Trying to Puzzle Through the Current Macro Situation

For the first time since 2009-2010, when I (mistakenly) believed that Bernanke at the Fed & Obama & the center of gravity of his advisors understood the seriousness of the situation & were about to take appropriate action to rapidly restore full employment, my short-term macro forecasts are going sufficiently awry to make me suspect the reliability of my vision of the Cosmic All. Hence I am trying to think about this.

My current guesses? A 40% chance that things are simply delayed by the long and variable lags, a 30% chance that I am in for a big surprise as it turns out that that the era of “secular stagnation” & permanently low equilibrium rates that place chronic deflationary pressure on the economy, and a 30% chance the “unknown unknowns” rule everything around us…

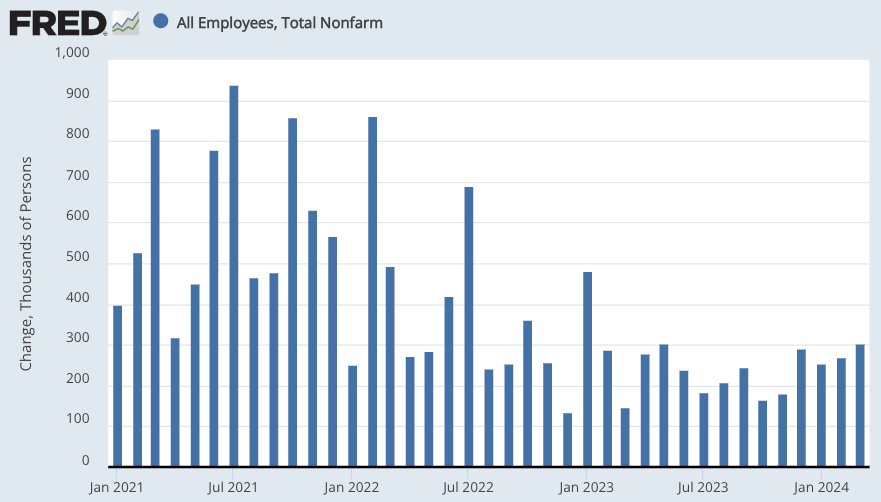

On the job-growth side, the market expected the BLS March Employment Report released on Friday April 5 to show estimated seasonally-adjusted payroll-survey nonfarm employment growth around 210,000 in March (compared to 275,000 in February). On the inflation side, the market expected core CPI inflation in the report report released on Wednesday April 10 to be not inconsistent with continued downward pressure on officially-recorded inflation.

Neither of those things happened.

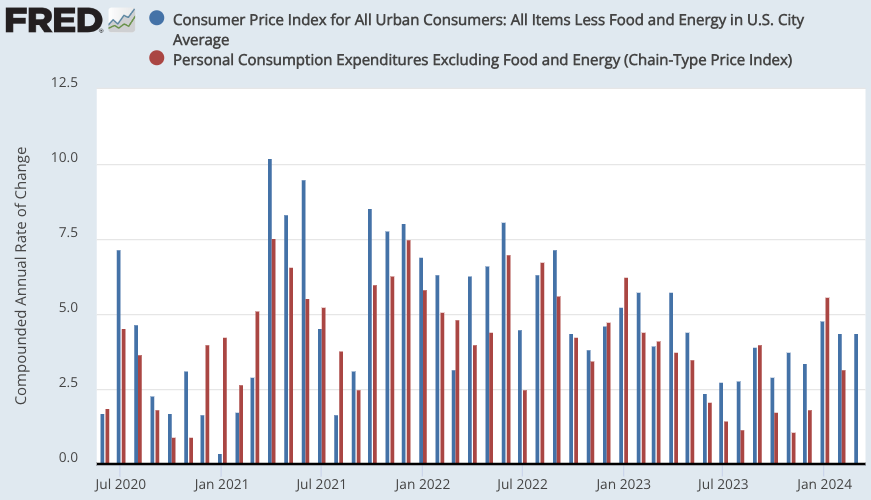

The CPI release told us that core CPI inflation continued at its previous level, with the one-month jump at an annualized rate of 4.4%. It is now very hard to avoid the conclusion that inflation kissed the Federal Reserve’s 2% core PCE-index concept in the second half of 2023, and now has taken a small uptick. The past six months’ core-PCE concept average annual inflation rate is now 2.9%—not far above the 2.0% target, but far enough above it to be noticed.

The Employment Report of April 5 told us that job growth around 210,000 in March was not what the market got. The market got a significantly stronger economy. What the market got was an estimated 303,000 increase in payroll-survey nonfarm employment, with job gains broad-based, plus a net-22,000 revision for January and February. That gave us in March an estimate of seasonally-adjusted payroll-survey employment 829,000 above the estimate as it stood in December. What the market got was household-survey unemployment rate at 3.8% staying in the narrow range of ±0.1%-point it has been in for 2/3 of a year. What the market got was a 26th straight month with the estimated unemployment rate below 4%: something not seen before in the working lives of anybody who is today less than eighty years old: