Beveridge Curve Slope Missing in Action...

As of March 2023, the bet that the rapid return to full employment coming out of the Plague Depression would be partially “paid for” with a recession did not look like an unreasonable one.

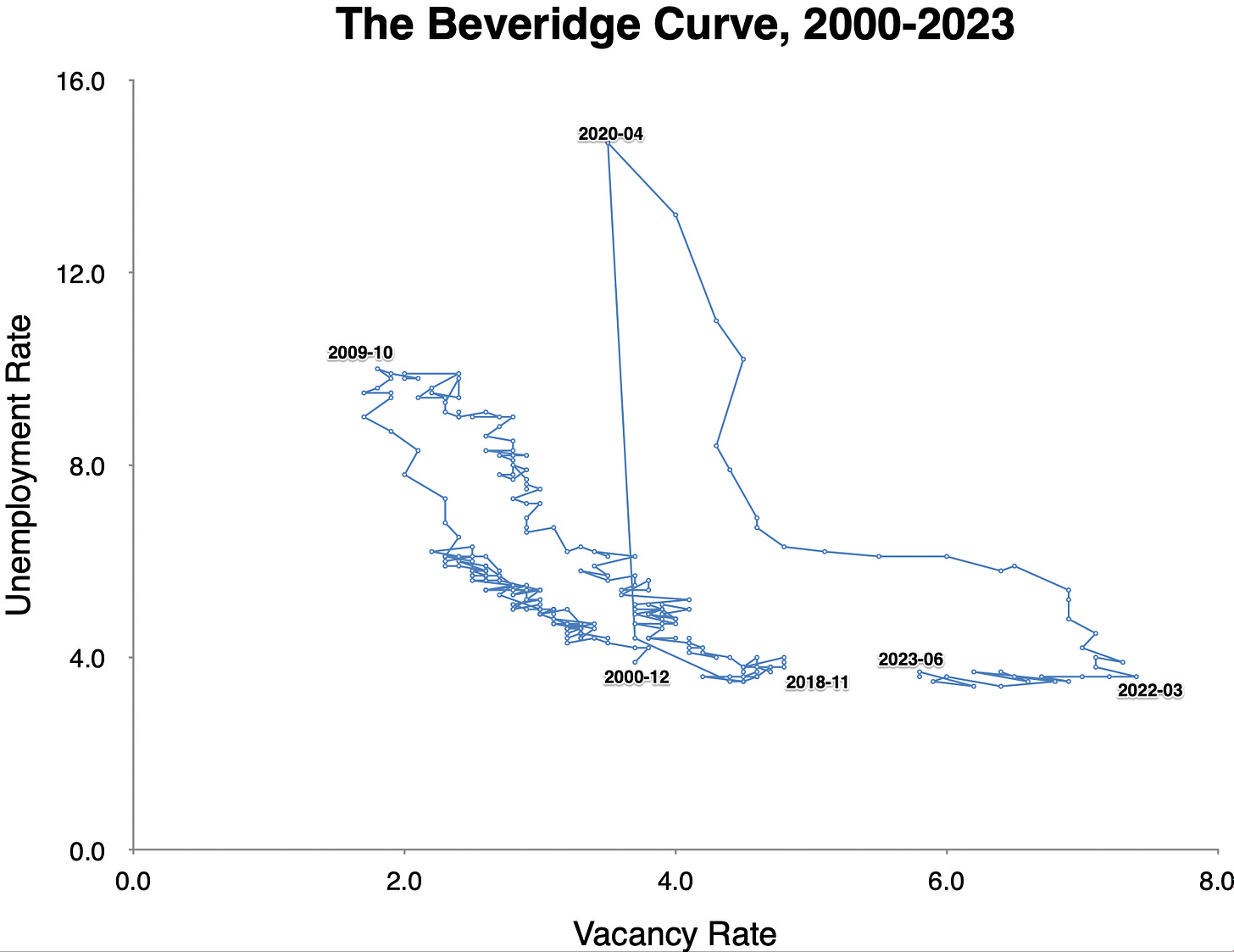

The Beveridge Curve—plotting the vacancy rate against the unemployment rate—was extremely anomalous, with a vacancy rate twice what we had seen with the same unemployment rate in 2000, and more than half again as high as what we had seen with the same unemployment rate in 2018:

Workers thus confronted firms feeling more pain from understaffing than usual at that unemployment rate, and hence had more bargaining power to exact nominal wage increases.

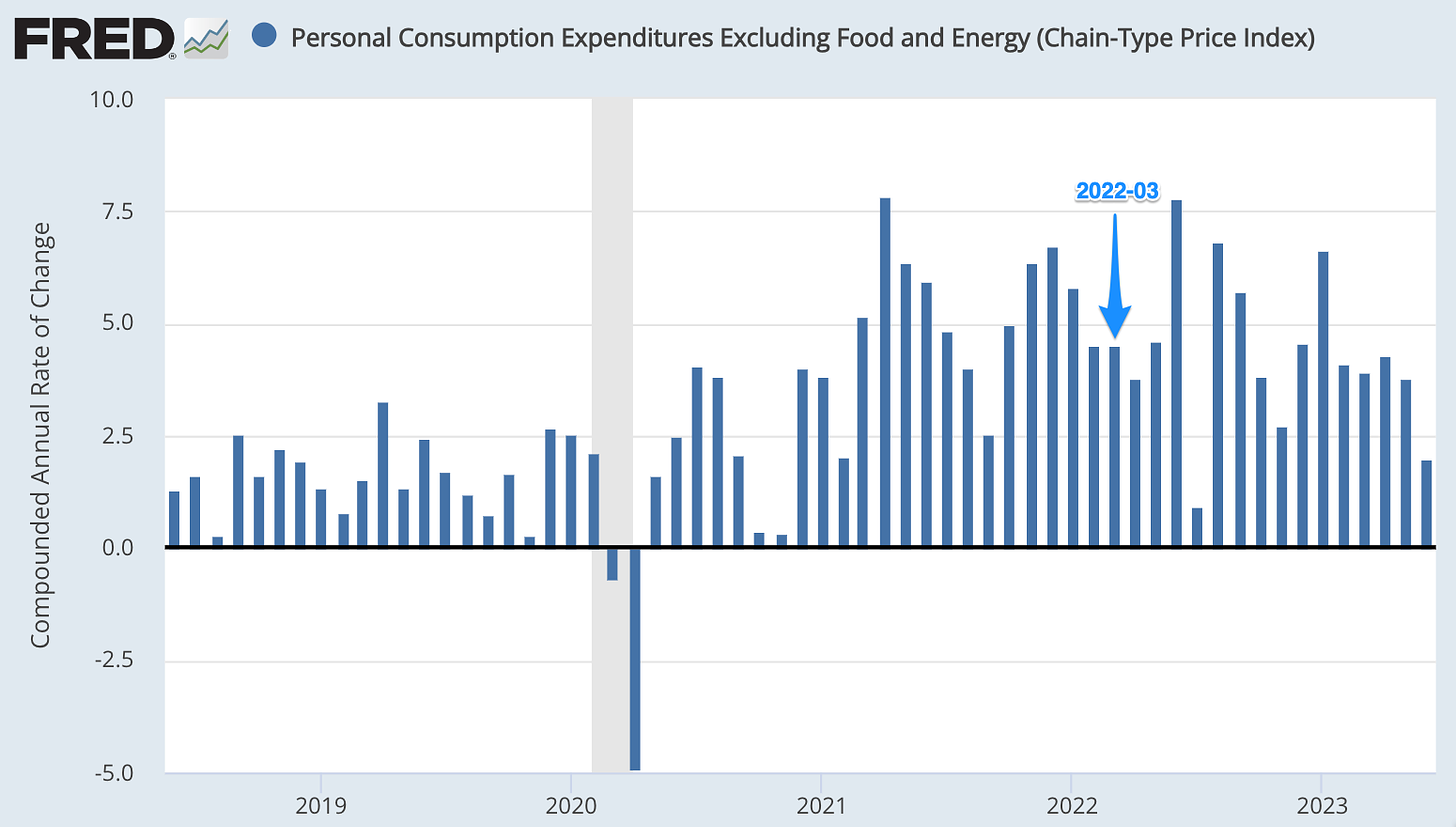

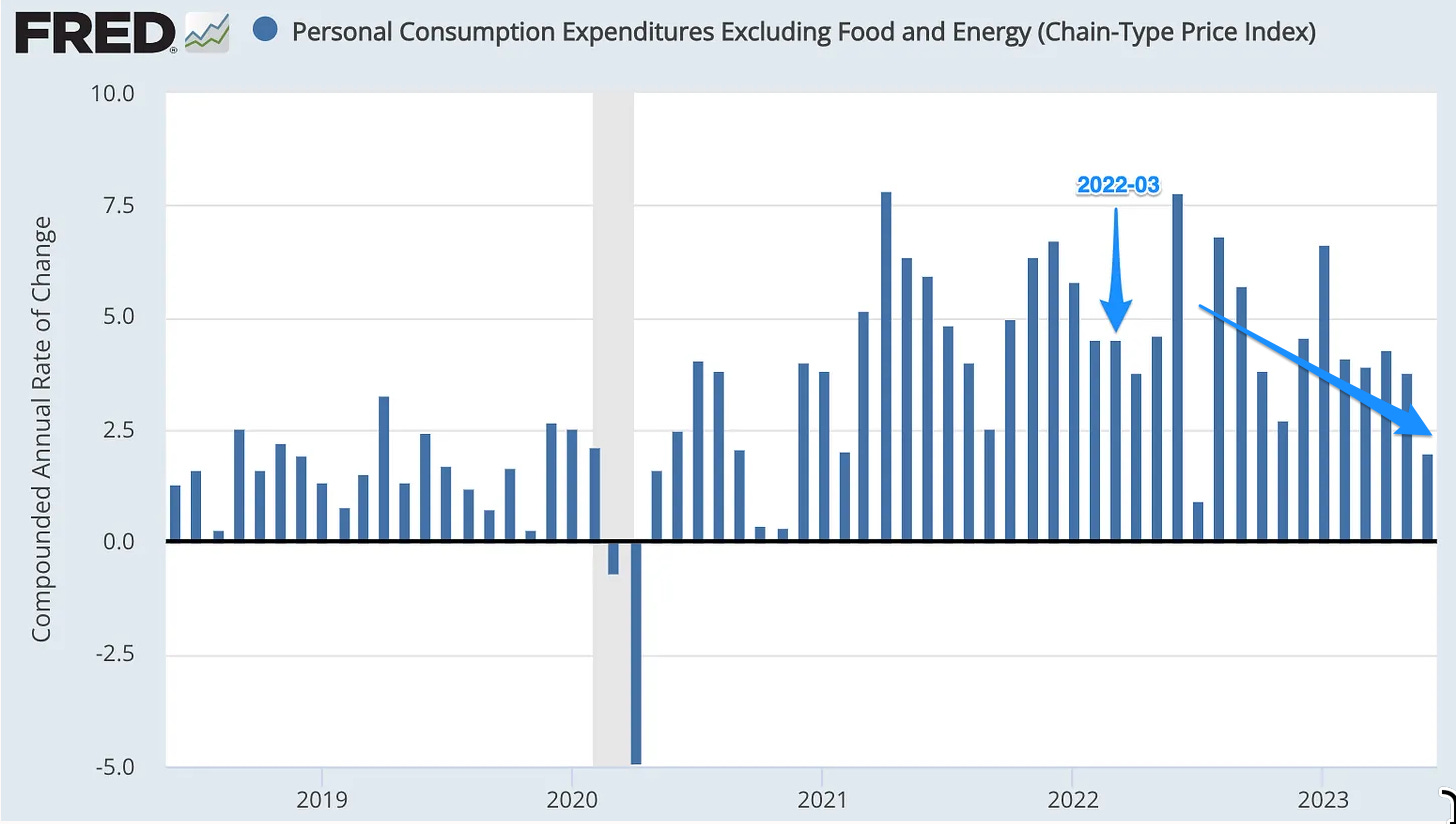

Moreover, the core PCE inflation rate in March 2022 was running at 4.2% per year, significantly in excess of the Fed’s 2% target:

How was this core inflationary pressure—not, mind you, supply-shock pressure from food and energy prices, but core pressure—to be alleviated without a large fall in the vacancy rate? How could that be accomplished without a large rise in the unemployment rate? Never you mind that Vladimir Putin’s attack on Ukraine had just delivered an extra inflationary supply shock to the world economy, and what consequences would that have?

Not, mind you, that a moderate recession in late 2022 and early 2023 would have put us in a worse place than a more cautious policy that avoided recession at the cost of a much slower initial recovery out of the Plague Depression.

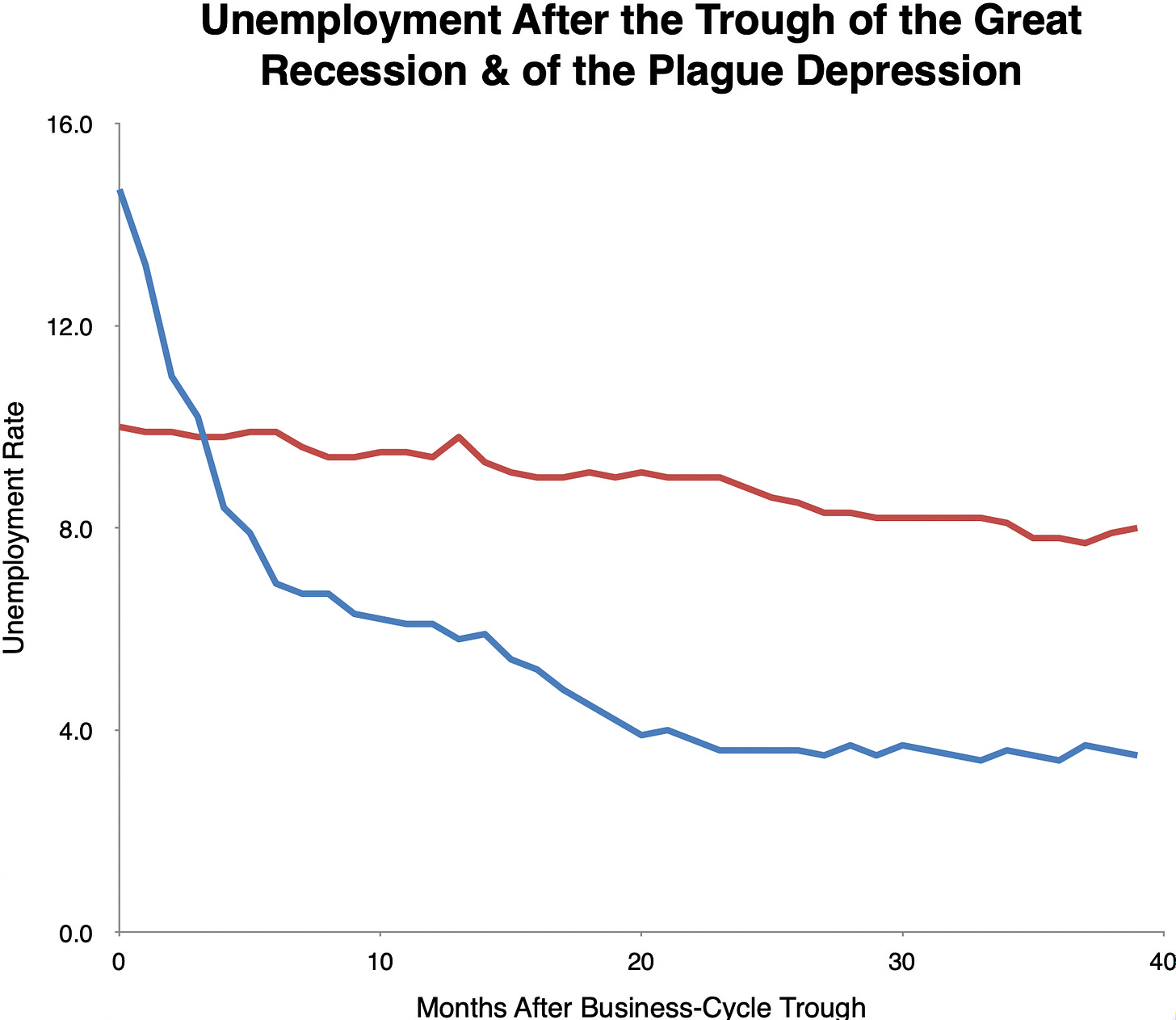

Remember: in the absence of extraordinary fiscal policy measures, the maroon-line unemployment-rate recovery after the 2009 Great Recession business-cycle trough was godawful slow. The blue-line recovery after the very short Plague Depression is so much better.

Putting the pedal to the metal, not doing that again, and leaving rubber on the road as the economy rejoined the highway at speed in 2021—that was a really, really good idea.

Keeping the policy foot off the stimulative gas and running a repeat of post-2009 would have been a really bad idea.

And even a recession in 2023 that pushed the unemployment rate up by 4%-points would not have left us now in a worse position than a repeat of post-2009 would have done.

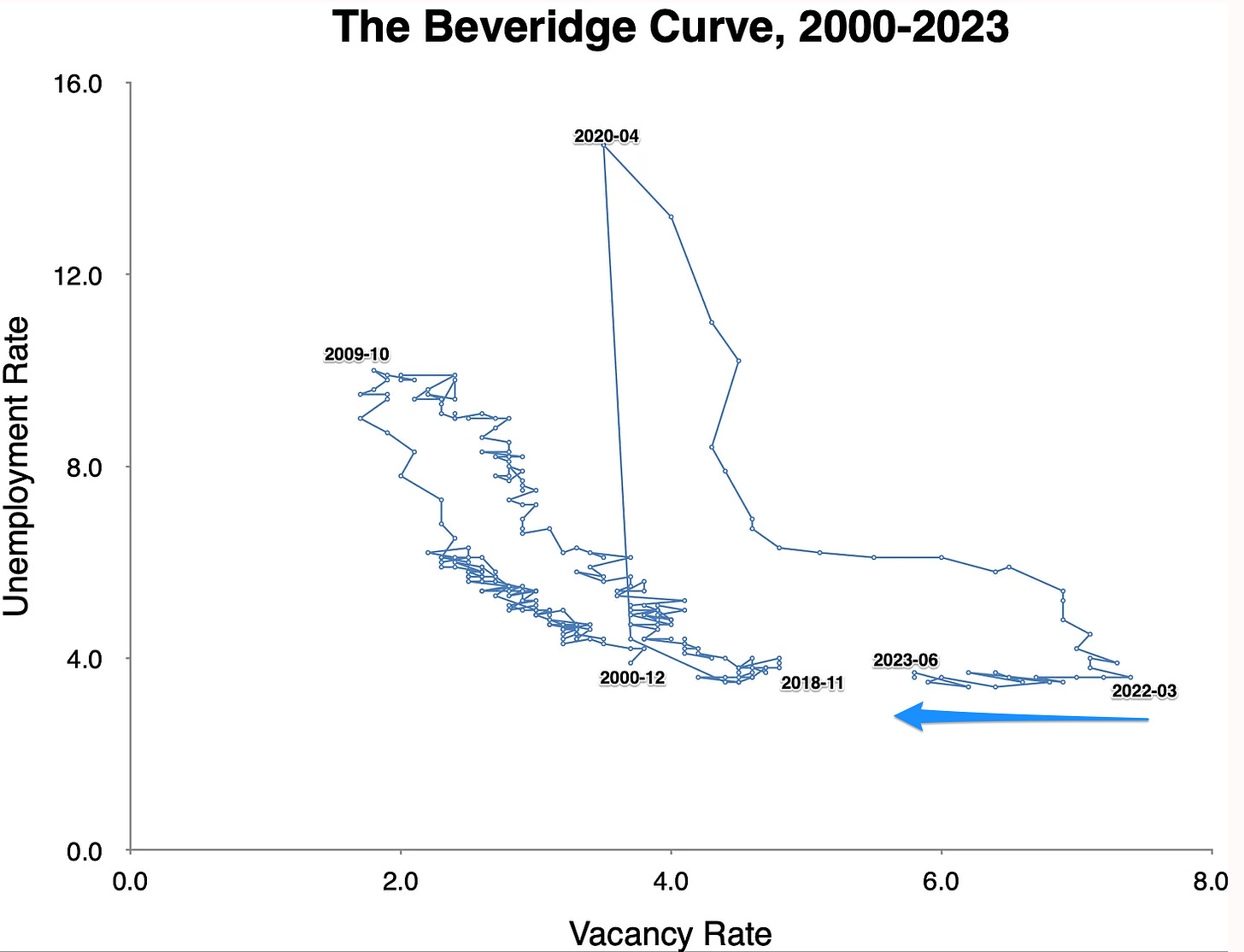

But the increase in the unemployment rate did not come. The recession did not come. And the vacancy rate fell, and is falling, smoothly, anyway.

There turned out to be no even semi-stable Beveridge Curve relating vacancies and unemployment, and not even anything that could be called a Beveridge Slope between the spring of 2022 and the fall of 2023:

And it is not just the headline inflation news that is good. Core inflation is coming down as well:

What is the lesson? The big lesson is that to rely on any past macroeconomic regularity and use it to make confident predictions about possibilities for the future is to make a very large intellectual bet at adverse odds. We do not know enough about how emergent macro regularities are based in micro exchange patterns to do anything more than give our best point forecast, and then warn everyone very strongly that the range of future macroeconomic possibilities is very, very wide indeed.

The veils of time and ignorance are extremely thick…

<https://fredaccount.stlouisfed.org/datalists/305660>

<https://fred.stlouisfed.org/series/PCEPILFE#0>