past job growth and an estimated +175,000 new payroll jobs in April give us a U.S. economy that as of mid-April had 153,000 more jobs (seasonally adjusted) than it had had in mid-March. With natural increase providing roughly 100,000 and immigration providing roughly another 100,000 more workers a month.

The U.S. labor market appears in balance as far as numbers are concerned.

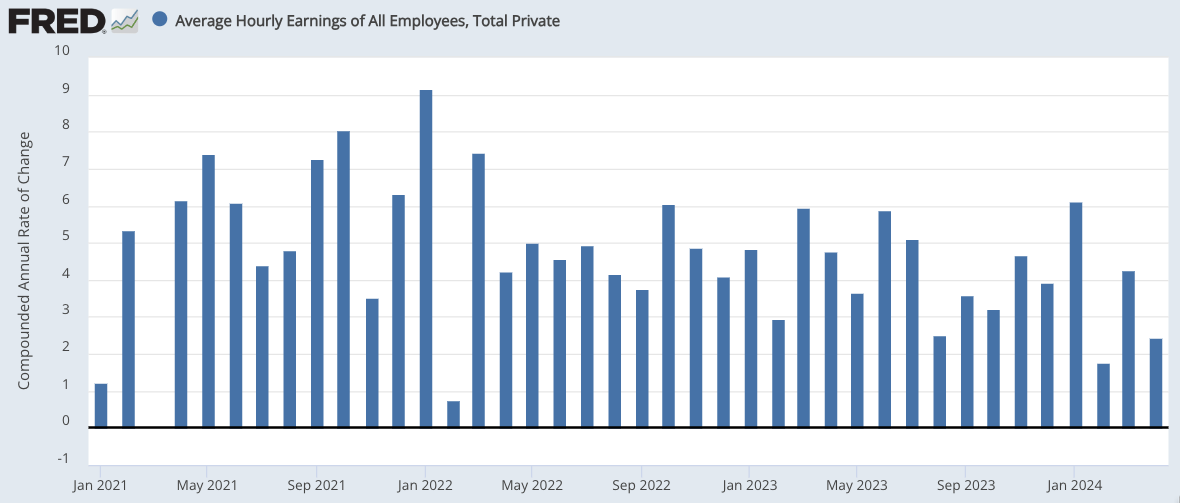

How about nominal earnings?

We see a 3.8% increase in both average hourly and average weekly earnings over the past year. We see a 2.8% per year rate of increase in both average hourly and average weekly earnings over the past three months. With a 1.5% per year trend rate of productivity growth and an 0.5% per year wedge between the CPI and the PCE inflation indices, the Federal Reserve’s 2.0% per year chain-PCE inflation target translates to a warranted rate of nominal earnings increase of 4.0% per year.

Is there any sign in all of this that the U.S. labor market is not in the middle of a soft landing?

If so, I simply do see it.

Are there pressures outside the labor market that might keep that soft-landing-in-progress from becoming reality for the economy as a whole? Such pressures might emerge—some damnfool (even more damnfool) thing in the Middle East or in Ukraine—but I do not see them here and now.

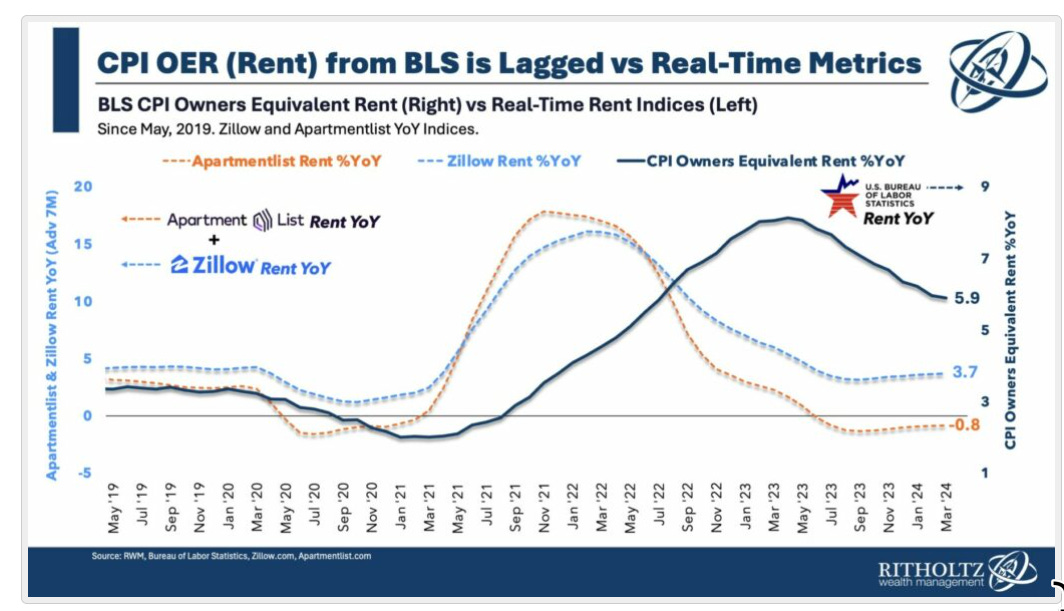

Barry Ritholtz is one of those—with whom I strongly agree—who strongly believes that the Federal Reserve should already be cutting interest rates. Why? Because shelter data have a huge weight in the CPI, shelter price decisions are reported with substantial lags, and shelter price-increase trends substantially lag actual pricing pressures in the economy because of renewals:

Barry Ritholtz: ’CPI model… rent… lag[a] other real-time measures by 18 months…. [Although] some of the lag is in how the BLS data is collected… I want to focus on a very important aspect that makes the BLS measure… different…. In a word, Renewals. Almost two-thirds of all existing leases for apartments or house rentals get renewed. Nearly all of these renewals were signed one or two years ago. Leases are contracts, and they lay out the specific terms for renewals within the document. What rates do you think landlords built into their lease renewals 12–24 months ago when they were drafting and negotiating those 2022 and ‘23 leases? They obviously reflected the inflation rates then—which were peaking…. BLS’[s]New Tenant Rent Index… does not include renewals. No surprise, it too peaked in 2022, and is now at +0.42% year over year… <https://ritholtz.com/2024/05/fed-cutting-oer/>

See: long and variable lags.

My friend Swedish economist Lars Jonung came through Berkeley last Monday and gave a seminar on how Sweden’s economists were asked to give advice to the government when the international gold standard collapsed in 1931 and the government actually had to immediately decide on how it was going to conduct monetary policy. Among the economists’ recommendations was that one smart and diligent young student should be set to work calculating a CPI for Sweden, ideally every week. The recommendation was followed. That student? Dag Hammarskjöld, future United Nations Secretary-General, shot down and killed over Congo in 1961, probably by Katanga secessionists backed by mining interests who did not like the probable shape of the Congo ceasefire Hammarskjöld was negotiating.

(There also appears to be a short book by Gunnar Myrdal, Penningpolitiskt Problem (Monetary Equilibrium), about post-gold standard monetary policy and its interaction with growth, stabilization, and income distribution policy that I would now dearly love to read. Given how many of the smart things I have to say are stolen from An American Dilemma and Asian Drama, I suspect I will learn quite a bit.)

UPDATE; ALAS! On downloading and looking at it, Monetary Equilibrium is a translation of Om Penningteoretisk Jämvikt, and not of Penningpolitiskt Problem. Tht remains untranslated.

References

Bureau of Labor Statistics. 2024. “Employment Situation Summary Table A. Household data, seasonally adjusted.” May 3. <https://www.bls.gov/news.release/empsit.t19.htm>.

Bureau of Labor Statistics. 2024. “Employment Situation Summary.” May 3, 2024. <https://www.bls.gov/news.release/empsit.nr0.htm>.

Curran, Enda. 2024. “Live Blog: U.S. Employment Report for April.” Bloomberg. May 3. <https://www.bloomberg.com/news/live-blog/2024-05-03/us-employment-report-for-april>.

Jones, Clair, James Politi, Martha Muir, & Kate Duguid. 2024. “US labour market undershoots forecasts with 175,000 new jobs”. Financial Times. <https://www.ft.com/content/fad96dd0-7064-4a74-bffb-e74b9b28ac09>.

Jonung, Lars. 2023. “The First Practical Guide to Inflation Targeting.” Working Papers, no. 2023:3. Lund University School of Economics and Management. <https://www.lusem.lu.se/lars-jonung/publication/7d48f248-45fd-49b5-abff-619d6ed7fe64>.

Myrdal, Gunnar. 1968. Asian Drama: An Inquiry into the Poverty of Nations. New York: Twentieth Century Fund. <https://archive.org/details/asiandramainquir0003unse>.

Myrdal, Gunnar. 1944. An American Dilemma: The Negro Problem and Modern Democracy. New York: Harper & Brothers. <https://archive.org/details/americandilemma00myrd>.

Myrdal, Gunnar. 1939 [1931]. Monetary Equilibrium. London: William Hodge. <https://archive.org/details/in.ernet.dli.2015.33886/page/n9/mode/1up?view=theater>.

Ritholtz, Barry. 2024. “# Why the FED Should Be Already Cutting.GREAT!” The Big Picture. May 2. <https://ritholtz.com/2024/05/fed-cutting-oer/>.

Saraiva, Augusta. 2024. “U.S. Jobs Post Smallest Gain in Six Months as Unemployment Rises.” Bloomberg. May 3. <https://www.bloomberg.com/news/articles/2024-05-03/us-jobs-post-smallest-gain-in-six-months-as-unemployment-rises?srnd=economics-v2>.