BRIEFLY NOTED: For 2023-08-23 We

…forecast, on teaching macro, on macro theory, & on þe history of macro thought…

MUST-READ: Worried Robert Skidelsky Is Worried:

In economic policy:

can we do this?

should we do this?

how is this best financed?

are three different and, almost always, completely separate questions. (1) is a question of real resources, constraints, technologies, and capabilities. (2) is a question of social welfare. And (3) is a question for economic and financial technocrats which should not be of interest to anyone else. Claims that rules people have adopted that constrain actions technocrats can take in (3) should govern discussions about (1) is a huge and stupid mistake to make:

Robert Skidelsky: Imagining a Keynesian Revival: ‘The economic shocks of the past two decades were not freak occurrences but rather the product of a profoundly flawed and corrupt system. But narrowing the policy discussion to a binary choice between market fundamentalism and protectionism overlooks the potential for constructive leadership… [and avoiding the] age-old standoff between market-based supply-side economics and a supply-side approach rooted in industrial policy… [that] echoes the capitalist-socialist divide of the early twentieth century… center[ed] on whether private or public spending is more effective at generating wealth and ensuring its equitable distribution….

[In] the economic-policy debate today… policymakers must convincingly show that their proposed industrial policies would bolster growth and employment, lest they violate their own budgetary principles…. We would be wise to give Keynesianism another chance…

As John Maynard Keynes said back in 1942:

Let us not submit to the vile doctrine of the nineteenth century that every enterprise must justify itself in… cash income.… Why should we not add in every substantial city the dignity of an ancient university or a European capital… an ample theater, a concert hall, a dance hall, a gallery, cafes, and so forth? Assuredly we can afford this and so much more. Anything we can actually do, we can afford….

Yet these must be only the trimmings on the more solid, urgent and necessary outgoings on housing the people, on reconstructing industry and transport and on replanning the environment of our daily life. Not only shall we come to possess these excellent things. With a big programme carried out at a regulated pace we can hope to keep employment good for many years to come. We shall, in fact, have built our New Jerusalem…

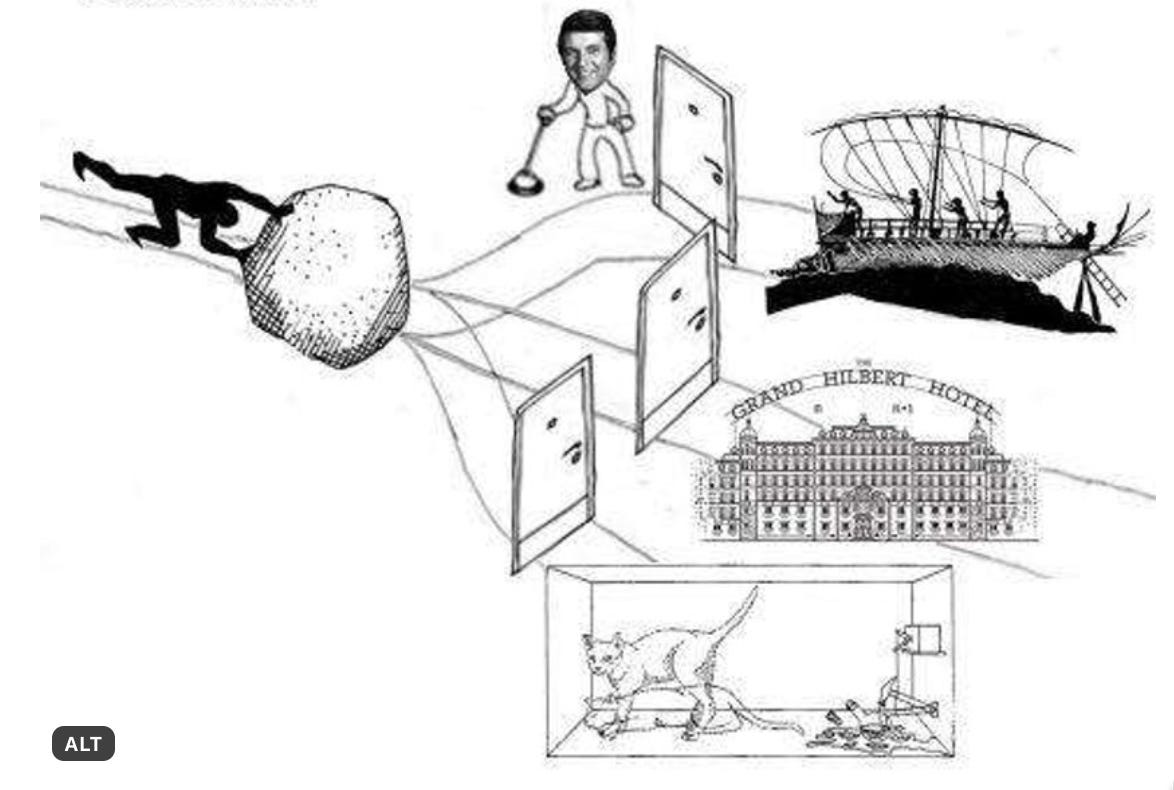

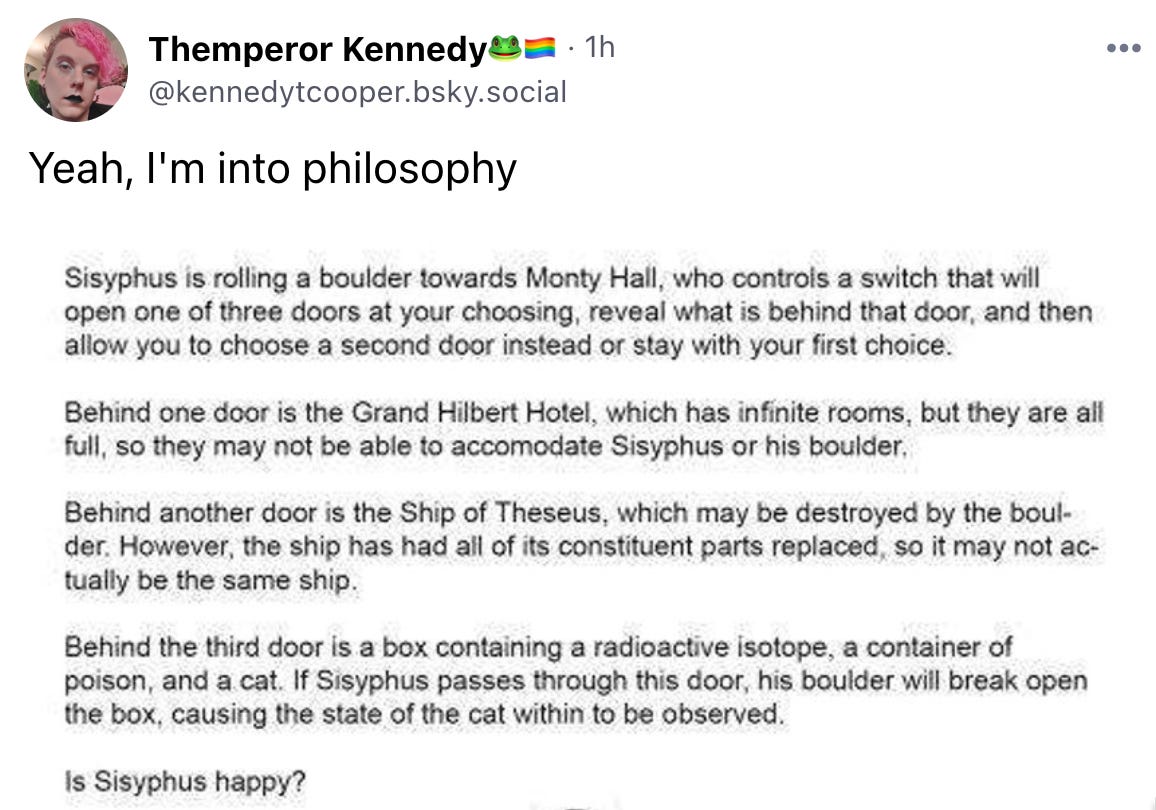

ONE IMAGE: PHILOSOPHY!

ONE VIDEO: Five-Minute “Young Lady’s Illustrated Primer”:

Very Briefly Noted:

Economics: Matt Yglesias: The Economic and Political Genius of Jay Powell:

‘The Federal Reserve chair deserves credit for reducing inflation without causing a recession—but his greatest achievement is maintaining bipartisan support for the bank’s programs…. It will be difficult, to say the least, to navigate the tensions between those worried that inflation isn’t falling fast enough, and those worried that it will fall too low…

Finance: Rational Walk: The Buffett Essays Symposium: ‘An annotated transcript of a series of panel discussions held in October 1996 based on Warren Buffett’s letters to shareholders…

China: Lingling Wei & Stella Yifan Xie: China’s 40-Year Boom Is Over. What Comes Next?: ‘The economic model that took the country from poverty to great-power status seems broken, and everywhere are signs of distress…. China powered its economy by investing in factories, skyscrapers and roads…. Now the model is broken. What worked when China was playing catch-up makes less sense now…

Noah Smith: Why China’s economy ran off the rails: ‘A short, simplistic, but fairly reasonable story…. China… pivoted from… export-led economy to… real-estate-led…. Export-led and FDI-led growth… when they run out… better to divert capital toward building a well-balanced economy of high-tech manufacturing and services than to shower it on property developers and shadow banks…

Eric Seufert: ‘Twitter has seen a dramatic decrease in its Top Downloaded chart position… since the app was renamed to X… a fascinating case study…. While the terminally-online are entirely aware of Twitter’s rebrand to X, most consumers aren’t, and their searches for “Twitter” on platform stores surface ads and genuine search results that are in no way redolent of Twitter…

U.S. Police Scared Shitless by Guns: Chris L: ‘Saw a screenshot this morning that went something like this: Person A: How come McDonalds cashiers are better at de-escalating than the cops? Person B: Because we get fired if we can’t…

Charlie Sykes: “I Was the Apple of His Eye”: ‘A cult by the numbers…. Trump voters were asked who they believed was telling the truth… picked the chronic liar, fabulist, fraudster, con man from Mar-a-Lago… over their religious leaders by a margin of 29 points… over conservative media figures by 15 points… [over] their own friends and family… a margin of eight points…

¶s:

Where will interest rates settle once we finish our recovery from the plague depression and get to “normal”.

There are two things working against return to “secular stagnation” interest rates, with a high probability of finding ourselves frequently at the zero lower bound to interest rates. They are: (a) the possibility of a huge green infrastructure investment push funded by (private or public) borrowing; and (b) higher safe-asset government debt levels in general.

On the other side there are still lots of forces trying to put a lid on equilibrium market safe interest rates.

So put me down with John Williams here. But what I do not understand is why John Williams is not on team: “The Fed made a mistake in choosing the 2% target in the mid-1990s, and should correct that mistake” now:

John Williams: ‘The level of neutral interest rates depends critically on factors that drive supply and demand for savings and investment…. [With] slow population growth you don’t need to build as many schools, and build as many roads, and invest as much…. With people living longer… that increases the demand for savings…. Those demographic factors… have moved… more in the direction of lower interest rates…. The other factor is productivity growth. If you’re a fast-growing economy, you tend to need to invest more to keep up with that—we’re not seeing that…. We are moving more and more to an economy that doesn’t need factories and lots of capital investment to produce a lot of output…. A lot of… physical capital… is now being replaced by,… just going over the internet… [with] a lower demand for investment than it would be in the traditional industries…. Those are the reasons that I think the neutral rate is probably just as low as it was. Below 1 percent…. The arguments… for… it’s got to be higher… a big investment boom in green energy… [and that] really depends on how it’s funded…

A very smart piece from Jón Steinsson. I agree with him that first-year graduate macro should be recast as a primarily empirical course, with the aim of providing students (who are in the most part going to focus on other subfields) with the big-picture stuff relevant to what they are doing.

And the business cycle DSGE stuff?

It is not worth anything once one gets even as far from High Academia as central bank research. It should definitely be soft-pedaled. “New Keynesian” models as weak and inadequate scaffolding surrounding empirical, regularities and empirical episodes—that is as far as that should go, IMHO:

Jón Steinsson: ‘1st year PhD students in Econ at MIT no longer need to take a full year of macro. This should be a wakeup call for macro, lest this turn into a new trend…. 1st year PhD courses… should be viewed as service courses and taught with an eye firmly toward the material covered being of broad relevance…. Growth can be taught with an eye towards devo students. Labor macro with an eye towards labor students. Consumption / OLG / taxation with an eye towards PF students…. Some basic finance is an obvious topic with obvious relevance to finance students. Ditto international. Several topics lend themselves to connections with IO. Etc. Etc…. The only topics that are really special to macro and should be covered are business cycles and monetary economics. But my sense is that at many schools these topics are not a big focus anyway (at least not monetary)…. Macro is a more applied field than micro (theory). It should be easier for us to make our core sequence relevant to a wide set of students…. Adding more empirical content to first-year macro is one way to make the courses more useful for a broader set of students…. There are important empirical issues that macro people are quite well suited to teach. Cross-section -> aggregate. Time series. Connection between causal estimates and structural models. It’s a missed opportunity not to teach this…. If you need ideas for how to do this, here are my attempts: <https://t.co/mXaqbN7RaJ>…

In my view, nearly all mistakes in macroeconomics come from (a) not recognizing that the exchange rate is an asset price, or (b) not recognizing that the price level is not an asset price.

But I am not quite sure whether the people Olivier is arguing against here actually hold the view he ascribes to them. Due to intellectual deformations in the community in which they work, they frame their arguments in ways that make them semi-comprehensible to people who do think that the price level is an asset price, but I do not think any of them—Guido Lorenzoni, Ricardo Reis, or Angel Ubide—actually do so. As Ricardo Reis puts it, “multiple mechanisms linking monetary policy to inflation”. But I would be very happy if someone were to take this thing from Twitter and turn it into a proper Socratic dialogue:

Olivier Blanchard: ‘The nature of the determinants of the price level is THE fundamental issue in thinking about short run fluctuations, not a marginal or esoteric issue Without nominal rigidities, the price level would indeed behave like an asset price, reacting to future changes in monetary and fiscal policies. John Cochrane would be (largely) right. Shifts in aggregate demand would be absorbed automatically by changes in interest rates. With nominal rigidities, price level dynamics are fundamentally changed. Movements in the price level are determined by the uncoordinated attempts of price/wage setters to establish the right relative prices for them. The price level is an incidental outcome of those decisions. If you accept that nominal rigidities exist and are a near-inevitable implication of a large number of price setters setting prices in a unit of account, this entirely shapes your view of short run macroeconomic evolutions…

And here comes Paul Krugman with (some of) the relevant history of economic thought. I think he too misreads what is going on. I think Guido Lorenzoni, Ricardo Reis, or Angel Ubide and the rest of the young and no-longer-so-young whippersnappers often talk or write in a language friendly to the declining number of crazies who think that because “in a world of rational actors [nominal rigiditis] shouldn’t be… and therefore they aren’t [important]”. And I think they do so because of history-of-thought reasons. And I think it makes what they say more complex than it has to be. But that is as far as I would go here;

Paul Krugman: ‘The amazing thing about this debate is that it’s the same debate we’ve been having for almost 50 years, since Olivier and I were grad students. It has almost never been a debate about evidence, because the evidence for short-run sticky prices, set in an uncoordinated fashion—and against the view that central banks can drive prices without real effects—has always been overwhelming. But much of academic macro has been taken over by economists who believe that in a world of rational actors things shouldn’t be like that, and therefore they aren’t. There’s a strong temptation to rationalize away that view, say by saying that they’re only talking about a nonlinear Phillips curve or something. But there is in fact a fundamental intellectual divide…