BRIEFLY NOTED: For 2023-07-20 Th

…immigration & bank failures, & ProPublica’s desperate hopes to go off the record…

MUST-READ:

Have stock-market returns really been that concentrated over the past thirty years? It looks like they have. And that means that anyone trying to diversify on their own is almost surely taking on a huge and stupid amount of idiosyncratic risk, for their own individual portfolio of stocks they are holding is not big enough to diversify much of that risk away. Plus there is all of the “trading against people like you” that being unable, psychologically, to sit on your hands afflicts you with:

Robin Wigglesworth: The global stock market rally isn’t as narrow as you think: ‘It’s not just AI hype, at least internationally…. The AI “theme”…. But Lapthorne points out that these top performers have something else in common, besides AI links of varying plausibility…. “The most obvious commonality amongst this year’s US winners were their big losses in 2022, when this group of stocks lost over 50% on average from the 2021 peak.”… In Europe and Japan, value stocks have powered the gains, while in the US it’s the usual growthy suspects. Does this broader-than-thought rally also mean that the market is also stronger-than-thought? Possibly. But the breadth and/or narrowness of stock market runs has always seemed like a silly way to judge a market’s health, given the fact that only 2.4 per cent of companies account for almost all of the $76tn of net global stock-market-wealth creation between 1990 and 2020…

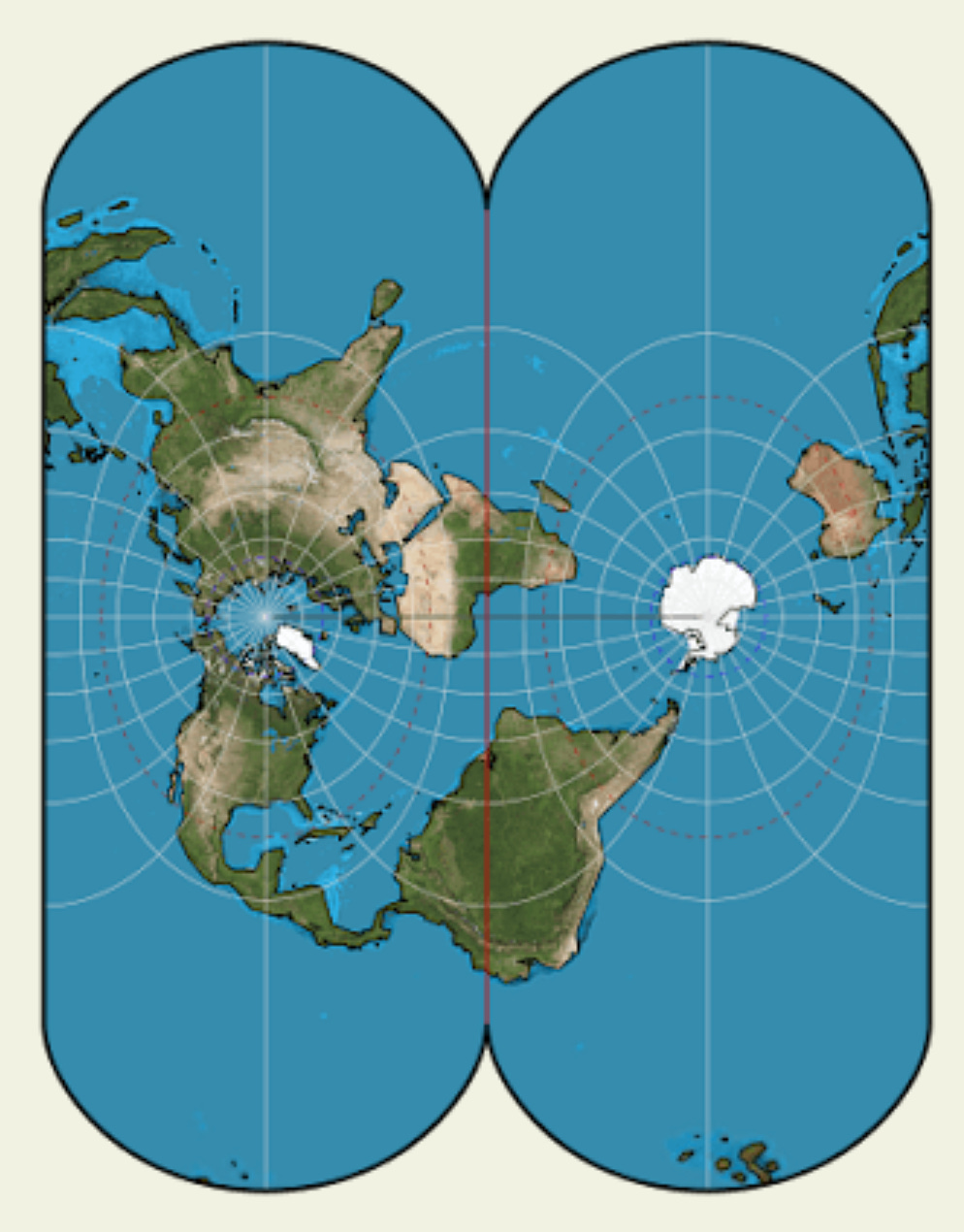

ONE IMAGE: Þe Ellipsoidal Transverse Mercator projection:

ONE VIDEO: Bell Labs (1973):

Very Briefly Noted:

William D. Cohan: Elon’s Options: ‘[Musk] is stiffing Twitter’s creditors… fired… the Twitter workforce… deprived many… of their rightful severance… including by stiffing JAMS, the arbitration professionals…. He will probably have to sell more Tesla stock to make the interest payments…. The next… is due in September—unless he wants to strategically skip the payment and risk an involuntary bankruptcy filing…

Zahra Hirji: This Year Is Already on Track to Be the Hottest Ever Recorded: ‘After the warmest June since records began in 1850, a new analysis concludes that there’s now an 81% chance this year will be the warmest on record…

Jeffrey Frankel: Is the US Economy Headed for a Soft Landing?: ‘The US economy jumped… more than a year ago. It is currently being buoyed by an unusually powerful updraft…. The parachute might still deploy as planned, allowing the economy to achieve a soft landing after all…

Dan Rasmussen: Private Equity Operational Improvements: ‘Measuring Value Creation in LBOs…

Heather Cox Richardson: July 18, 2023: ‘“I approve this message.”… Biden’s Twitter account put that line over an ad using the words of… Marjorie Taylor Greene…. [Her] description… Biden “had the largest public investment in social infrastructure and environmental programs that is actually finishing what FDR started, that LBJ expanded on”—was such an argument in Biden’s favor that the Biden-Harris campaign used it to advertise what the Democratic administration stands for…

Matthew C. Klein: China’s Missing Post-Pandemic Rebound: ‘The end of “Covid Zero” was supposed to lead to a burst of “revenge spending”, at least after the virus had finished ripping through the population. Instead, the economy has continued to sputter…

Tom Scocca: Make the Wayback Machine the real internet: ‘The Internet Archive and its Wayback Machine have been helping people do these sorts of things for a long time…. What happens when the entire internet is one big series of gaps?… [Not] “constantly breaking”… [but] just “broken.” The current platforms are either unusable or on their way to unusability…

Abraham Thomas: Data and Compute Are the Ultimate Flywheel: What’s valuable—and why—in an AI-driven world….

Catherynne M. Valente: Mark F***king Zuckerberg Is Not Your Friend…

¶s:

The argument that those who rise to the top of any hierarchy are those who are predisposed to undertake mammoth absolutely insane negative expected present-value gambles—that those at the top are selected from those who do so and for whom those gambles come off—is almost surely a correct one. That means that top leaders (and the superwealthy) are insanely risk-loving and have very bad reality testing. This is a huge problem for societal systems—and not just political ones—that give substantial power to “leaders”:

Timothy Burke: War! What Is It Good For?: ‘States deploying military and police power against another state? How often does that actually work in Clausewitzian terms, to achieve a political outcome that one state sought in another state, in the last seventy-five years? I loathe the blithe anti-war slogan that war never settles anything simply because it’s blatantly untrue, but in the interstate system established after World War II, it does seem to me that interstate aggressors have rarely achieved what they say they wanted to achieve through the use of military power…. A regime thinking about conquest or unprovoked territorial aggression is already flagged as having a problem simply because they are thinking about aggression. It is weakness posing as strength…. It suggests… the interstate system will never be stable because… all states are prone at some moment to producing rulers or potential rulers… who decide that it is better to roll the dice, at whatever long odds, because power has always already crossed its Rubicon…

A decision that is absolutely bonkers from a policy, a legislative intent, and—I would argue—a plain meaning standpoint. The security-ness of a security is something inherent in it, in the representations the issuer makes to those who it hopes will provide the initial this has fundamental value push to get the speculative gambling machine running. That afterwards it becomes almost entirely the domain of grifters, griftees, and those in it for the lulz does not—or should not—purge it of its security-ness. And so, once again, Matt Levine tries to take a day away to do other things, and fails:

Matt Levine: Ripple Is a Security and It Isn’t: ‘Programming note: Money Stuff was supposed to be off today, but is not…. When Ripple sold XRP to institutional investors in over-the-counter trades, with due diligence and investment agreements, that was an “investment contract” and so a securities offering. When Ripple sold XRP to retail investors in on-exchange trades, anonymously and with no disclosure, that was not an “investment contract” and so not a securities offering. That’s so weird!… If you go around making public statements, on your website and on Reddit and elsewhere, saying things like “if you buy our token we will use the money to build an ecosystem and make the token more valuable,” that makes your token a security, but only to people who are sophisticated enough to read your website. Sophisticated institutional investors who read your disclosure documents and understand that they are making an investment in your business are entitled to the protections of the securities laws, while random retail day-traders who just like your ticker symbol are not. You cannot be doing securities fraud on them, because they are not paying attention…. [This] is … obviously … terrible … policy? “The securities laws protect only sophisticated investors who negotiate directly with the company, not retail investors who trade on public exchanges” is the exact opposite of the normal rule:..

(a) I do not have a good gauge on how much restored immigration is boosting aggregate supply. And (b) I do not have a good gauge on how much tightening of “financial conditions” has been created by recent bank failures. John Williams knows more about this than I do, and he says that (a) is large and (b) is small. The impact on his view of best Federal Reserve policy going forward is “reply hazy; ask again”:

John Williams: ‘I don’t have a recession in my forecast. I have pretty slow growth’: ‘The input increase in labour force participation has been an important contributor to improving supply, but I don’t know if we can get a lot more from that. Now, there is a second part of that story, and that is immigration and the labour force growing from people coming into the US and adding to the productive capacity in our economy. That obviously slowed quite a bit during the pandemic. We have seen that come back, and come back actually quite robustly. That is another factor that contributes to more labour supply and helping to get the balance back in our economy…. If you go back to March, the distribution of possible outcomes in terms of banking stress was quite wide. It could have been that banking stress had more of a contagion effect and spilled over to other institutions and into confidence in the economy. We have not seen that, so that is good news. The situation in the banking sector really has stabilised . . . That clearly means that from a risk management point of view, some of the downside risks to my mind are less…

If ProPublica were willing to say “we got badly snookered by Republican congressional staffers” They might regain some of their credibility in my eyes. But “we will only talk off the record” is a very strong sign that those who invested in them as the Great Hope for a better journalism would have been better-served to set their money on fire. “We will only talk off the record” speaks very loudly indeed:

James Fallows: ProPublica Takes Another Look at Wuhan: ‘Trying to know the unknowable. And a reminder that it is easier to preach transparency than to practice it…. PP declined my requests, and I assume requests from others, to answer any questions or say anything more about the story. A spokesperson from PP suggested that I have an off-the-record discussion with one of PP’s senior figures. I declined. Among other reasons, that would put me in the position of knowing things I was not allowed to reveal or discuss. “Off the record” is mainly for when you are gathering information that might put a source in jeopardy. It’s not a normal arrangement with the person or organization you are writing about. I believe that most PP reporters and editors would decline such an offer in comparable circumstances…