People Should Not Prioritize What They Think Are "Vibes" Over Actual Data: The Economic Situation Really Is—Relative to All Other Years since 2000—Excellent

A follow-up to Hexapodia LVII: “The ‘Vibecession’ Is Losing Its Vibe”. In which I demand that many—perhaps especially the Financial Times & Bloomberg Editorial Boards—shape up & do better…

Noah Smith and I covered this in our latest Hexapodia Podcast—the disjunction between the economy and various forms of “confidence”:

We concluded it was probably:

Lags

Partisanship

Journalistic “what bleeds, leads”

Reinforced by the fact that journalists are currently under the latest round of the Schumpeterian creative-destruction harrow; are, accordingly, rationally fearful and depressed; and that leaks over.

But that the biggest effect was that things work with a lag. And we ended by encouraging people to say true things about the world, rather than obsess over trying to figure out what metanarrative they should tell about perhaps or probably evanescent gaps between perceptions and reality.

One thing we did not cite in our podcast—but should have—was this from Ryan Cummings and Neale Mahoney at the excellent Briefing Book:

Ryan Cummings & Neale Mahoney: Digesting inflation: ‘The impact of inflation on consumer sentiment decays at a rate of about 50 percent per year…. 30 percent of the gap between consumer sentiment and what you would expect based on economic conditions can be explained by asymmetries in partisan bias…. Consumers are currently digesting 3.2 percent current inflation, 7.8 percent inflation from last year, and 6.2 percent inflation from the year before. If we scale these numbers by the estimated impacts from our preferred proportional model and add them up, we get a cumulative downward drag of -16 index points relative to a baseline with target 2 percent inflation (see table). This is down only 40 percent from the -27 index point cumulative effect in June 2022…. The cumulative impact of inflation on consumer sentiment will be -8 index points a year from now, a 50 percent reduction relative to the current impact of -16 index points… <https://www.briefingbook.info/p/digesting-inflation>

And now this morning I see Paul Krugman agreeing with us. Paul Krugman writes:

Paul Krugman: ‘Recent economic news has been extremely good. But there’s a strange meme among some D consultants that Biden shouldn’t boast about it, because it seems out of touch—that people aren’t feeling the good economy. But they are! The venerable Michigan survey has rocketed up lately 2/

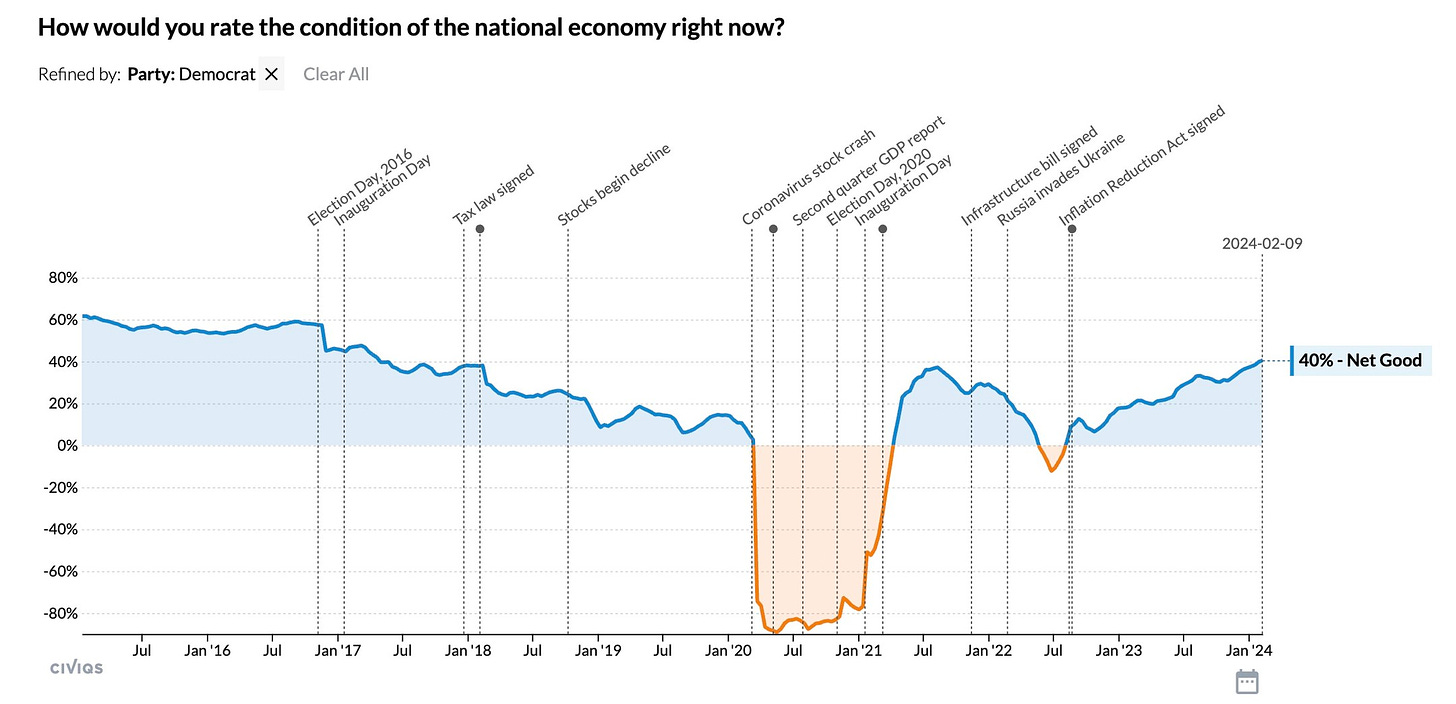

It’s true that consumer sentiment is still weaker than you might expect given the economic numbers. But that’s largely partisanship. Using Civiqs numbers, Democrats have more or less fully accepted the good news.

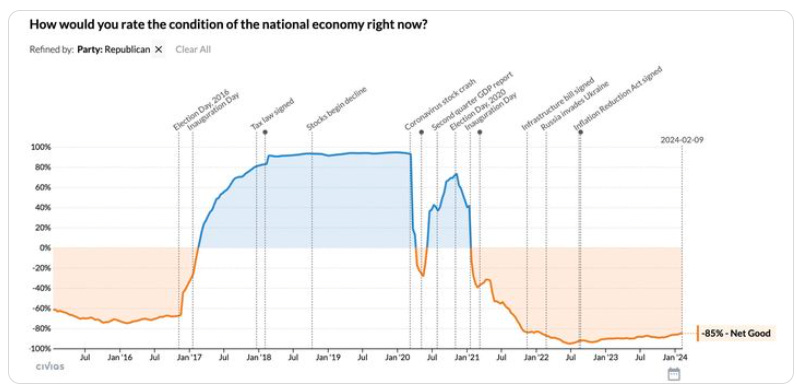

Republicans hold down the average because they see, hear and speak no good when a Democrat is president:

What about independents? To a first approximation, they don’t exist — all but a handful are de facto Rs or Ds. And while there is some partisan effect in Democratic sentiment, it’s much smaller than the effect among Rs, who say that the current economy is worse than the depths of the Great Recession or the stagflation of 1980:

So people who will say you’re out of touch if you tout the current economy are people who will never, ever vote Democrat anyway. Boast away! <https://www.threads.net/@paulkrugman7/post/C3KxgyGOI-q>

This leads me to want to stress five points:

(1) While Republicans say that they think the economy is doing horribly when asked by pollsters and surveyors, they are certainly not acting as though the economy is doing horribly—raising the question of whether they believe what they are saying at all, or simply think that it is appropriate to give approved tribal responses to politics-adjacent questions. Nothing in the spending flow has ever indicated that people are sufficiently worried to start trying to build up their financial reserves as buffers against risk <https://www.ft.com/content/c9b5ce44-c374-4ead-823b-3f022ae27096>, or does now indicate that. And the wise John Burn-Murdoch is all-in on “US consumer sentiment… the latest victim of expressive responding, where people give incorrect answers to questions to signal wider tribal political or social affiliations…” <https://www.ft.com/content/9c7931aa-4973-475e-9841-d7ebd54b0f47>

(2) Analysts may look stupid if they live in the future—recognize that their readers are going to take their words and try to apply them to the situation as it evolves over the next three months. But analysts will almost surely look stupid if the last time they marked their beliefs to market was six months ago. I winced at the Financial Times Editorial Board’s December 3, 2023 “The inflation battle enters the hard last mile” <https://www.ft.com/content/865681af-041c-4b7e-b14d-0f0f193e28ad>. Please, people, do not be like that! Yet even the terrifyingly perceptive Gillian Tett with her immense Krell-like brain falls victim to this! <https://www.ft.com/content/11d327e3-ac47-437f-86ea-488192cd9661>.

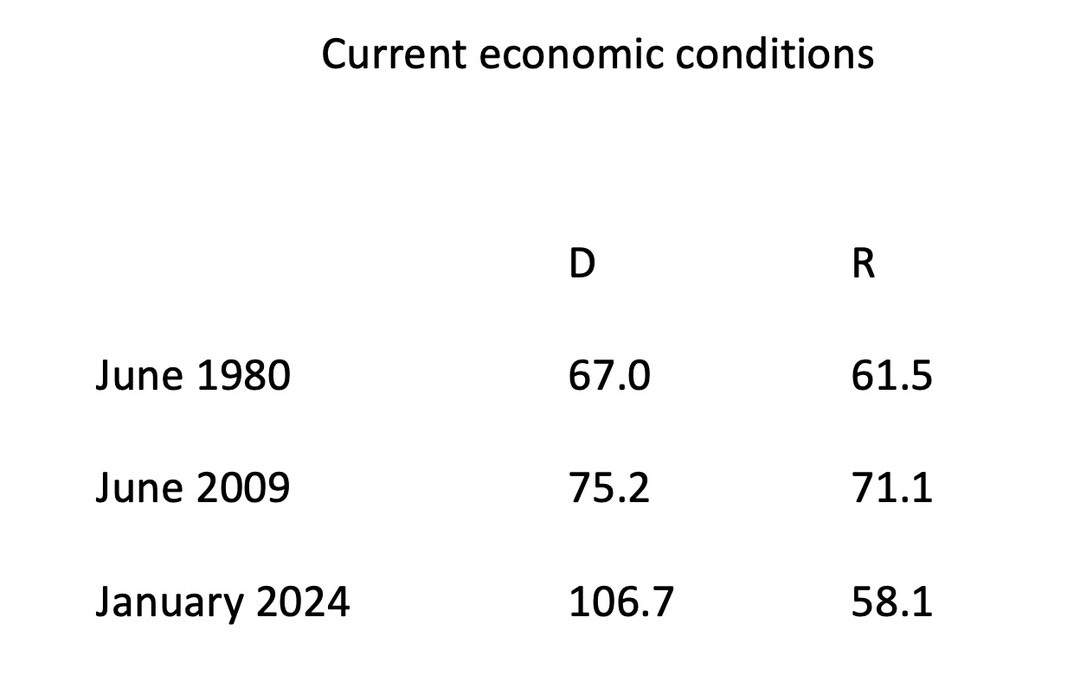

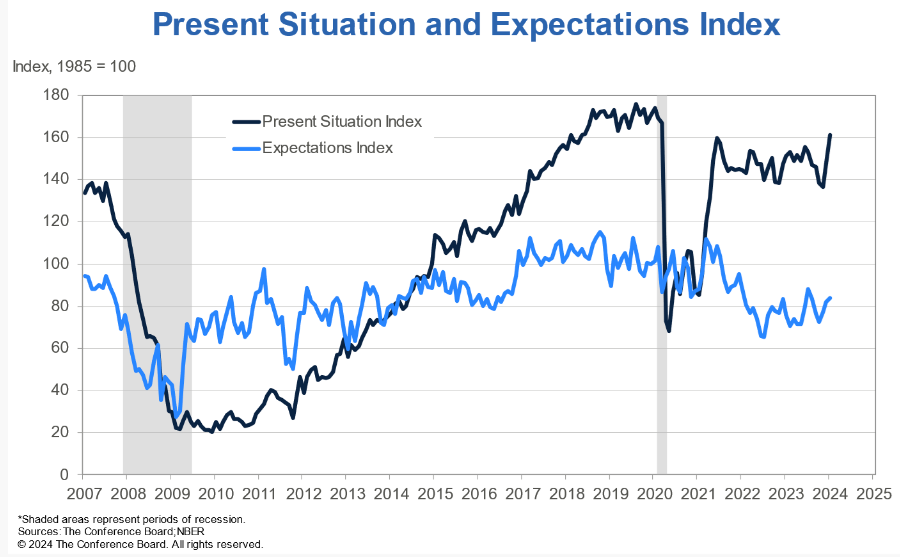

(3) Note that even Republicans tell the Conference Board that the present economic situation is fine—better than in 2007, and significantly better than during all of the Obama years <https://www.conference-board.org/topics/consumer-confidence>. It was the expectations component that underwent a minus 20-point largely inflation-driven and partisan-driven slide in 2021:

(4) To some degree Republican dismay about the state of the economy is a good thing, and a sign of hope. They see their own financial system as good, but they hear from the Media Machine that there are lots of things going very wrong elsewhere, and they are concerned because they are not without empathy—at least, not without empathy for the right kind of people. And that, truly, is something we can build on.

(5) But when it gets into “who are you going to believe: the data or what we cranky old men feel as the vibes” territory, things get truly embarrassing for the writers. For example, from the Bloomberg Editorial Board the month before last:

The Biden administration has been less adept. Officials have been eager to declare victory over inflation for months. They’ve argued that a hot labor market has boosted wages more than prices, leaving workers on average better off, so what’s the problem? Maybe voters don’t understand economics. When it comes to managing their budgets, they understand it just fine. Since 2020, prices overall have risen by roughly 20%. Average wages have indeed risen a fraction more. But for many families, the cost of living depends especially on the prices of groceries, utilities, housing and credit…. Many households don’t just feel worse off; they are worse off…

Yes. Such is always the case: it is a big economy with lots of people gaining in real income and lot of people losing. that many households are worse off than last year is a constant.

And so, the Bloomberg Editorial Board demands, we economists and others should not tell people the true fact that the overall state of the economy is, relative to every other year since 2000, excellent because “telling them the economy is in excellent shape only adds insult to injury…”

The Bloomberg Editorial Board would be well advised to look very hard at the Conference Board’s actual numbers before it writes again. Individual anecdotes do not trump actual data:

References:

Bloomberg Editorial Board. 2023. “Voters Are Right to Complain About b Inflation: Many households don’t just feel worse off; they are worse off.” Bloomberg. December 7. <https://www.bloomberg.com/opinion/articles/2023-12-07/inflation-gives-voters-plenty-of-reason-to-complain-about-economy?srnd=undefined>

Burn-Murdoch, John. 2023. “Should We Believe Americans When They Say the Economy Is Bad?” Financial Times. December 1. <https://www.ft.com/content/9c7931aa-4973-475e-9841-d7ebd54b0f47>.

Conference Board. 2024. “Consumer Confidence”. January 30. <https://www.conference-board.org/topics/consumer-confidence>.

Cummings, Ryan, & Neale Mahoney. 2023. “Digesting inflation”. Briefing Book. December 4. <http://briefingbook.info/p/digesting-inflation>.

DeLong, J. Bradford, & Noah Smith. 2024. “Hexapodia LVII: The ‘Vibecession’ Is Losing Its Vibe”. Hexapodia Podcast. February 7. <https://braddelong.substack.com/p/podcast-hexapodia-lvii-the-vibecession>.

Edgecliffe-Johnson, Andrew. 2022. “Anxious US consumers carry on spending regardless”. Financial Times. August 21. <https://www.ft.com/content/c9b5ce44-c374-4ead-823b-3f022ae27096>.

Financial Times Editorial Board. 2023. “The inflation battle enters the hard last mile”. Financial Times. December 3. <https://www.ft.com/content/865681af-041c-4b7e-b14d-0f0f193e28ad>.

Krugman, Paul. 2024. “Recent economic news has been extremely good…”. Threads. February 10. <https://www.threads.net/@paulkrugman7/post/C3KxgyGOI-q>.

Tett, Gillian. 2023. “How American consumers lost their optimism: It is possible that the lived experience is worse than official employment and inflation data imply”. Financial Times. July 6. <https://www.ft.com/content/11d327e3-ac47-437f-86ea-488192cd9661>

Wikipedia. 2023. Krell. December 31. <https://en.wikipedia.org/wiki/Krell>