Nobody Expected Our Current Interest-Rate Configuration

Nobody—well, very few people—here in the United States expected our current interest-rate configuration.

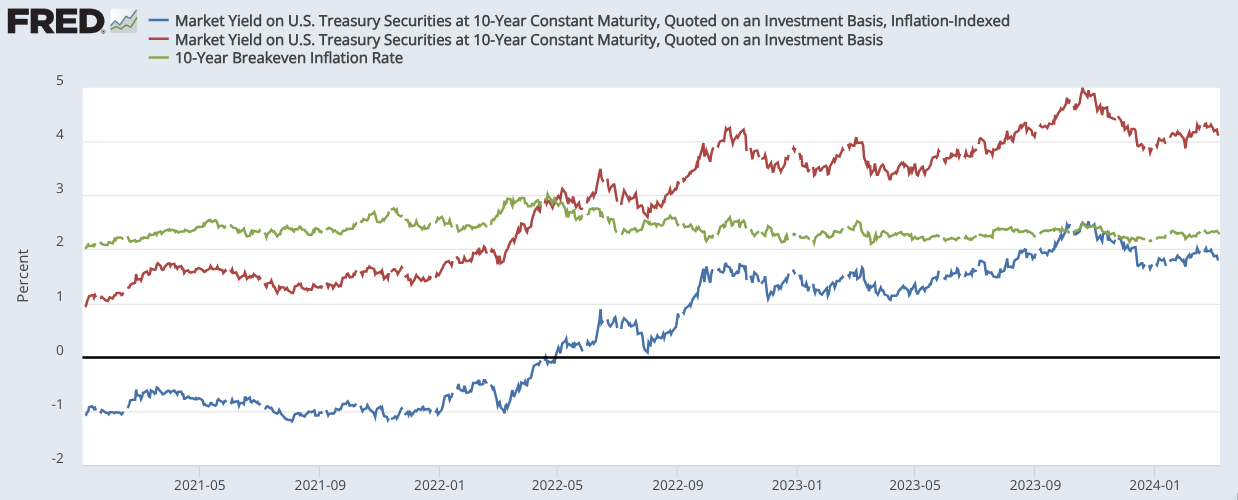

From early March to mid-May 2022 the long-term real safe interest rate in the United States—the thing that along with “financial conditions” governs incentives to build and also, through its impact on the exchange rate, the balance of net exports—jumped by more than 1%-point as the bond market noted that the Federal Reserve would not long be pedal-to-the-metal in the hope of speeding employment recovery as fast as possible. Then, from late August to early October 2022, this governing real interest rate took another upward jump, this time by an annual 1.5%-points, as bond traders speculated that the Federal Reserve might have to move monetary policy much tighter in the context of a fear of persistent inflation in a U.S. that had reattained full employment.

That essentially gave us our current configuration, in which interest rates are far, far higher by 2%-points or so above what anyone five years ago, back before the plague, would have guessed at the value of the “neutral” interest rate that, in the words of John Maynard Keynes, “bring[s] about… [proper] adjustment between the propensity to consume and the inducement to invest…” And with an interest rate universally seen as above the neutral level, nearly all observers were confident that recession, or at least sufficient weakening that it would take enormous fancy footwork and a good deal of luck to avoid recession, was on the way.