BRIEFLY NOTED: For 2024-02-19 Mo

The Biden-era compression of wage inequality; how Biden’s industrial policies are changing the world; the FT on the nutsness that is Nvidia’s current valuation; the U.S. Treasury is issuing too much long-term debt; very briefly noted; econo-social creative-destruction & the wellsprings of fascism; don’t collapse everyone to your right into one amorphous reactionary mass if you want my vote; false starts in Sub-Saharan Africa; & BRIEFLY NOTED for 2024-02-14 We…

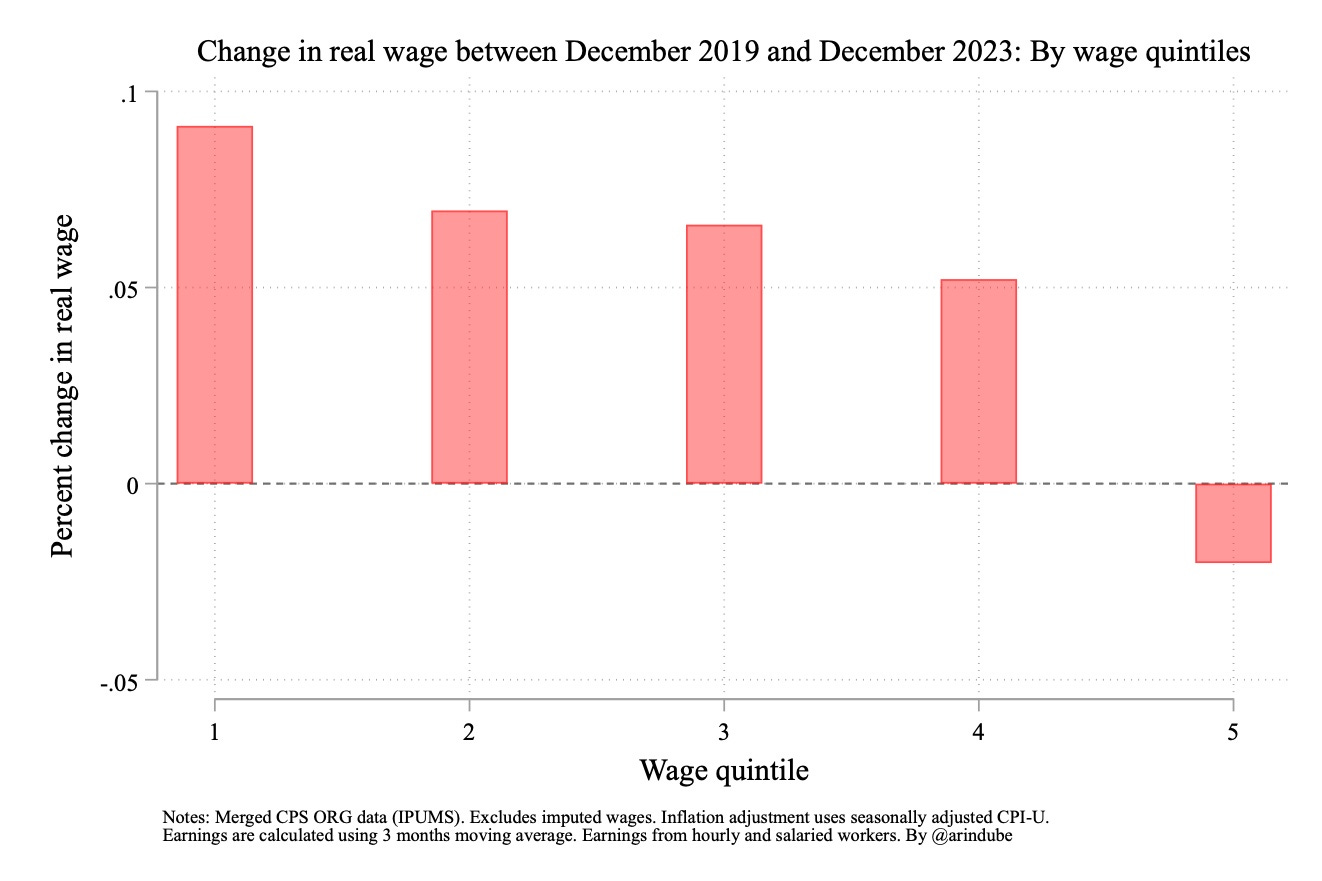

ONE IMAGE: Arin Dube Plots the Numbers on the Biden-Era Compression of Wage Inequality:

ONE VIDEO: FT: How Biden’s IRA Changed the World:

SubStack NOTES:

Economics: Ten slower and less capable GPUs, each one tenth as effective as a leading-edge GPU, can effectively substitute for one such if the software is there. Betting on Nvidia’s hypervaluation is a bit that all of the following are true:

software will not be there for at least a decade,

Over the next decade TSMC will not use its market power as Nvidia’s effective soul supplier to redistribute the surplus in its favor.

Nvidia will maintain its current GPU design lead for at least a decade/

What are the odds that all of these are true? Low. So what would be the best way to start thinking about how to put on a limited-risk short.

Because, of course, maybe something else is going on. Maybe the real play is that lots of ignorant VCs and meme stock traders will get themselves fleeced by grifters, all of whom think spending a fortune on Nvidia chips are necessary table stakes for keeping the grift going:

Dan McCrum: Nvidia is nuts, when’s the crash?: ‘A chip in every pot: Before the AI fever breaks few will bet against Nvidia’s market value rising further as stock market investors swoon at thoughts of the bot-overlord future. This week Nvidia’s market cap passed the $1.8tn mark, leapfrogging Alphabet—whose 2023 net income was greater than Nvidia’s 2023 revenues—to become the third most valuable US company…. Nvidia options have gone wild—Tesla wild. Nvidia’s chips are essential to the current generation of machine learning models and their associated services, and so will earn the company extraordinary profits for the foreseeable future. That seems to be the general idea at least. Pour cold water over it at your peril…. Allow us instead to merely pass on a few back-of-the-envelope calculations… from the tech-focused curmudgeons over at Chameleon Capital…. Nvidia shareholders are making a bet that… competition, innovation, and pricing pressure will not come to bear until at least the mid-2030s… <https://www.ft.com/content/0cffec6e-ede8-4513-93b1-bb45f03e6595>

Economics: The remarkable continued profitability of the Treasury Basis Trade tells us that the U.S. Treasury has profoundly misjudged what kinds of Treasury securities that market really wants to hold. Hedge funds are filling in the gap via a maturity transformation that substantially shortens the effective duration of Treasury-created assets—and are making an awful lot of money by doing so. What is the Treasury gaining by issuing long-term debt that Hedgies immediately transform into short-term debt? It is moderating the impact of short-term moves in interest rates on its monthly funding reports. Is that gain worth handing the profits for effective money creation over to Hedgies (and possibly creating some systemic risk in the case that the Hedgies get overleveraged and so out over their skies?). Perhaps. But I would like to see the argument at greater length, depth, and sophistication than I have:

Steven Kelly: Can the Treasury Kill the Basis Trade?: ‘A hedge fund (typically) performing the basis trade will go long the Treasury bond, and short the corresponding futures contract that is trading relatively richly…. There’s a ton of structural demand at the short end of the issuance curve. All else equal, the funders of Treasury repo would likely be happier with Treasury bills—no counterparty risk, no collateral price risk, no legal/operational risk with respect taking possession of collateral. (i.e., better money.)… Big Shorten: Financial engineering can provide substantial value, but, in the case of the basis trade, the Treasury doesn’t actually need its help. The market’s demand for institutional money assets exceeds what the Treasury has been issuing. Treasury can skip over the risk-creating basis machinations and issue directly to the ultimate funds-provider for the basis trade: short-term money market investors. The acclaim Treasury got for its November refunding announcement can be just the beginning… <http://www.withoutwarningresearch.com/p/can-the-treasury-kill-the-basis-trade>

Very Briefly Noted:

Economics: Dan Davies: the blue circle of strategy: ‘“We built a big silo in Oslo… just kept a few tonnes in it to sell to local builders… kept it spick and span in the corporate colours…. The value of this silo was that every time my opposite number at Lafarge came for a meeting with the joint venture partners, he would sit down in their boardroom, with a lovely view across the Oslo harbour. And as he was discussing strategic plans, just out of the corner of his eye, it would always be right there… a blue circle. Try making a game theory model out of that!”… <backofmind.substack.com/p/the-blu…>

Arin Dube: How a tight labor market helped narrow the racial divide: ‘This recent narrowing of wage and unemployment gaps can be attributed to…d substantial fiscal interventions… the tight labor market that emerged in the pandemic’s wake… the power of a tight labor market in addressing long-standing inequalities…. The recent, surprising fall in the Black/white wage and unemployment differential serves as a reminder of the potential for progress in the pursuit of racial equity in the labor market… <arindube.substack.com/p/how-a-t…>

Barry Ritholtz: CPI Shelter Measures: 6-12 Month Lag: ‘This week’s big [market] sell-off… was a reaction to data that was either old or very old. It would not surprise me to see that as people figure this out, we claw back that sell-off over the next few days or weeks. The ever-present question: How much does the FOMC recognize how behind the curve this data is?… <https://ritholtz.com/2024/02/cpi-shelter-measures-6-12-month-lag/>

Pinelopi Koujianou Goldberg: Why Are Americans Dissatisfied Despite a Strong Economy?: ‘Even though inflation appears to have been tamed without triggering a recession, Americans report broad dissatisfaction with the country’s economic leadership. While there are multiple likely explanations for this, one important factor is the role of unfulfilled promises in a world of rising aspirations…. [Perhaps] the current discontent is a byproduct of the progress the US has made…. In relative terms, white males have lost the most. If one views the world through the prism of a continuous zero-sum power struggle, one should not be surprised to see pushback from those who are losing privileges…. Another “positive” take is that… people are aware of new opportunities and the factors leading to success… [and] focus on where they have fallen short of their aspirations. <https://www.project-syndicate.org/commentary/us-economy-strong-so-what-explains-bidens-low-approval-by-pinelopi-koujianou-goldberg-2024-01>

Robert Armstrong & Ethan Wu: Where Increasing Returns Come From: ‘It’s not all network effects…. Michael Mauboussin… economies of scale; international trade; learning by doing; network effects; and recombination of ideas… It is worth thinking about whether increasing returns stemming from different causes have different half lives…<https://www.ft.com/content/5c7e0feb-7688-48e1-b0c8-6c41422e6cf5>

Economic History: Johan Fourie: Let’s Read 60 Papers… <http:/www.ourlongwalk.com/p/lets-read-60-papersz>

Carolyn Sissoko: Becoming a central bank: The development of the Bank of England’s private sector lending policies during the [1797-1821] Restriction: ‘Although the process was far from smooth, the Bank was learning to act as a central bank… transformed its internal operating procedures to put regulation-based constraints on its private sector lending, established regular reviews of its policies and their effects on the money market, and adopted a distinct crisis-orientated lending policy…. The 1810 crisis was a turning point in the Bank’s understanding of its role in the economy: the Bank directors both acknowledged privately the Bank’s duty to the public, and restructured its discount policies with a view to promoting financial and monetary stability.., <https://onlinelibrary.wiley.com/doi/abs/10.1111/ehr.13110>

Global Warming: Stefan Rahmsdorf: New study suggests the Atlantic overturning circulation AMOC “is on tipping course”: ‘The main findings of the new paper… the AMOC has a tipping point…. The Atlantic is “on tipping course”, i.e. moving towards this tipping point. The billion-dollar question is: how far away is this tipping point?… The Dutch group proposed a new, physics-based and observable type of early warning signal… freshwater transport by the AMOC at the entrance of the South Atlantic, across the latitude of the southern tip of Africa…. The study also provides more detailed and higher resolution simulations of the impacts of an AMOC collapse on climate…. Northern Europe from Britain to Scandinavia would suffer devastating impacts, such as a cooling of winter temperatures by between 10 °C and 30 °C occurring within a century…. Major shifts in tropical rainfall belts…. It’s observational data from the South Atlantic which suggest the AMOC is on tipping course. Not the model simulation, which is just there to get a better understanding of which early warning signals work, and why… <https://www.realclimate.org/index.php/archives/2024/02/new-study-suggests-the-atlantic-overturning-circulation-amoc-is-on-tipping-course/>

Cybergrifting: Zoë Schiffer: Who killed Twitter?: ‘Was it Jack Dorsey or Elon Musk? Kurt Wagner and Zoë Schiffer, authors of two new books on the subject, interview each other about what they learned…. [Zoë Schiffer’s] Extremely Hardcore: Inside Elon Musk’s Twitter… Battle for the Bird: Jack Dorsey, Elon Musk, and the $44 Billion Fight for Twitter’s Soul, by Bloomberg’s Kurt Wagner…. The internet and the open web as we know it are fragile. And these companies that we take for granted, and we think of as somewhat infallible, are for sale to the highest bidder. And when that happens, which we saw so clearly with Elon, there’s very little a board or the employees, and certainly not the users, can do to stop it. With Elon in particular, there are very few checks on his power. I don’t know what that means for all of us, but it certainly made me feel like there’s a vulnerability to all of this that I hadn’t fully appreciated before… <https://www.platformer.news/kurt-wagner-battle-for-the-bird-interview-zoe-schiffer-extremely-hardcore/>

Steven Levy: Kara Swisher Is Sick of Tech People, So She Wrote a Book About Them: ‘Silicon Valley’s top pundit dishes on her memoir Burn Book, immature billionaires, and whether she’s actually mean….Less a scorched-earth exposé than a primer for Swisher newbies…. In one of their most famous interviews, she and Mossberg moderated a blissfully convivial joint session with lifetime rivals Bill Gates and Steve Jobs in 2007 that brought many in the audience to tears… <https://www.wired.com/story/kara-swisher-burn-book/>