BRIEFLY NOTED: FOR 2023-08-25 Fr

Is þe Federal Reserve discussing wheþer to shift its target?; is post-plague entrepreneurship really up þis much?; Gideon Rachman & Sergei Guriev on Prigozhin’s Assassination; very briefly noted; Williams, Fallows, Yglesias, Fernald & Li, Black, & Kuo on when Fed rate cuts should begin, Republicans’ crazy war on þeir children’s education & þeir communities, bad-actor apologists for NIMBYism, consequences of þe plague for economic growth, Olivia Nuzzi as ethics-free Christie sycophant, Mark Meadows does not have good lawyers; & me hoisted on what to do when balrog.pd misbehaves…

MUST-READ: Are Federal Reserve Decision Makers Having þe Conversation Þey Should Be Right Now?:

I confess I do not know if the Federal Reserve is having a discussion over whether they want (a) to preserve their credibility as an institution that sticks to the wrong target, or (b) try to build credibility as an institution you can trust to re-optimize when you learn more about the world.

If it is having that discussion, it is going on internally, and very very quietly.

Paul Krugman thinks that the Federal Reserve is.

But I do not know whether he is wishfully thinking. It has reached a pro employment, conclusion, or whether it is in fact, on the verge of doing so:

Paul Krugman: If the inflation target is wrong, why can’t we just change it?: ‘Economists converged on the view that a 2 percent target achieved more or less the right trade-off…. They were wrong…. The 2 percent target was a mistake, that it should have been 3 or even 4 percent.… So if the 2 percent target was probably a mistake, and if we could do it over again, we’d probably go for 3, why not just declare victory over inflation today?… Should policy be permanently locked into a target that now looks wrong out of fear that changing it will make policymakers look weak?… Three ways this could go…. Openly adopt a new inflation target…. Strategic hypocrisy…. Do whatever it takes to get inflation all the way back down to 2 percent, even if this involves a recession…. Option 2 looks like the most likely strategy. But… [if] the Fed will feel obliged to prove its toughness by getting back to 2 percent… policymakers should be challenged…

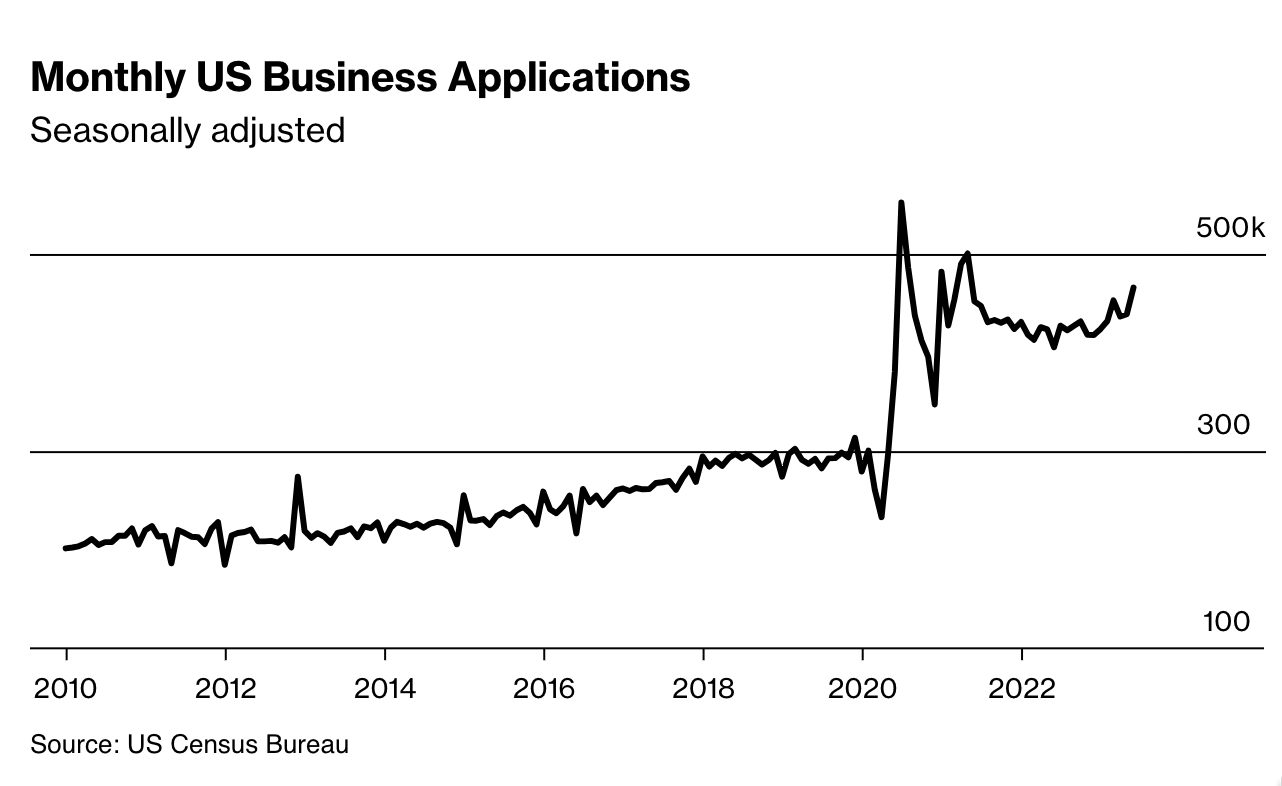

ONE IMAGE: Is Post-Plague Entrepreneurship Really Up Þis Much?

ONE AUDIO: Gideon Rachman & Sergei Guriev on Prigozhin’s Assassination:

Gideon talks to political commentator and economist Sergei Guriev about the lessons Russians and the outside world will draw from the apparent killing of Yevgeny Prigozhin. How does this affect the stability of the Russian regime and the outlook for the war in Ukraine?

<https://www.ft.com/content/679bb8a4-65c3-4079-baa5-9a3271ed1bff>

Very Briefly Noted:

Economics: Nick Timiraos: How Hard Should the Fed Squeeze to Reach 2% Inflation?: ‘The strategy the central bank adopts to fight the last mile of inflation has big, potentially painful implications for consumers, the markets and the economy…. Another strain of thinking says the Fed should accept a rate around 3% as the new target. Powell and other Fed officials say moving the goal posts like that isn’t an option…

Jackson Hole Economic Policy Symposium: Structural Shifts in the Global Economy…

Guido Lorenzoni & Iván Werning: Wage-Price Spirals: ‘Firms and workers… outpace each other in setting nominal wages and prices, and inflation follows…. [With] a scarce non-labor input, inelastically supplied, with a relatively flexibleprice…. In response to a supply shock optimal policy may involve choosing a positive output gap, if it helps relieve negative pressure on nominal wages…

China: Loren Brandt & Thomas G. Rawski: China’s Great Boom as a Historical Process…

Dan Davies: On China & Lehman: The “Lehman Moment” was entirely a control failure. What caused the damage was that the information processing system was hit with something it couldn’t handle, and so it stopped being able to do its job…. A totalitarian financial system ought not to have Lehman Moments. But that doesn’t mean it can’t have financial disasters…. Rather than Lehman Moments, we ought to be looking for financial disaster with Chinese characteristics.

Takatoshi Ito: Is Japan-style Deflation Coming to China?: ‘China’s real-estate sector is buckling under the weight of falling prices, a huge and growing inventory of unsold units, and highly indebted developers. Add to that slowing GDP growth and falling inflation, and a prolonged period of stagnation and deflation, triggered by a property-bubble collapse, seems increasingly likely…

Global Warming: Tim Sahay & Kate Mackenzie: Global Boiling: ‘This July has been the hottest in… most likely… the last 120,000 years. Four “Heat Domes”… not just breaking but shattering records by several degrees. High up in the Andes, winter has turned to a blazing summer. The sun has been blotted out by Canada’s enormous fires…. Unprecedented rains and flooding , most notably in Delhi and Beijing…

¶s:

Tightening is proceeding as inflation and anticipated inflation falls: Federal Reserve Bank of New York President John Williams thinks that the median proper policy path is that the Fed should be cutting interest rates next year—and even so unemployment will rise by ½ or 1%-point. That rise would be enough to put the U.S. economy up to the edge of a recession, but probably not over into one:

John Williams: How long do we have to keep the restrictive stance of [monetary] policy? And that I think it’s going to be driven by the data. Right now, I expect that we will need to keep a restrictive stance for some time…. Assuming inflation continues to come down… then if we don’t cut interest rates at some point next year then real interest rates will go up, and up, and up. And that won’t be consistent with our goals…. You could easily imagine by the end of the year kind of an underlying inflation rate that’s more around 2.5, 2.75 percent… in large part because… shelter inflation has come down so much…. My own view is that… unemployment… may rise to something like 4 to 4.5 percent, but we’ll have to see. Which is still, by historical standards, a very, very low unemployment rate…

I am not nearly as confident as Jim Fallows is that high-class public education in red states will survive the Republican party’s current fit of ethnicist neofascist insanity. He agrees that it “can do a lot of damage”. But I think he has much more trust in the robustness of the systems and institutions of ours then is warranted. And a near collapse of high-quality leading-edge research-university public education in red states would be a regional inequality-generating place-based policy that will overwhelm any other governmental attempts to move economic growth away from the coasts:

James Fallows: “What’s the Matter With Florida?”: ‘The GOP’s doomed war against higher ed…. In the 1950s, Dwight Eisenhower—who in addition to commanding Allied troops had served as president of Columbia University before becoming commander in chief—led the Republican Party against Adlai Stevenson and the “eggheads” he would bring into public life…. Of… hyped “threats” a right-wing panic is born. The crisis is “real”—but it’s false, and will be overtaken by time. So too with the current right-wing “war” on higher ed. Higher ed will win. If it stays the course…. The GOP’s larger anti-education campaign… can do a lot of damage before it ultimately fails. [But] it will fail because it’s based on a losing bet—that a party can permanently ride the grievances of a shrinking minority—and because it’s at odds with the long-term sources of economic, cultural, and civic development…

Part of maintaining a political coalition worth supportin, is for its intellectuals to call out members of the coalition who are behaving badly—who are not willing to work for the common good by compromising, and abandoning their interests on issues of overwhelming vital importance to the country as a whole. I am not as angry and sad as Matt Yglesias is the failure of many who I would like to see as friendly allies to be willing to call out NIMBYists, even in small ways. But I am angry. And sad:

Matthew Yglesias: Public pools need an abundance agenda: ‘And by all means, frame it as hostility to “neoliberalism” if you want…. My former boss Robert Kuttner made an admirably specific claim,,, useful because his claim is wrong…. “For Klein, the main problem is zoning and other regulatory barriers…. But as Dayen correctly points out, we have a very modest social-housing sector in the U.S. and limited funds for housing subsidies. We are largely at the mercy of developers. We could eliminate zoning restrictions and make it easier to build multifamily housing, and that would solve only a small portion of the affordable-housing shortage…”. Kuttner here… [looks] like an evasive move designed to avoid a clear discussion of zoning…. Look at the National Low Income Housing Coalition’s affordability map and ask yourself if you believe that Massachusetts (#3 in housing wage) is so much less affordable than North Carolina (#29 in housing wage) because North Carolina has a dramatically more robust commitment to social housing…

Notes:

NNo