BRIEFLY NOTED: For 2024-02-02 Fr

A low-inflation boomtime economy at cruising speed; “spatial computing” enthusiast Brian Tong; very briefly noted; Elon Musk self-driving Twitter into bankruptcy; John Gruber on Apple’s three new products this day; Bloomberg is wrong in claiming that the Fed’s job is “no easier”; & alarmed at the Fed’s standing pat; lecture on 1870-1914 globalization; greedy jobs & biological clocks; & BRIEFLY NOTED: For 2024-01-29 Mo…

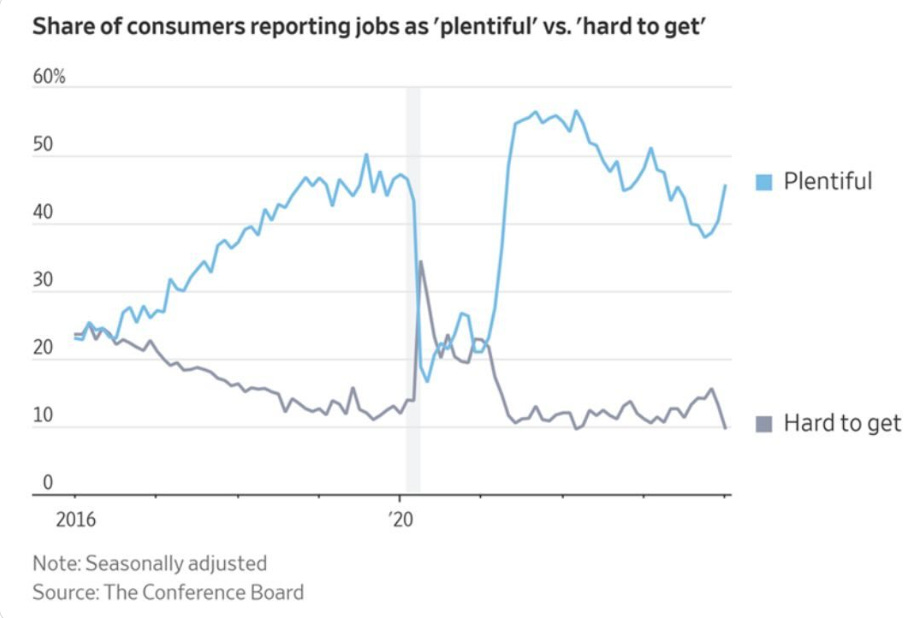

ONE IMAGE: A Low-Inflation Boomtime Economy at Cruising Speed:

ONE VIDEO: “Spatial Computing” Enthusiast Brian Tong:

Very Briefly Noted:

“Spatial Computing”: M. G. Seigler: ‘Happy Vision Pro Week to those who celebrate…. Normally, reviews of Apple products are entirely predictable… because Apple products are, for the most part, that good… best-in-class…. But this launch is all sorts of weird, and you can tell that Apple is sweating it…. The Apple Watch also launched without knowing what market is was going after…. You’re going to look ridiculous while wearing the Vision Pro… <https://spyglass.org/vision-profoundly-uncool/>

TechnoUtopia: Steve Jobs (2007): iPhone Introduction: ‘Today we’re introducing three revolutionary products of this class. The first one is a widescreen iPod with touch controls. The second is a revolutionary mobile phone. And the third is a breakthrough Internet communications device. So, three things: a widescreen iPod with touch controls; a revolutionary mobile phone; and a breakthrough Internet communications device. An iPod, a phone, and an Internet communicator. An iPod, a phone… are you getting it? These are not three separate devices, this is one device, and we are calling it iPhone. Today, Apple is going to reinvent the phone, and here it is… <https://singjupost.com/steve-jobs-iphone-2007-presentation-full-transcript/>

Journamalism: John Ganz: The Race to the Swift: ‘What On Earth Is Going On Now?… Granted, [Ross] Douthat is playing around a bit here, but still it goes from the normal—”A sweet thing to watch”—sure, to the frankly creepy—“we need them to marry and procreate,” very rapidly. The smart, sensible conservative take on Kelce-Swift is that it’s not a psyop for the Pentagon—yes, that’s what a Fox News host really said—but rather that it could be helpful for their breeding programs. Is it not possible to just relate to any of this like a human being?… <http://www.unpopularfront.news/p/the-race-to-the-swift>

Economics: Skanda Amarnath: It Wasn’t AI: How Fiscal Supports, Supply Chain Healing, & Full Employment Explain Exceptional Productivity in 2023: ‘Productivity growth is a multi-causal phenomenon, but recent history suggests that getting to elevated levels of prime-age employment raise the odds of achieving impressive growth outcomes. In a univariate linear specification that excludes recession-distorted observations, 1% higher on the Prime-Age Employment Rate translates into an additional 0.3% of productivity growth… <www.employamerica.org/blog/it-w…>

Matthew Klein: Argentina and the Limits of Fiscal Space: ‘“Anything we can actually do, we can afford” is an important and underrated insight. The corollary is that acting as if you “can afford” what you cannot “actually do” leads to trouble… <http://theovershoot.co/p/argentina-and-the-limits-of-fiscal>

Dan Davies: irritating arithmetic: ‘bank regulation unfortunately makes no sense whatever…. It is not at all difficult to get into a situation which very much looks as if the banks have delegated some of their most crucial management functions to a regulatory handbook, while the regulators are doing impromptu industrial policy. The big original sin that lands you in the mental prison is, in this case and many others, taking a set of numbers that you have to calculate for one purpose, and using them for another purpose because it’s cheaper and easier than starting again from scratch… <http://backofmind.substack.com/p/irritating-arithmetic>

Paul Krugman: Europe has problems, but not the ones a lot of people seem to think it does: ‘Inflation has been plunging in Europe… [but] official… sound much more reluctant than their U.S. counterparts to reverse recent rate hikes, so Europe is running a much bigger risk of recession…. What’s the matter with Europe? No, the continent hasn’t been overrun by immigrants. No, strong welfare states haven’t stifled the incentives to work and innovate. But Europe does suffer from policymakers who are excessively conservative, not in the left-right political sense, but in the sense of being too worried about inflation and debt, and too hesitant about promoting economic recovery… <https://messaging-custom-newsletters.nytimes.com/dynamic/render?CCPAOptOut=true&campaign_id=116&emc=edit_pk_20240130&first_send=0&instance_id=113880&nl=paul-krugman&paid_regi=1&productCode=PK®i_id=64675225&segment_id=156827&te=1&uri=nyt://newsletter/76c968c2-fa03-5379-9975-f066716ec5cd&user_id=8a3fce2ae25b5435f449ab64b4e3e880>

Brad DeLong: Comments on “A Useful & Human Grand Narrative for the 21st Century”: ‘That is one of the most interesting things about “commercial society”. In agrarian society or in the gunpowder-empire mode of what followed, it is pretty clear who the moochers are—the thugs with spears, their bosses, their tame accountants, propagandists, and bureaucrats, plus the lumpenproletariat. In the commercial-society mode of what followed, it is not at all clear who the moochers and takers are… <http://braddelong.substack.com/p/a-useful-and-human-grand-narrative/comments>

CryptoGrifters: Dave Karpf: The Chroniclers of the Crypto Collapse: ‘I read three of the resulting books this year – Ben McKenzie (with Jacob Silverman)’s Easy Money, Zeke Faux’s Number Go Up, and Michael Lewis’s Going Infinite. In some ways, I think the defining feature of each book is how the author(s) adjusted to the sudden change of fortunes among the blockchain billionaire class…

Neofascism: Virginia Postrel (2005): From the Archives: Another View of News Bias, as Selling Point: ‘If bias is a product flaw, why doesn’t it behave like auto repair rates and decline under competitive pressure?… What exactly makes a story a lemon?… “Recession Fears Grow,” notes that 200,000 people have lost their jobs in the past quarter. It quotes a gloomy John Kenneth Galbraith comparing the president to Herbert Hoover and is illustrated with a photograph of a long line of people waiting for unemployment benefits…. “Turnaround in Sight,” emphasizes the small magnitude… quotes the stock analyst Abby Joseph Cohen… accompanied by a photo of a smiling Ms. Cohen. “Each of these stories could easily have been written by a major U.S. newspaper,” write Professors Mullainathan and Shleifer. “Neither story says anything false, yet they give radically different impressions”… <http://vpostrel.substack.com/p/from-the-archives-another-view-of>

SubStack NOTES:

Neofascism: I confess that I had not thought until this weekend that even Elon Musk could manage to drive Twitter into bankruptcy in less than three years. But now I think that is more likely than not: turning the whole platform into the Nazi bar in such a short time is one hell of an accomplishment!:

Drew Hartwell ‘X has now for two days blocked all searches for one of the world’s biggest superstars, during a very newsy weekend, because it couldn’t stop AI-generated sex images of her. If only X hadn’t fired 80% of its workers and most of its “trust and safety” team… <bsky.app/profile/drewharwell.com/post/3…>

“Spatial Computing”: Back in 2007—only 17 years ago—Steve Jobs introduced the Apple iPhone as three devices: “a widescreen iPod with touch controls; a revolutionary mobile phone; and a breakthrough Internet communications device…” <https://www.perplexity.ai/search/iphone-introduction-transcript-y8CCgecCTASB5I99IFpQDw?s=c>. John Gruber today sees the Apple visionPro as worth it right now as an entertainment device—anyone thinking of spending more than $2,000 on an individual home-entertainment system should get an Apple visionPro RIGHT NOW—as pointing to the likely future of spatial, or what used to be called ambient, computing, and as demonstrating that even with near-infinite money headset technology is only compelling for the crazed. But I am sensing the same “early adopters here are living in the future” vibe one gets rarely—with the Osborne and Apple II PCs, with the Macintosh, with the iPhone, with the Tesla Model S, and… I cannot really think of other hardware examples in my lifetime:

John Gruber: The Vision Pro: ‘For the last six days, I’ve been simultaneously testing three entirely new products from Apple. The first is a VR/AR headset with eye-tracking controls. The second is a revolutionary spatial computing productivity platform. The third is a breakthrough personal entertainment device…. These are not three separate devices. They’re one: Apple Vision Pro. But if you’ll pardon the shameless homage to Steve Jobs’s famous iPhone introduction, I think these three perspectives are the best way to consider it…. It’s too heavy and too big for everyone, and too expensive for the mass market. But, like that original iPhone and the original Macintosh before it, this first Vision Pro is no joke…. The conceptual design of VisionOS lays the foundation for an entirely new direction of interaction design. Just like how the basic concepts of the original Mac interface were exactly right, and remain true to this day. Just like how the original iPhone defined the way every phone in the world now works…. Vision Pro is simply a phenomenal way to watch movies, and 3D immersive experiences are astonishing. There are 3D immersive experiences in Vision Pro that are more compelling than Disney World attractions that people wait in line for hours to see…. I can recommend buying Vision Pro solely for use as a personal theater. I paid $5,000 for my 77-inch LG OLED TV a few years ago. Vision Pro offers a far more compelling experience…. Spatial computing in VisionOS is the real deal. It’s a legit productivity computing platform right now, and it’s only going to get better. It sounds like hype, but I truly believe this is a landmark breakthrough like the 1984 Macintosh and the 2007 iPhone… <https://daringfireball.net/>

Journamalism: Word-salad from the Bloomberg Editorial Board. What “Federal Reserve dilemma” are they talking about? What could they be possibly talking about? A “dilemma” is when you face two (or more) options with significant drawbacks. But what might those drawbacks be?

The question “will there be a soft landing?” was “can the Fed get core-PCE inflation back to 2% per year with expectations aligned to that target of its without a deep recession?” The answer to that question turns out to have been: yes. The soft landing has been achieved. It is time to declare victory with respect to that question. With the macroeconomy in balance—in neutral—policy should be rapidly moving toward neutral as well, and should continue to do so until some new shock hits.

Yes, there is a future. And the future will raise new challenges for monetary policy. But to pretend right now that the macroeconomy is not in balance is to simply be stupid. Yet the Bloomberg Editorial Board appears desperate to pretend that there is some important dimension along which the macroeconomy is out of balance. But all they can offer is word-salad:

Bloomberg Editorial Board: Federal Reserve’s Dilemma Is a Nice Problem to Have: ‘A hoped-for soft landing is increasingly plausible, but this won’t make the Fed’s job any easier…. The central bank’s policymakers need to weigh risks and uncertainties that could still upend expectations…. Progress made so far on inflation. The Fed’s preferred… price index… rose 2.9% in December from a year earlier…. For the second half of 2023, core PCE prices went up by just 1.9% at an annual rate, bringing that metric back to the Fed’s 2% target. Even so, it’s too soon to declare victory…. If [the Fed] anticipates too eagerly, and demand does not subside as expected, an overstimulated economy might, even now, overturn the central bank’s apparent victory over inflation… <https://www.bloomberg.com/opinion/articles/2024-01-30/federal-reserve-s-dilemma-on-interest-rates-and-the-economy?srnd=opinion>