BRIEFLY NOTED: For 2023-12-18 Mo

GPT vs. bureaucracy; EMH fanatics lose the plot; Binyamin Netanyahu is not a victim here; a minimally prompted ChatGPT4 success; TED Talks enable Kathie Wood’s grifting; very briefly noted; & respect the judgment of the Federal Reserve!, Cyrus propagandizes; consequences for development of manufacturing’s delaborization, and BRIEFLY NOTED: For 2023-12-15…

SubStack NOTES:

GPT-LLM-ML: Use as a natural-language interface to a reliable and ideally well-structured database is, I think, one of the use cases for LLM’s that is actually likely to be very useful soon. And Dave Guarino is on it!:

Dave Guarino: Using AI to make sense of policy documents <http://daveguarino.substack.com/p/using-ai-to-make-sense-of-policy>: ‘I’ve been experimenting with using AI to do “policy reasoning.” That’s because fundamentally this is what staff have to do to answer questions about often complicated and complex rules.…. I think… pairing a policy question in an end-user’s own language with the specific policy language that a government staff member would use to answer it… [is] of promise…. I am working on experimenting and evaluating more. There are definitely ways that this would need to be hardened to be used in something closer to a production (real users) environment. Though my first step would most likely be to have a human in the loop, with something like an email support desk or a content web site as the service channel. (That mitigates a lot of the risk of having it be instantaneous)…

Economics: Somewhere along the road, orthodox finance economists lost the plot.

The Efficient Market Hypothesis was, originally: the market knows more than you do, and so you cannot “beat the market” in utility terms—if you do find a systematic way to “beat the market”, it will be because in the states of the world in which you receive high returns each unit of wealth is worth less to society than in the states of the world in which you receive low returns. You can benefit by holding other than the market portfolio if your rate of time preference is different from the market’s or if your tolerance for risk is different from the market’s or if your alternative portfolio aligns incentives. But you cannot beat the market.

But the returns to beta were never, plausibly, there because in the states of the world in which you receive high returns each unit of wealth is worth less to society than in the states of the world in which you receive low returns. And such claims for small vs. large, value vs. growth, robust vs. weak profitability, and conservative vs. aggressive on investment were an order of magnitude even more ludicrous.

So you can beat the market, by a lot over time, if you are patient and are willing to do five things systematically.

That is not an “Efficient Market Hypothesis”. That is a “Systematically Inefficient Market Hypothesis”. And only those for whom confusion is a friend and chaos is a ladder have any business calling it the EMH:

Market Sentiment <https://www.marketsentiment.co/p/great-expectations>: ‘Leverage Factors: The past 6 decades of data show us that 5 factors were able to explain 95% of the differences in returns between diversified portfolios (all figures are annualized). a. Market Risk (MKT-RF): The market beat one-month treasury bills by 5.37%. b. Size (SMB — small minus big): Small stocks beat large stocks by 2.04% c. Value (HML — high minus low): Value stocks beat growth stocks by 2.68%. d. Profitability (RMW — robust minus weak): Highly profitable companies outperformed weakly profitable companies by 2.8%. e. Investment (CMA — conservative minus aggressive): Companies that were conservative in asset growth beat aggressive growers by 2.93%. What this shows us in simple terms is that even if we believe in the Efficient Market Hypothesis, certain factors would get us better results through long-term exposure rather than just sticking to market-cap-weighted index funds…

War: There is something very, very wrong with Michael Ignatieff. Binyamin Netanyahu is not a person with limited options being “driven” “toward annexation and expropriation” by spoiler “settlers”. The the entire point of his government is to grab land. If, in the process, that gins up enough Arab rage to make the Israeli electorate reluctant to support more peace-oriented politicians—well, that is all to the good, from his perspective. The only thing he did not want was for so many Israeli civilians to die on October 7:

Michael Ignatieff: Universal Values at Bay <https://www.project-syndicate.org/commentary/universal-declaration-human-rights-being-tested-in-middle-east-but-can-still-win-out-by-michael-ignatieff-2023-12>: ‘Peace can still be achieved through the mutual recognition of pain and loss, but not until the spoilers on both sides—the settlers rampaging the West Bank and driving Binyamin Netanyahu’s government toward annexation and expropriation, and the jihadist militants who want nothing but to destroy Israel—are beaten…

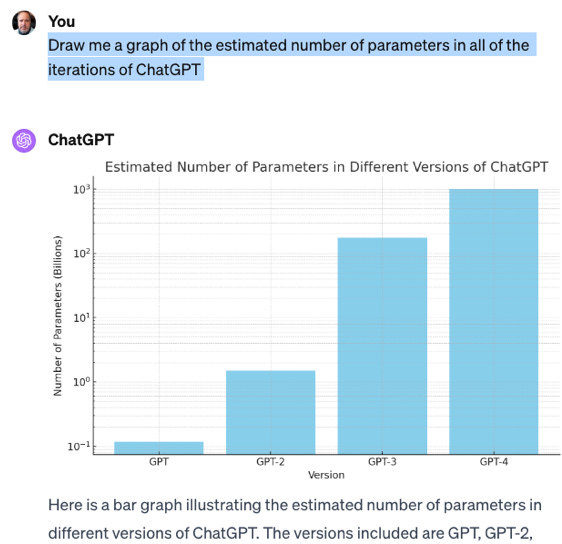

ONE IMAGE: If There Is a Reliable Database ChatGPT4 Can Glom onto…

…or even a data table, it is getting pretty damned good:

ONE VIDEO: Posted Simply as an Example of a Cognitive Denial of Service Attack by a Grifter…

…who believes that she can no longer bang the crypto drum to get money to fall out of people’s pockets:

Very Briefly Noted:

Journamalism: Jamison Foser: ‘The New York Times <https://mastodon.social/@foser/111601917680012953>, an absolute tire fire of a newspaper, publishes a guest essay portraying Donald Trump as a moderate, written by a guy [Matthew Schmitz] who is promoting the essay by saying it would be undemocratic to hold Trump legally accountable for his many crimes…

Jamison Foser: Substackers Against Nazis <http://findinggravity.substack.com/p/substackers-against-nazis>: ‘I joined this campaign in large part because Substack is not, as it and its defenders claim, merely a platform passively hosting racist content. Substack and its leadership is actively promoting some of the most virulent racists around, like Richard Hanania. Don’t get fooled by the “it’s just a neutral platform refusing to censor people” rhetoric; it is in fact actively and intentionally promoting bigots…

Economics: https://mastodon.social/@foser/111601917680012953 Thomas L. Hutcheson: ‘The truly depressing implications <https://substack.com/@thomaslhutcheson/note/c-45577875> of this is that while the “Royal Road” [to development via exporting low-wage manufactures] was open and wide, one needed only minimal good governance to get and stay on it, (cf China) To make the best of a more difficult path will require better governance, stricter adherence to the rule of law, more careful cost-benefit analysis of public investments, taxation with smaller dead-weight losses, transfers using non-leaky buckets, well-chosen Pigou taxes and subsidies [COP 28, take note]. In a word, “neoliberalism.” :)…

UBS: The great wealth transfer <https://www.ubs.com/global/en/media/display-page-ndp/en-20231130-the-great-wealth-transfer.html>: ‘For the first time… billionaires have accumulated more wealth through inheritance than entrepreneurship…. This is a theme we expect to see more of over the next 20 years, as more than 1,000 billionaires pass an estimated USD 5.2 trillion to their children…

Dani Rodrik: Better Jobs Mean Better Development <https://www.project-syndicate.org/commentary/services-not-manufacturing-must-become-source-of-middle-class-jobs-by-dani-rodrik-2023-12>: ‘Manufacturing industries are no longer the labor-absorbing sectors they used to be, and that is a big problem for developed and developing economies alike. Achieving sustainable, inclusive growth will now depend on creating opportunities in services – a sector not generally associated with good, productive jobs…

Philip Koop: ‘The “policy” case <https://braddelong.substack.com/p/i-was-on-team-transitory-my-historical/comment/45502251> for the Fed to raise rates (as opposed to the political case… is a counterfactual: had the Fed not acted, we would have assumed that they would never act, and expectations of inflation would have become self-reinforcing. This is a plausible counterfactual but it is inaccessible…. You and Larry will go to your graves without every knowing whether Larry had a point… Thomas L. Hutcheson: ‘This is just a discussion about when the Fed should have started tightening. I don’t think Summers was all that clear about when HE though it should happen. And his message was further muddied by talking about the size of the Biden relief package instead of focusing on the Fed reaction to that and other shocks…

Oks & Williamson: ‘With the global population outside of Africa entering a long era of slow growth or decline, and African population in the midst of a long and spectacular boom, the future of development and poverty reduction will hinge on the future of Africa. In the past, the exceptionally strong performances of East Asian economies have statistically compensated for less impressive results elsewhere, especially among the African economies—many of which, despite improvements in health, cannot be said to be meaningfully richer or more economically developed now than they were in 1980…

Matthew Klein: Argentina and the Limits of Fiscal Space <http://theovershoot.co/p/argentina-and-the-limits-of-fiscal>: ‘“Anything we can actually do, we can afford” is an important and underrated insight. The corrollary is that acting as if you “can afford” what you cannot “actually do” leads to trouble….

Literature: Henry Oliver: [Jane Austen’s] Persuasion should have been called Consequences <https://www.commonreader.co.uk/p/persuasion-should-have-been-called>: ‘Wentworth must learn how the world works…. Initially he thinks Anne was weak; by the end, he realises she was realistic. Anne is the only character who understands the equilibrium of social consequence, having a character of consequence, and the importance of considering the consequences of your actions…

Berkeley Next Semester: Berkeley Academic Guide: ECON 115 001 - LEC 001 <https://classes.berkeley.edu/content/2024-spring-econ-115-001-lec-001>: ‘The World Economy in the Twentieth Century :: James Bradford Delong :: Jan 16 2024 - May 03 2024 :: TU, TH 8:00 am - 9:29 am :: Hearst Mining 390 :: Class #:17563 :: Units:4 :: Instruction Mode: In-Person Instruction Offered through Economics…. Sections: 101 M 1:00 pm Evans 4; 102 M 2:00 pm Evans 71; 103 Tu 11:00 am Evans 2; 104 Tu 10:00 am Evans 81; 105 W 4:00 pm Evans 4; & 106 W 5:00 pm Evans 4…