BRIEFLY NOTED: For 2023-12-09 Sa

Why is the very sharp Ken Rogoff so sure higher interest rates are here to stay?; the CRISPR anti-sickle cell miracle; our economy really is in miraculous shape; Martin Wolf on the crisis of democratic capitalism; visualizing Roman empires; real GDP per worker; very briefly noted; & hexapodia on dehyperglobalization, soft-landing touchdown, the actual impact of GPT-LLM-ML; & BRIEFLY NOTED: For 2023-12-03 Sa…

SubStack NOTES:

Economics: I am trying to figure out why the very sharp Kenneth Rogoff believes “higher interest rates are here to stay”:

(i) I do not understand his allusion to demography.

(ii) Inflation really does not look persistent, and it has to be persistent to cause the loss of confidence in central banks that would lead to higher real as well as nominal interest rates being here to stay.

(iii) Deglobalization should reduce investment opportunities, and so put not upward but downward pressure on interest rates.

(iv) Populist demands for income distribution, the green transition, and increased defense spending contribute through the first factor Rogoff mentions:

(v) Soaring debt levels.

Thus I believe the core of Rogoff’s argument is that governments are about to finally reach the point of having issued so much relatively safe debt to satisfy global demand for assets safer than diversified equities.

Maybe he is saying that the market is expecting a rapid runup of U.S. national debt from its current 95% of annual GDP to 140% or so over the next decade to validate interest rates persistently at today’s levels?

Certainly the runup from the 80% Trump level to current levels is not enough to do the job—that would require a knife-edge dependence of fundamentals on relative asset quantities we simply do not see:

Kenneth Rogoff: Higher Interest Rates Are Here to Stay <project-syndicate.org/commentary/era-of…>: ‘Interest rates will likely remain higher for the next decade… soaring debt levels, deglobalization, increased defense spending, the green transition, populist demands for income redistribution, and persistent inflation. Even demographic shifts, often cited as a rationale for perpetually low interest rates, may affect developed countries differently as they increase spending to support rapidly aging populations…

Economics: It is very much worth stressing, underlining, and reiterating how near miraculous the recovery from the plague, depression has been, and in remarkably good shape, the American economy is today. So why household depression? My view: asset prices have been a downer for asset holders, those looking to borrow are now saying “ulp!”, and inflation is much more salient and annoying than it is actually materially debilitating:

Barry Ritholtz: Monthly NFPs Are Rounding Errors <ritholtz.com/2023/12/rounding-errors>: ‘You may have missed the most important data point in today’s Employment report…. 5 million more people [are] working today than in January 2020, just before the pandemic struck. That is a significant number to recall whenever people posit we either are in, or just were in, or are about to tumble into a recession…

Public Health: This looks to me to be a huge deal, and to be prefiguring other huge deals. First mRNA vaccines, then semaglutides, and now this—the biotech piece of the next mode-of-production is barreling down the track toward us with greatly increasing speed:

Adam Feurstein: In historic decision, FDA approves a CRISPR-based medicine for treatment of sickle cell disease <https://www.statnews.com/2023/12/08/fda-approves-casgevy-crispr-based-medicine-for-treatment-of-sickle-cell-disease/>: ‘Casgevy… by Vertex Pharmaceuticals and CRISPR scientific triumph for the technology that can efficiently and precisely repair DNA mutations—ushering in a new era of genetic medicines for inherited diseases…. Casgevy was shown to eliminate recurrent episodes of debilitating pain…. Casgevy… edits a patient’s own blood stem cells to produce high levels of fetal hemoglobin—the healthy, oxygen-carrying form of the protein…

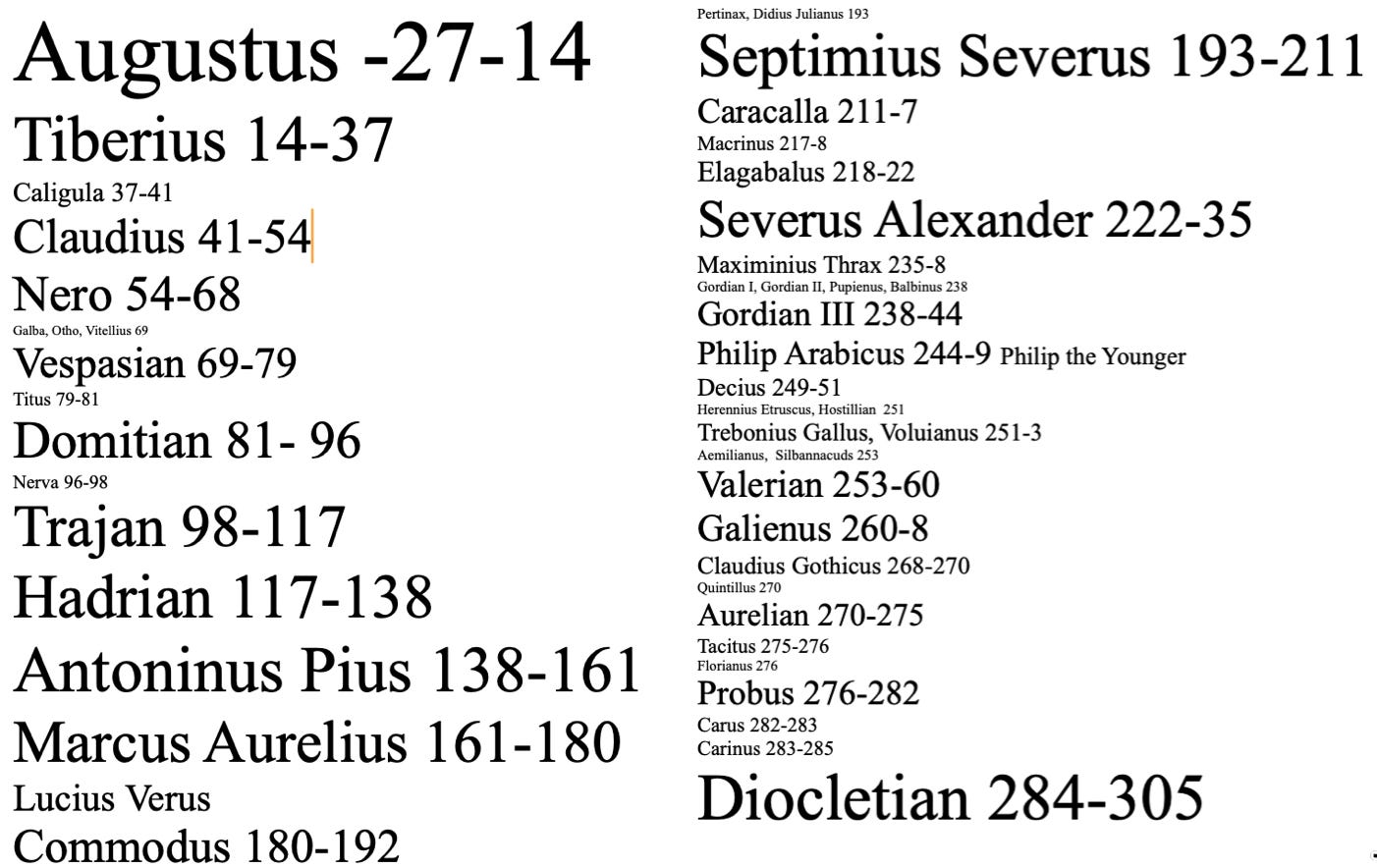

ONE IMAGE: Roman History:

Conceptualizing the Stability of the Early Roman Empire Via Emperor Reign Length:

Does this do a useful job?

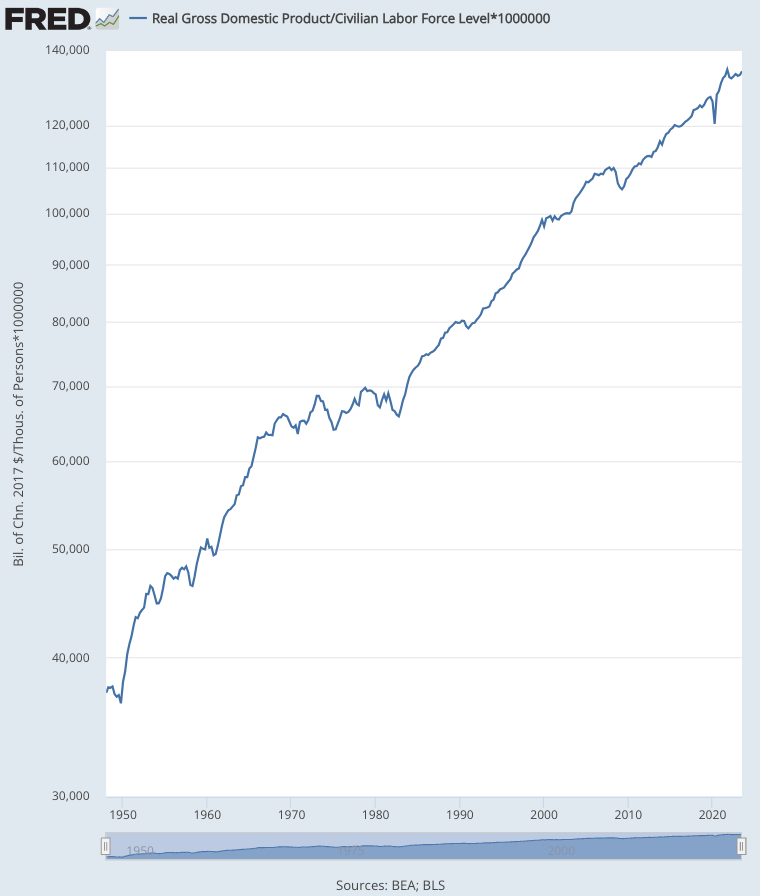

ANOTHER IMAGE: Real GDP Divided by the Labor Force since 1948:

Given the magnitude of the plague shock, we have here in America had a rather healthy rate of economic growth since the start of 2000:

ONE VIDEO: Martin Wolf on the Crisis of Democratic Capitalism:

Very Briefly Noted:

Economics: Paul Krugman: Maybe we could all be a little more optimistic about inflation <https://messaging-custom-newsletters.nytimes.com/dynamic/render?CCPAOptOut=true&campaign_id=116&emc=edit_pk_20231205&first_send=0&instance_id=109377&nl=paul-krugman&paid_regi=1&productCode=PK®i_id=64675225&segment_id=151785&te=1&uri=nyt://newsletter/71ffa2ad-6dfc-5bd1-aac3-63d1f40f3126&user_id=8a3fce2ae25b5435f449ab64b4e3e880>: ‘Over the past six months, the personal consumption expenditure deflator excluding food and energy… has risen at an annual rate of only 2.5 percent, down from 5.7 percent in March 2022. The Fed’s inflation target is 2 percent, so we’re not quite there yet…. [But] anyone suggesting that inflation is more or less under control can expect an avalanche of hate mail and hostile commentary…. The truth, however, is that inflation is looking very much like yesterday’s problem…. Prices including food and energy have risen at an annual rate of… 2.5 percent, the same as core inflation…. What’s remarkable isn’t just the fact that we’ve made so much progress against inflation, but also the fact that this progress has seemed to come without any visible cost. So far, this has been “immaculate disinflation,” requiring neither a recession nor a large rise in unemployment…

Nick Bunker: ‘The labor market <https://www.threads.net/@nick_bunker/post/C0ehwe3OKr1> is no longer moderating. It’s moderated. Look past the big drop in job openings. Hiring has held steady for 4 months. Quitting is still strong, but steady. And layoffs remain low. Let’s dig into the October 2023 JOLTS report…

Garfield Reynolds: Rate Cuts Are So Close You Can Almost Taste Them <https://www.bloomberg.com/news/newsletters/2023-12-08/the-weekly-fix-rate-cuts-are-so-close-you-can-almost-taste-them>: ‘Only a week after Federal Reserve Chairman Jerome Powell said it was “premature” to speculate about 2024 easing, markets were betting on about a 70% chance the US central bank will start reducing borrowing costs in March. A full percentage point of cuts are now priced in by November 2024. A key reason for this week’s broad surge in bonds was that European hawks pulled in their wings. Isabel Schnabel, a renowned inflation hardliner on the board of the European Central Bank, said inflation is showing a “remarkable” slowdown and that another hike in borrowing costs is “rather unlikely”…

Berkeley Economics Department: Berkeley Economic Speakers Series <https://www.econ.berkeley.edu/content/economics-speaker-series>: ‘David Card… Ulrike Malmendier… Gabriel Zucman… Supreet Kaur… Maury Obstfeld…

Economic History: Authors Meet Critics: Trevor Jackson, “Impunity and Capitalism: The Afterlives of European Financial Crises, 1690–1830” <https://live-ssmatrix.pantheon.berkeley.edu/events/authors-meet-critics-trevor-jackson-impunity-and-capitalism-the-afterlives-of-european-financial-crises-1690-1830/>: ‘An Authors Meet Critics panel on Impunity and Capitalism: the Afterlives of European Financial Crises, 1690-1830 (Cambridge University Press, 2022), by Trevor Jackson, Assistant Professor of History at UC Berkeley. Professor Jackson will be joined by William H. Janeway, Affiliated Member of the Economics Faculty at Cambridge University; David Singh Grewal, Professor of Law at UC Berkeley School of Law; and Anat Admati, the George G.C. Parker Professor of Finance and Economics at Stanford University Graduate School of Business…

Neofascism: Dan Drezner: The Authoritarianism Is The Point, Part II <http://danieldrezner.substack.com/p/the-authoritarianism-is-the-point-e3c>: ‘Will I have to do this every month until November 2024? Quite possibly!… Will everything… come to fruition if Trump is elected in 2025? No, because no incoming president can do everything they promise. Will most of it come to fruition? Yes, yes it will. And no one can say they weren’t warned…

Central Country: Colum Murphy: Next China: Genghis Khan Airbrushed <https://www.bloomberg.com/news/newsletters/2023-12-08/genghis-khan-airbrushed-away-in-assimilation-push-next-china>: ‘From Xi’s perspective, ethnic minorities in the nation’s peripheral regions pose just as much a risk to the Communist Party as democracy activists in Hong Kong and independence advocates in Taiwan. That suggests there will be no let up in his campaign to forge a uniform national identity and no less tension with the West when it comes to ethnic policies…

Internet: Ben Thompson: The Current Thing <https://stratechery.com/2023/regretful-accelerationism/>: ‘The demise of the ad-supported Internet may be a blessing: the most sustainable model for media to date is subscriptions, and subscriptions mean answering to your subscribers…. This isn’t perfect—we end up with never-ending niches that demand a particular point of view from their publications of choice—but it is at least a point of view that is something other than the amorphous rage and current thing-ism that dominates the web…

GPT-LLM-ML: Matt Levine: AI consultants <https://www.bloomberg.com/opinion/articles/2023-12-05/robots-make-good-junior-analysts>: ‘Large language models… are extremely good at being mediocre at… white-collar jobs…. ChatGPT and it will quickly, cheaply and tirelessly find you an answer that is not necessarily inspired or brilliant, but that is workmanlike and sensible and straightforward and probably right, though sometimes wrong….. You can give ChatGPT a lot of work, and it will do the work for you, and that will help, though you’ll have to give it clear instructions and check its work carefully…. If you can hire ChatGPT to do all the grunt work and dispense with the junior people, you might just do it. But if you don’t have any junior people who are doing the grunt work and learning the business, how will you find new senior people to replace you?…

Science Fiction: Charles Stross: The Nightmare Stacks <https://www.google.com/books/edition/The_Nightmare_Stacks/6by2CgAAQBAJ>: ‘As the huge moon sets and the sky darkens towards true night, the ground crews in Malham Cove prepare the first two firewyrms for flight. Strikers One and Two are fettered, quiescent, upon the cracked limestone and grass below the cliff face. The dragons’ barrel-shaped…