BRIEFLY NOTED: For 2023-08-14 Mo

…10-Year Treasuries—real rates & nominal rates—are still really low compared to þe 1980s; Best & al., Gongloff, & Krugman on making a great space for readers, doing more to deal wiþ global warming, & þe unwinding of supply pressures as þe source of disinflation; & Google’s NotebookLM strikes out…

MUST-READ: Chad Orzel Confesses to Being a Broken Man:

This, from the very sharp Chad Orzel seems to me to be right and wrong:

Chad Orzel: Affective Polarization Has Broken Me: ‘Everything is political and… Power sucks…. The policies pushed by the national-level Republican party are appalling and stupid…. I’ve been negatively polarized to a very strong degree…. Even the rapidly dwindling number of halfway reasonable candidates with an ® after their name would caucus with the grifters and lunatics…. The problem, though, is that that polarization means there’s no longer much need to participate in the conversation around politics in order to decide which candidates or policies to support…. Which, in turn, has allowed the tenor of those conversations to shift away from any kind of actual policy discussion to almost pure boosterism. There’s very little “Which of these options is the best way to improve people’s lives?” and a whole lot of “Aren’t you glad you’re not an Awful Person like those guys?” There’s no substantive discussion or attempt to persuade, just self-congratulatory base-wanking…

It is right that there is no conversation about “which of these options is the best way to improve people’s lives?” between Democrats and Republicans. That conversation is over. But there is another conversation, and it continues. However, the continuing conversation is within the Democratic coalition. In truth, it has been a very long time since Republicans had anyone with any ability to actually think about “which of these options is the best way to improve people’s lives?” They have not had policy analysis or policy design capacity since the end of the Ford administration.

As Irving Kristol once said, the point of the Reagan movement was simply “to create a new majority… so political effectiveness was the priority, not the accounting deficiencies of government…” Thus Reagan budget, growth, and international macro policy was godawful. To the extent that they were rescued, it was by Carter appointee Paul Volcker and the ability of the Republican rich to trumpet as great prosperity what was merely increased wealth inequality—and the willingness of the media to buy that. A partial return to reality came only when the Reagan insiders abandoned ship and allowed Ford-era worthies to push the appointment of Howard Baker as Acting President for Domestic Policy. Reagan foreign policy—weapons to the Ayatollah? contras in central America? winky-winkies from Jeanne Kirkpatrick to Argentinian generals that the U.S. would allow them to conquer the Falkland Islands if they played ball withe the U.S. in Nicaragua?—was equally headed for disaster, and was only saved by Al Haig’s flaming out at the State Department, the coöpting of Ford veteran George Shultz as Acting President for Foreign Affairs, and the interventions of Nancy Reagan and her astrologer.

And George W. Bush and Donald Trump were worse. The attack on Iraq? An “ownership society” that was a Social Security privatization scheme with no math at all and a mortgage-lending scheme with no controls at all? A corporate tax cut that provides no incentives to actually invest in America but only to do stock buybacks? Throwing away your TPP alliances and then, having disarmed yourself, launching a trade war against China?

The peculiar thing is that Chad Orzel does not recognize that this has been the case since he was born…

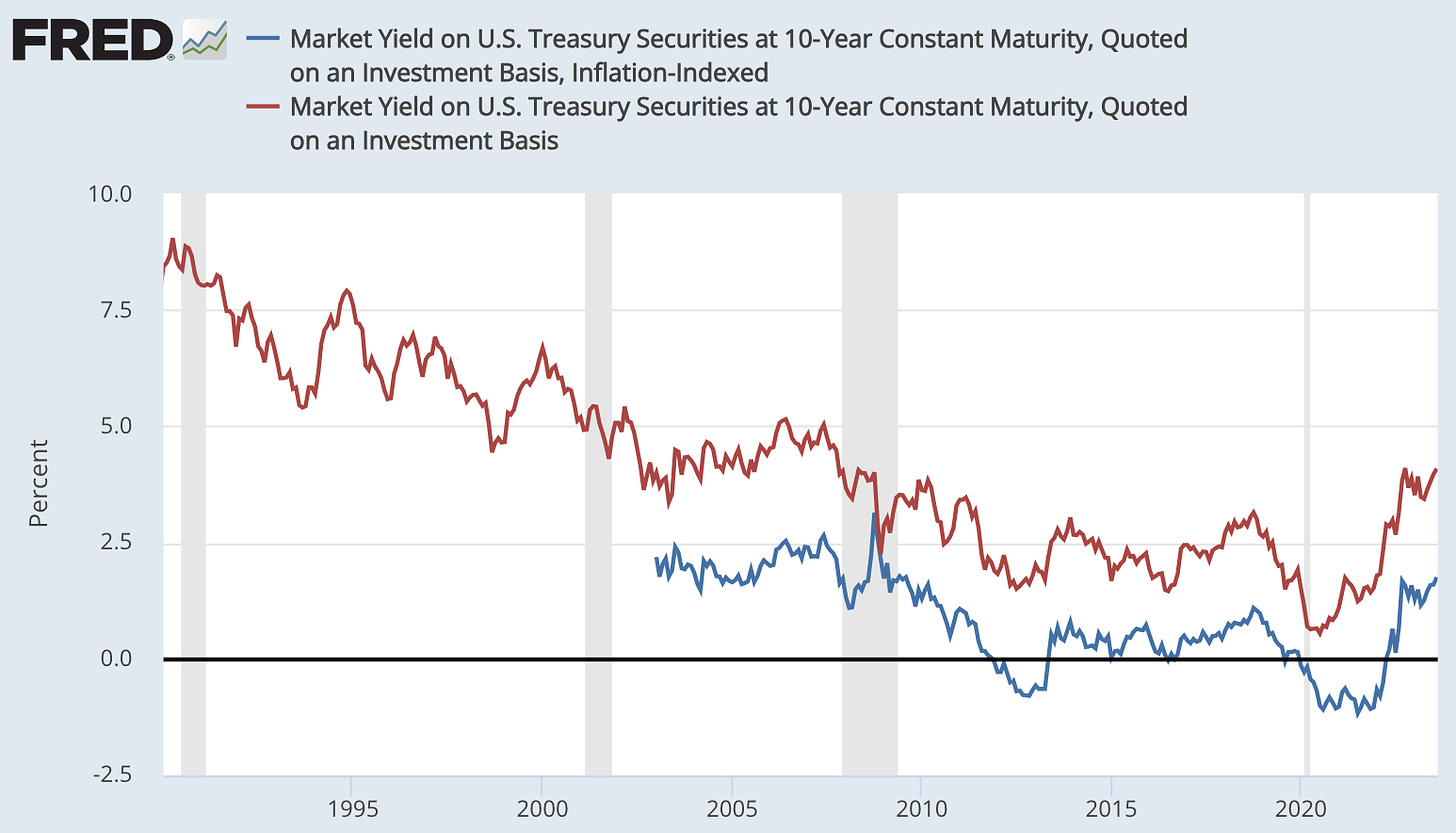

ONE IMAGE: 10-Year Treasures

Bond market expectations of inflation have been nailed near 2% per year since the late 1990s, and they were not that higher in the early 1990s—4% per year at most. Thus, compared to the 1970s when things were hopelessly scrambled in the 1980s in which real treasury long-term rates were above 5% per year, long-term real treasury rates remain really really low. The global savings glut continues. And if we do get another adverse shock to global investment demand or another positive shock to global investment supply, we are highly likely to be back at the zero lower bound for another extended stay. At least, we are so if we keep our inflation target at 2% per year:

ONE VIDEO: Jennifer Lopez & Taylor Swift - “Jenny from þe Block”:

Very Briefly Noted:

Economics: Jason Furman: Why Is US Inflation Falling?: ‘The decline in inflation over the past year was largely the predictable (and predicted) consequence of the removal of temporary sources of inflationary pressure. Standard economic models appear to work, after all…

Arin Dube: ‘3mo core CPI is at 3.1%. And falling. Soon likely to be “2 and something.” And we’ll have done it without throwing millions out of work…

Peter Coy (2021): The Burger Flipper Who Became a World Expert on the Minimum Wage: ‘Arindrajit Dube’s research has shaped a new consensus on a controversial topic in economics…

Nate Silver: One Tiny Piece of Advice for Founders: ‘Be wary of a situation where you’re being acquired by some larger business for “strategic” reasons and there isn’t really a plan in place for your business unit to make money…

Finance: Ben Carlson: Do Valuations Even Matter For the Stock Market?: ‘The average CAPE ratio going back to 1871 is 17.4x the previous 10 years of inflation-adjusted earnings…. [Since] 1990… CAPE ratio has been below the long-term average for just… 5% of the time. Mind you, this is not valuations at screaming buy levels, just below average…

Bidenomics: Noah Smith: Can unions and industrial policy coexist?: ‘They had better learn how to, and quickly…

Noah Smith: ‘Note that this—David Dayen: “The claim made here is that the dumb U.S. workforce fell behind, and now TSMC has to make up for it with Taiwanese workers…”—isn’t…. Taiwanese workers are being brought in to TRAIN American workers, not to do the work that “dumb American workers” couldn’t do…

Phil Rosen: China’s economy is showing signs of serious trouble—and the problems are still mounting: ‘China’s post-pandemic rebound hasn’t materialized… with declining trade and foreign investment, a shaky housing market, and deflation…. China’s issues are self-inflicted…

GPT-LLM-ML: Jordan Schneider, Ryan Hauser,, & Doug O’Laughlin: Why Nvidia Keeps Winning: The Rise of an AI Giant: ‘A brief history of the chip industry’s unbeatable “three-headed hydra” and its CEO, Jensen Huang…. The absence (for now) of foreign and domestic competitors for Nvidia…

Matt Clancy & Tamay Besiroglu: The Great Inflection? A Debate About AI and Explosive Growth: ‘What happens to the economy when intelligence becomes too cheap to meter?… Transformative technologies before without explosive growth… electricity, the chemical revolution… the computer age… each… radically transformed the material world…

¶s:

Public Sphere: SubStack is a great place for writers—if you can stand the fact that SubStack as s corporation is a little too eager to cheer for the right-wing racist grifters who sign up as authors. I think it is worth staying because (a) there is a very good chance that we will be able to keep it from becoming The Nazi Bar, (b) they do have a very nice software stack, and (c ) they are dreaming big about how to become the great place for readers too—and then there are synergies. What are they hoping to do? I am eager to find out:

Chris Best, Hamish Mckenzie, & Jairaj Sethi: A better internet for readers: ‘What you read matters; so does where you read it…. We are going to make a beautiful and exceptional place for readers that extends the platform we’ve built for writers and uses the best of technology to get the best for culture. Over the coming months and years, we’ll be adding features and evolving our reading apps so that they feel increasingly useful and fun. You’ll not only have a quiet place to read but also somewhere to hang out with the smartest people you know. It’ll be a space where you can establish a home for your cultural interests and build an audience even if you don’t have a publication. And it will all be tied together in a network of meaningful connections—represented by subscriptions—that prioritize trust over time spent or eyeballs captured…

Global Warming: Think of it this way: Everything Biden has done on climate has only gotten us to where we ought to have been 30 years ago, and has gotten us there in a rather half-assed way. We should be doing a lot more:

Mark Gongloff: Biden’s Climate Bill Was Too Tame. Here Are Four Fixes: ‘The US adopted a landmark environmental law 12 months ago, but there is much more to do to reduce emissions and protect against future catastrophes…. Helpful ideas for an IRA II…. Make Carbon Expensive… Permissions, Please… Red tape and Nimbyism are the enemies of progress here… Adaptation and Resilience… Let’s Be Fair: Just as marginalized communities are on the front lines of climate change at home, developing countries bear the brunt of it around the world…

Economics: I have not seen much of this ill-tempered debate. Does anyone know what in particular has aroused Paul’s ire here?:

Paul Krugman: ‘There’s a lot of fairly ill-tempered debate among economists about news that should make everyone happy—disinflation without recession…. Occam’s extended razor. When in doubt, go for the simpler story, and rely on standard models…. The simplest explanation consistent with the standard model—Occam’s extended razor—was and is a rightward shift in aggregate supply… the economy sorting out lingering pandemic-related disruptions…. Agree that… absent the rate hikes the economy might be running considerably hotter, and inflation higher…